Moving Average Shift WaveTrend StrategyMoving Average Shift WaveTrend Strategy

🧭 Overview

The Moving Average Shift WaveTrend Strategy is a trend-following and momentum-based trading system designed to be overlayed on TradingView charts. It executes trades based on the confluence of multiple technical conditions—volatility, session timing, trend direction, and oscillator momentum—to deliver logical and systematic trade entries and exits.

🎯 Strategy Objectives

Enter trades aligned with the prevailing long-term trend

Exit trades on confirmed momentum reversals

Avoid false signals using session timing and volatility filters

Apply structured risk management with automatic TP, SL, and trailing stops

⚙️ Key Features

Selectable MA types: SMA, EMA, SMMA (RMA), WMA, VWMA

Dual-filter logic using a custom oscillator and moving averages

Session and volatility filters to eliminate low-quality setups

Trailing stop, configurable Take Profit / Stop Loss logic

“In-wave flag” prevents overtrading within the same trend wave

Visual clarity with color-shifting candles and entry/exit markers

📈 Trading Rules

✅ Long Entry Conditions:

Price is above the selected MA

Oscillator is positive and rising

200-period EMA indicates an uptrend

ATR exceeds its median value (sufficient volatility)

Entry occurs between 09:00–17:00 (exchange time)

Not currently in an active wave

🔻 Short Entry Conditions:

Price is below the selected MA

Oscillator is negative and falling

200-period EMA indicates a downtrend

All other long-entry conditions are inverted

❌ Exit Conditions:

Take Profit or Stop Loss is hit

Opposing signals from oscillator and MA

Trailing stop is triggered

🛡️ Risk Management Parameters

Pair: ETH/USD

Timeframe: 4H

Starting Capital: $3,000

Commission: 0.02%

Slippage: 2 pips

Risk per Trade: 2% of account equity (adjustable)

Total Trades: 224

Backtest Period: May 24, 2016 — April 7, 2025

Note: Risk parameters are fully customizable to suit your trading style and broker conditions.

🔧 Trading Parameters & Filters

Time Filter: Trades allowed only between 09:00–17:00 (exchange time)

Volatility Filter: ATR must be above its median value

Trend Filter: Long-term 200-period EMA

📊 Technical Settings

Moving Average

Type: SMA

Length: 40

Source: hl2

Oscillator

Length: 15

Threshold: 0.5

Risk Management

Take Profit: 1.5%

Stop Loss: 1.0%

Trailing Stop: 1.0%

👁️ Visual Support

MA and oscillator color changes indicate directional bias

Clear chart markers show entry and exit points

Trailing stops and risk controls are transparently managed

🚀 Strategy Improvements & Uniqueness

In-wave flag avoids repeated entries within the same trend phase

Filtering based on time, volatility, and trend ensures higher-quality trades

Dynamic high/low tracking allows precise trailing stop placement

Fully rule-based execution reduces emotional decision-making

💡 Inspirations & Attribution

This strategy is inspired by the excellent concept from:

ChartPrime – “Moving Average Shift”

It expands on the original idea with advanced trade filters and trailing logic.

Source reference:

📌 Summary

The Moving Average Shift WaveTrend Strategy offers a rule-based, reliable approach to trend trading. By combining trend and momentum filters with robust risk controls, it provides a consistent framework suitable for various market conditions and trading styles.

⚠️ Disclaimer

This script is for educational purposes only. Trading involves risk. Always use proper backtesting and risk evaluation before applying in live markets.

Analysis

Stock valuation key metricsKey metrics for Stock valuation.

Following Data will be shown on the right side on top:

- P/E

- EPS

- Dividend

- Debt / FCF

- ROIC median

- ROE median

- ROA median

- EPS growth median

- EPS growth estimated

- FCF growth median

- Equity growth median

- Revenue growth median

Depending on the historical data the medians are calculated for multiple years up to 10 year.

