INVITE-ONLY SCRIPT

(8) Closing Score VS-345

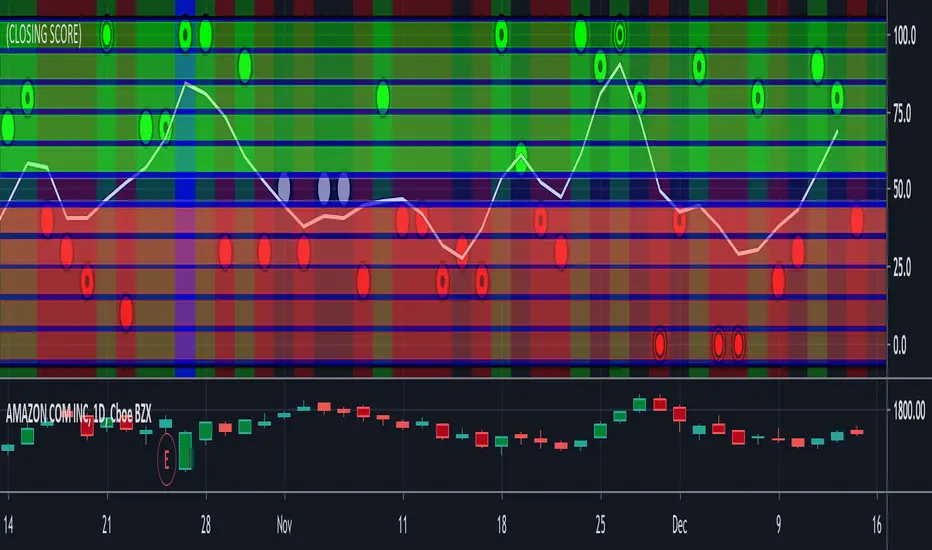

Closing Score discloses to traders the sentiment of the traders in control of the current price. If we can accurately determine trader’s sentiment, we can determine where the market is heading.

Closing Score utilizes a very simple concept and formula to determine the trader's collective sentiment. The formula (((Close – Low) / (High – Low) * 100)) produces a range that is extracted from the true range of the stock’s activity. The High to the Low within the time frame / bars you have chosen. The final output of the formula produces a finite score, between 0 and 100 that indicates to the trader, what the sentiment of the traders where, at the conclusion of this bar or at the end of the trading day. This is displayed on a graph with 10 horizontal stratifications (shown below) each representing 1/10 of the indicators total range of 100. The final dots utilized to indicate the output of this indicator are then rounded to allow placement within the graphs stratification.

The closer the indicator's outputted signal comes to either extreme, zero or 100, the stronger the correlation is between the closing score and future price movements. 97 to 100 are very strong positive signals. 0 to 3 are very negative signals and both have been validated as statically significant, Three-Sigma-Signals. Additionally, we have added an interior band within the placement of the dots to indicate that their proximity is within 3% of the extreme reading of this indicator. If the volume is above the 14 day moving average it is indicated by placing a dot within the center of the indicator dots to denote a volume confirmation of this specific indicators signal. Dots that are both within the statistically relevant, extreme range and the volume for these bars were above the 14 day moving average produce a bulls-eye.

If you study or use candlestick analysis in your trading, you can think of Closing Score as an automatic candle stick analysis tool. Take a look at any candlestick pattern and compare the point of the closes in that pattern with its corresponding closing score and you will see a very strong correlation, greater than 95%, between what the Closing Score indicates and what the candlestick pattern is indicating.

There is an in-depth explanation of this indicator on our website as well as multiple resources related to understanding trader emotions and sentiment. This indicator was published in the Journal of Technical Analysis of Stock and Commodities; June, 2016 by Michael Slattery.

Access this Genie indicator for your Tradingview account, through our web site. (Links Below) This will provide you with additional educational information and reference articles, videos, input and setting options and trading strategies this indicator excels in.

Closing Score utilizes a very simple concept and formula to determine the trader's collective sentiment. The formula (((Close – Low) / (High – Low) * 100)) produces a range that is extracted from the true range of the stock’s activity. The High to the Low within the time frame / bars you have chosen. The final output of the formula produces a finite score, between 0 and 100 that indicates to the trader, what the sentiment of the traders where, at the conclusion of this bar or at the end of the trading day. This is displayed on a graph with 10 horizontal stratifications (shown below) each representing 1/10 of the indicators total range of 100. The final dots utilized to indicate the output of this indicator are then rounded to allow placement within the graphs stratification.

The closer the indicator's outputted signal comes to either extreme, zero or 100, the stronger the correlation is between the closing score and future price movements. 97 to 100 are very strong positive signals. 0 to 3 are very negative signals and both have been validated as statically significant, Three-Sigma-Signals. Additionally, we have added an interior band within the placement of the dots to indicate that their proximity is within 3% of the extreme reading of this indicator. If the volume is above the 14 day moving average it is indicated by placing a dot within the center of the indicator dots to denote a volume confirmation of this specific indicators signal. Dots that are both within the statistically relevant, extreme range and the volume for these bars were above the 14 day moving average produce a bulls-eye.

If you study or use candlestick analysis in your trading, you can think of Closing Score as an automatic candle stick analysis tool. Take a look at any candlestick pattern and compare the point of the closes in that pattern with its corresponding closing score and you will see a very strong correlation, greater than 95%, between what the Closing Score indicates and what the candlestick pattern is indicating.

There is an in-depth explanation of this indicator on our website as well as multiple resources related to understanding trader emotions and sentiment. This indicator was published in the Journal of Technical Analysis of Stock and Commodities; June, 2016 by Michael Slattery.

Access this Genie indicator for your Tradingview account, through our web site. (Links Below) This will provide you with additional educational information and reference articles, videos, input and setting options and trading strategies this indicator excels in.

초대 전용 스크립트

이 스크립트에 대한 접근은 작성자가 승인한 사용자로 제한되며, 일반적으로 지불이 필요합니다. 즐겨찾기에 추가할 수 있지만 권한을 요청하고 작성자에게 권한을 받은 후에만 사용할 수 있습니다. 자세한 내용은 StockSwinger에게 문의하거나 아래의 작성자의 지시사항을 따르십시오.

트레이딩뷰는 스크립트 작성자를 100% 신뢰하고 스크립트 작동 원리를 이해하지 않는 한 스크립트 비용을 지불하고 사용하는 것을 권장하지 않습니다. 대부분의 경우 커뮤니티 스크립트에서 무료로 좋은 오픈소스 대안을 찾을 수 있습니다.

차트에 이 스크립트를 사용하시겠습니까?

경고: 액세스를 요청하기 전에 읽어 보시기 바랍니다.

NO EMOTION ~ Plan Your Trade and Trade Your Plan

HODL+ Managed Risk Bitcoin Trades

Bitcoin-Trend-Trader.com/

stockdotgenie.com/

crypto-trend-trader.com

HODL+ Managed Risk Bitcoin Trades

Bitcoin-Trend-Trader.com/

stockdotgenie.com/

crypto-trend-trader.com

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.