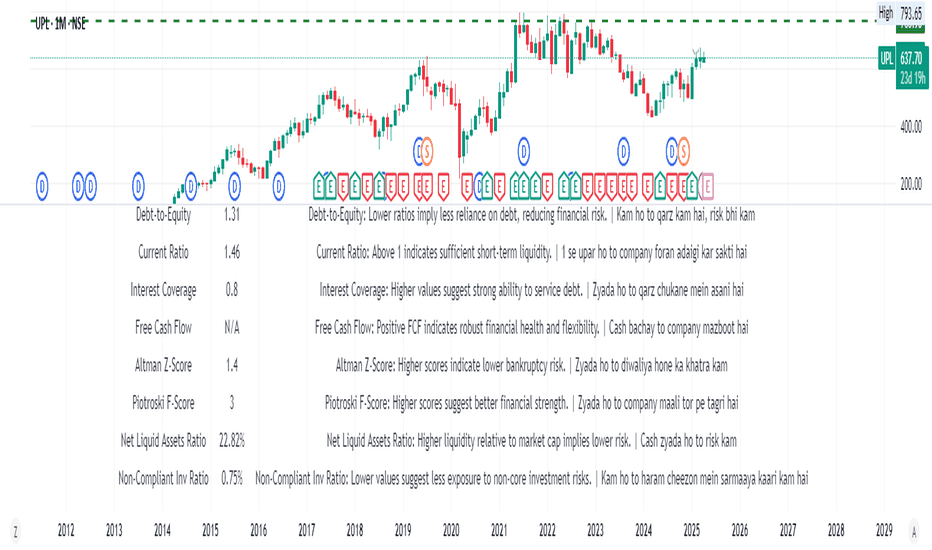

DeenDun.com Fundamentals📊 PERFECT Trades - Fundamental Snapshot Undel Panel

This indicator by PERFECT Trades fetches and displays key fundamental financial metrics directly on the TradingView chart for the current stock symbol.

🧾 What It Does:

Shows essential financial data (e.g., Market Cap, P/E Ratio, ROE, Sales Growth, etc.) for the stock currently loaded on the chart. If the metric is negative then ignore it.

Helps investors quickly evaluate fundamentals without switching to external websites.

Perfect for fundamental screening during chart analysis, especially for halal investment decisions.

📌 Metrics Displayed (examples – update as per script):

Market Capitalization

Price-to-Earnings (P/E) Ratio

Return on Equity (ROE)

Net Profit Growth %

Sales Growth %

Debt-to-Equity Ratio

Dividend Yield

Book Value

Momentum Cloud.V33🌟 Introducing MomentumCloud.V33 🌟

MomentumCloud.V33 is a cutting-edge indicator designed to help traders capture market momentum with clarity and precision. This versatile tool combines moving averages, directional movement indexes (DMI), and volume analysis to provide real-time insights into trend direction and strength. Whether you’re a scalper, day trader, or swing trader, MomentumCloud.V33 adapts to your trading style and timeframe, making it an essential addition to your trading toolkit. 📈💡

🔧 Customizable Parameters:

• Moving Averages: Adjust the periods of the fast (MA1) and slow (MA2) moving averages to fine-tune your trend analysis.

• DMI & ADX: Customize the DMI length and ADX smoothing to focus on strong, actionable trends.

• Volume Multiplier: Modify the cloud thickness based on trading volume, emphasizing trends with significant market participation.

📊 Trend Detection:

• Color-Coded Clouds:

• Green Cloud: Indicates a strong uptrend, suggesting buying opportunities.

• Red Cloud: Indicates a strong downtrend, signaling potential short trades.

• Gray Cloud: Reflects a range-bound market, helping you avoid low-momentum periods.

• Dynamic Volume Integration: The cloud thickness adjusts dynamically with trading volume, highlighting strong trends supported by high market activity.

📈 Strength & Momentum Analysis:

• Strength Filtering: The ADX component ensures that only strong trends are highlighted, filtering out market noise and reducing false signals.

• Visual Momentum Gauge: The cloud color and thickness provide a quick visual representation of market momentum, enabling faster decision-making.

🔔 Alerts:

• Custom Alerts: Set up alerts for when the trend shifts or reaches critical levels, keeping you informed without needing to constantly monitor the chart.

🎨 Visual Enhancements:

• Gradient Cloud & Shadows: The indicator features a gradient-filled cloud with shadowed moving averages, enhancing both aesthetics and clarity on your charts.

• Adaptive Visual Cues: MomentumCloud.V33’s color transitions and dynamic thickness provide an intuitive feel for the market’s rhythm.

🚀 Quick Guide to Using MomentumCloud.V33

1. Add the Indicator: Start by adding MomentumCloud.V33 to your chart. Customize the settings such as MA periods, DMI length, and volume multiplier to match your trading style.

2. Analyze the Market: Observe the color-coded cloud and its thickness to gauge market momentum and trend direction. The thicker the cloud, the stronger the trend.

3. Set Alerts: Activate alerts for trend changes or key levels to capture trading opportunities without needing to watch the screen continuously.

⚙️ How It Works:

MomentumCloud.V33 calculates market momentum by combining moving averages, DMI, and volume. The cloud color changes based on the trend direction, while its thickness reflects the strength of the trend as influenced by trading volume. This integrated approach ensures you can quickly identify robust market movements, making it easier to enter and exit trades at optimal points.

Settings Overview:

• Moving Averages: Define the lengths for the fast and slow moving averages.

• DMI & ADX: Adjust the DMI length and ADX smoothing to focus on significant trends.

• Volume Multiplier: Customize the multiplier to control cloud thickness, highlighting volume-driven trends.

📚 How to Use MomentumCloud.V33:

• Trend Identification: The direction and color of the cloud indicate the prevailing trend, while the cloud’s thickness suggests the trend’s strength.

• Trade Execution: Use the green cloud to look for long entries and the red cloud for short positions. The gray cloud advises caution, as it represents a range-bound market.

• Alerts: Leverage the custom alerts to stay on top of market movements and avoid missing critical trading opportunities.

Unleash the power of trend and momentum analysis with MomentumCloud.V33! Happy trading! 📈🚀✨

Wyckoff Event Detection [Alpha Extract]Wyckoff Event Detection

A powerful and intelligent indicator designed to detect key Wyckoff events in real time, helping traders analyze market structure and anticipate potential trend shifts. Using volume and price action, this script automatically identifies distribution and accumulation phases, providing traders with valuable insights into market behavior.

🔶 Phase-Based Detection

Utilizes a phase detection algorithm that evaluates price and volume conditions to identify accumulation (bullish) and distribution (bearish) events. This method ensures the script effectively captures major market turning points and avoids noise.

🔶 Multi-Factor Event Recognition

Incorporates multiple event conditions, including upthrusts, selling climaxes, and springs, to detect high-probability entry and exit points. Each event is filtered through customizable sensitivity settings, ensuring precise detection aligned with different trading styles.

🔶 Customizable Parameters

Fine-tune event detection with adjustable thresholds for volume, price movement, trend strength, and event spacing. These inputs allow traders to personalize the script to match their strategy and risk tolerance.

// === USER INPUTS ===

i_volLen = input.int(20, "Volume MA Length", minval=1)

i_priceLookback = input.int(20, "Price Pattern Lookback", minval=5)

i_lineLength = input.int(15, "Line Length", minval=5)

i_labelSpacing = input.int(5, "Minimum Label Spacing (bars)", minval=1, maxval=20)

❓How It Works

🔶 Event Identification

The script scans for key Wyckoff events by analyzing volume spikes, price deviations, and trend shifts within a user-defined lookback period. It categorizes events into bullish (accumulation) or bearish (distribution) structures and plots them directly on the chart.

// === EVENT DETECTION ===

volMA = ta.sma(volume, i_volLen)

highestHigh = ta.highest(high, i_priceLookback)

lowestLow = ta.lowest(low, i_priceLookback)

🔶 Automatic Filtering & Cleanup

Unconfirmed or weak signals are filtered out using customizable strength multipliers and volume thresholds. Events that do not meet the minimum conditions are discarded to keep the chart clean and informative.

🔶 Phase Strength Analysis

The script continuously tracks bullish and bearish event counts to determine whether the market is currently in an accumulation, distribution, or neutral phase. This allows traders to align their strategies accordingly.

🔶 Visual Alerts & Labels

Detects and labels key Wyckoff events directly on the chart, providing immediate insights into market conditions:

- PSY (Preliminary Supply) and UT (Upthrust) for distribution phases.

- PS (Preliminary Support) and SC (Selling Climax) for accumulation phases.

- Labels adjust dynamically to avoid chart clutter and improve readability.

🔶 Entry & Exit Optimization

By highlighting supply and demand imbalances, the script assists traders in identifying optimal entry and exit points. Wyckoff concepts such as springs and upthrusts provide clear trade signals based on market structure.

🔶 Trend Confirmation & Risk Management

Observing how price reacts to detected events helps confirm trend direction and potential reversals. Traders can place stop-loss and take-profit levels based on Wyckoff phase analysis, ensuring strategic trade execution.

🔶 Table-Based Market Analysis (Table)

A built-in table summarizes:

- Market Phase: Accumulation, Distribution, or Neutral.

- Strength of Phase: Weak, Moderate, or Strong.

- Price Positioning: Whether price is near support, resistance, or in a trading range.

- Supply/Demand State: Identifies whether the market is supply or demand dominant.

🔶 Why Choose Wyckoff Market Phases - Alpha Extract?

This indicator offers a systematic approach to understanding market mechanics through the lens of Wyckoff's time-tested principles. By providing clear and actionable insights into market phases, it empowers traders to make informed decisions, enhancing both confidence and performance in various trading environments.

TradFi Fundamentals: Momentum Trading with Macroeconomic DataIntroduction

This indicator combines traditional price momentum with key macroeconomic data. By retrieving GDP, inflation, unemployment, and interest rates using security calls, the script automatically adapts to the latest economic data. The goal is to blend technical analysis with fundamental insights to generate a more robust momentum signal.

Original Research Paper by Mohit Apte, B. Tech Scholar, Department of Computer Science and Engineering, COEP Technological University, Pune, India

Link to paper

Explanation

Price Momentum Calculation:

The indicator computes price momentum as the percentage change in price over a configurable lookback period (default is 50 days). This raw momentum is then normalized using a rolling simple moving average and standard deviation over a defined period (default 200 days) to ensure comparability with the economic indicators.

Fetching and Normalizing Economic Data:

Instead of manually inputting economic values, the script uses TradingView’s security function to retrieve:

GDP from ticker "GDP"

Inflation (CPI) from ticker "USCCPI"

Unemployment rate from ticker "UNRATE"

Interest rates from ticker "USINTR"

Each series is normalized over a configurable normalization period (default 200 days) by subtracting its moving average and dividing by its standard deviation. This standardization converts each economic indicator into a z-score for direct integration into the momentum score.

Combined Momentum Score:

The normalized price momentum and economic indicators are each multiplied by user-defined weights (default: 50% price momentum, 20% GDP, and 10% each for inflation, unemployment, and interest rates). The weighted components are then summed to form a comprehensive momentum score. A horizontal zero line is plotted for reference.

Trading Signals:

Buy signals are generated when the combined momentum score crosses above zero, and sell signals occur when it crosses below zero. Visual markers are added to the chart to assist with trade timing, and alert conditions are provided for automated notifications.

Settings

Price Momentum Lookback: Defines the period (in days) used to compute the raw price momentum.

Normalization Period for Price Momentum: Sets the window over which the price momentum is normalized.

Normalization Period for Economic Data: Sets the window over which each macroeconomic series is normalized.

Weights: Adjust the influence of each component (price momentum, GDP, inflation, unemployment, and interest rate) on the overall momentum score.

Conclusion

This implementation leverages TradingView’s economic data feeds to integrate real-time macroeconomic data into a momentum trading strategy. By normalizing and weighting both technical and economic inputs, the indicator offers traders a more holistic view of market conditions. The enhanced momentum signal provides additional context to traditional momentum analysis, potentially leading to more informed trading decisions and improved risk management.

The next script I release will be an improved version of this that I have added my own flavor to, improving the signals.

Blockchain Fundamentals: Liquidity & BTC YoYLiquidity & BTC YoY Indicator

Overview:

This indicator calculates the Year-over-Year (YoY) percentage change for two critical metrics: a custom Liquidity Index and Bitcoin's price. The Liquidity Index is derived from a blend of economic and forex data representing the M2 money supply, while the BTC price is obtained from a reliable market source. A dedicated limit(length) function is implemented to handle limited historical data, ensuring that the YoY calculations are available immediately—even when the chart's history is short.

Features Breakdown:

1. Limited Historical Data Workaround

- Functionality: limit(length) The function dynamically adjusts the lookback period when there isn’t enough historical data. This prevents delays in displaying YoY metrics at the beginning of the chart.

2. Liquidity Calculation

- Data Sources: Combines multiple data streams:

USM2, ECONOMICS:CNM2, USDCNY, ECONOMICS:JPM2, USDJPY, ECONOMICS:EUM2, USDEUR

- Formula:

Liquidity Index = USM2 + (CNM2 / USDCNY) + (JPM2 / USDJPY) + (EUM2 / USDEUR)

[b3. Bitcoin Price Calculation

- Data Source: Retrieves Bitcoin's price from BITSTAMP:BTCUSD on the user-selected timeframe for its historical length.

4. Year-over-Year (YoY) Percent Change Calculation

- Methodology:

- The indicator uses a custom function, to autodetect the proper number of bars, based on the selected timeframe.

- It then compares the current value to that from one year ago for both the Liquidity Index and BTC price, calculating the YoY percentage change.

5. Visual Presentation

- Plotting:

- The YoY percentage changes for Liquidity (plotted in blue) and BTC price (plotted in orange) are clearly displayed.

- A horizontal zero line is added for visual alignment, making it easier to compare the two copies of the metric. You add one copy and only display the BTC YoY. Then you add another copy and only display the M2 YoY.

-The zero lines are then used to align the scripts to each other by interposing them. You scale each chart the way you like, then move each copy individually to align both zero lines on top of each other.

This indicator is ideal for analysts and investors looking to monitor macroeconomic liquidity trends alongside Bitcoin's performance, providing immediate insights.

MTF Signal XpertMTF Signal Xpert – Detailed Description

Overview:

MTF Signal Xpert is a proprietary, open‑source trading signal indicator that fuses multiple technical analysis methods into one cohesive strategy. Developed after rigorous backtesting and extensive research, this advanced tool is designed to deliver clear BUY and SELL signals by analyzing trend, momentum, and volatility across various timeframes. Its integrated approach not only enhances signal reliability but also incorporates dynamic risk management, helping traders protect their capital while navigating complex market conditions.

Detailed Explanation of How It Works:

Trend Detection via Moving Averages

Dual Moving Averages:

MTF Signal Xpert computes two moving averages—a fast MA and a slow MA—with the flexibility to choose from Simple (SMA), Exponential (EMA), or Hull (HMA) methods. This dual-MA system helps identify the prevailing market trend by contrasting short-term momentum with longer-term trends.

Crossover Logic:

A BUY signal is initiated when the fast MA crosses above the slow MA, coupled with the condition that the current price is above the lower Bollinger Band. This suggests that the market may be emerging from a lower price region. Conversely, a SELL signal is generated when the fast MA crosses below the slow MA and the price is below the upper Bollinger Band, indicating potential bearish pressure.

Recent Crossover Confirmation:

To ensure that signals reflect current market dynamics, the script tracks the number of bars since the moving average crossover event. Only crossovers that occur within a user-defined “candle confirmation” period are considered, which helps filter out outdated signals and improves overall signal accuracy.

Volatility and Price Extremes with Bollinger Bands

Calculation of Bands:

Bollinger Bands are calculated using a 20‑period simple moving average as the central basis, with the upper and lower bands derived from a standard deviation multiplier. This creates dynamic boundaries that adjust according to recent market volatility.

Signal Reinforcement:

For BUY signals, the condition that the price is above the lower Bollinger Band suggests an undervalued market condition, while for SELL signals, the price falling below the upper Bollinger Band reinforces the bearish bias. This volatility context adds depth to the moving average crossover signals.

Momentum Confirmation Using Multiple Oscillators

RSI (Relative Strength Index):

The RSI is computed over 14 periods to determine if the market is in an overbought or oversold state. Only readings within an optimal range (defined by user inputs) validate the signal, ensuring that entries are made during balanced conditions.

MACD (Moving Average Convergence Divergence):

The MACD line is compared with its signal line to assess momentum. A bullish scenario is confirmed when the MACD line is above the signal line, while a bearish scenario is indicated when it is below, thus adding another layer of confirmation.

Awesome Oscillator (AO):

The AO measures the difference between short-term and long-term simple moving averages of the median price. Positive AO values support BUY signals, while negative values back SELL signals, offering additional momentum insight.

ADX (Average Directional Index):

The ADX quantifies trend strength. MTF Signal Xpert only considers signals when the ADX value exceeds a specified threshold, ensuring that trades are taken in strongly trending markets.

Optional Stochastic Oscillator:

An optional stochastic oscillator filter can be enabled to further refine signals. It checks for overbought conditions (supporting SELL signals) or oversold conditions (supporting BUY signals), thus reducing ambiguity.

Multi-Timeframe Verification

Higher Timeframe Filter:

To align short-term signals with broader market trends, the script calculates an EMA on a higher timeframe as specified by the user. This multi-timeframe approach helps ensure that signals on the primary chart are consistent with the overall trend, thereby reducing false signals.

Dynamic Risk Management with ATR

ATR-Based Calculations:

The Average True Range (ATR) is used to measure current market volatility. This value is multiplied by a user-defined factor to dynamically determine stop loss (SL) and take profit (TP) levels, adapting to changing market conditions.

Visual SL/TP Markers:

The calculated SL and TP levels are plotted on the chart as distinct colored dots, enabling traders to quickly identify recommended exit points.

Optional Trailing Stop:

An optional trailing stop feature is available, which adjusts the stop loss as the trade moves favorably, helping to lock in profits while protecting against sudden reversals.

Risk/Reward Ratio Calculation:

MTF Signal Xpert computes a risk/reward ratio based on the dynamic SL and TP levels. This quantitative measure allows traders to assess whether the potential reward justifies the risk associated with a trade.

Condition Weighting and Signal Scoring

Binary Condition Checks:

Each technical condition—ranging from moving average crossovers, Bollinger Band positioning, and RSI range to MACD, AO, ADX, and volume filters—is assigned a binary score (1 if met, 0 if not).

Cumulative Scoring:

These individual scores are summed to generate cumulative bullish and bearish scores, quantifying the overall strength of the signal and providing traders with an objective measure of its viability.

Detailed Signal Explanation:

A comprehensive explanation string is generated, outlining which conditions contributed to the current BUY or SELL signal. This explanation is displayed on an on‑chart dashboard, offering transparency and clarity into the signal generation process.

On-Chart Visualizations and Debug Information

Chart Elements:

The indicator plots all key components—moving averages, Bollinger Bands, SL and TP markers—directly on the chart, providing a clear visual framework for understanding market conditions.

Combined Dashboard:

A dedicated dashboard displays key metrics such as RSI, ADX, and the bullish/bearish scores, alongside a detailed explanation of the current signal. This consolidated view allows traders to quickly grasp the underlying logic.

Debug Table (Optional):

For advanced users, an optional debug table is available. This table breaks down each individual condition, indicating which criteria were met or not met, thus aiding in further analysis and strategy refinement.

Mashup Justification and Originality

MTF Signal Xpert is more than just an aggregation of existing indicators—it is an original synthesis designed to address real-world trading complexities. Here’s how its components work together:

Integrated Trend, Volatility, and Momentum Analysis:

By combining moving averages, Bollinger Bands, and multiple oscillators (RSI, MACD, AO, ADX, and an optional stochastic), the indicator captures diverse market dynamics. Each component reinforces the others, reducing noise and filtering out false signals.

Multi-Timeframe Analysis:

The inclusion of a higher timeframe filter aligns short-term signals with longer-term trends, enhancing overall reliability and reducing the potential for contradictory signals.

Adaptive Risk Management:

Dynamic stop loss and take profit levels, determined using ATR, ensure that the risk management strategy adapts to current market conditions. The optional trailing stop further refines this approach, protecting profits as the market evolves.

Quantitative Signal Scoring:

The condition weighting system provides an objective measure of signal strength, giving traders clear insight into how each technical component contributes to the final decision.

How to Use MTF Signal Xpert:

Input Customization:

Adjust the moving average type and period settings, ATR multipliers, and oscillator thresholds to align with your trading style and the specific market conditions.

Enable or disable the optional stochastic oscillator and trailing stop based on your preference.

Interpreting the Signals:

When a BUY or SELL signal appears, refer to the on‑chart dashboard, which displays key metrics (e.g., RSI, ADX, bullish/bearish scores) along with a detailed breakdown of the conditions that triggered the signal.

Review the SL and TP markers on the chart to understand the associated risk/reward setup.

Risk Management:

Use the dynamically calculated stop loss and take profit levels as guidelines for setting your exit points.

Evaluate the provided risk/reward ratio to ensure that the potential reward justifies the risk before entering a trade.

Debugging and Verification:

Advanced users can enable the debug table to see a condition-by-condition breakdown of the signal generation process, helping refine the strategy and deepen understanding of market dynamics.

Disclaimer:

MTF Signal Xpert is intended for educational and analytical purposes only. Although it is based on robust technical analysis methods and has undergone extensive backtesting, past performance is not indicative of future results. Traders should employ proper risk management and adjust the settings to suit their financial circumstances and risk tolerance.

MTF Signal Xpert represents a comprehensive, original approach to trading signal generation. By blending trend detection, volatility assessment, momentum analysis, multi-timeframe alignment, and adaptive risk management into one integrated system, it provides traders with actionable signals and the transparency needed to understand the logic behind them.

Blockchain Fundamentals: Global LiquidityGlobal Liquidity Indicator Overview

This indicator provides a comprehensive technical analysis of liquidity trends by deriving a Global Liquidity metric from multiple data sources. It applies a suite of technical indicators directly on this liquidity measure, rather than on price data. When this metric is expanding Bitcoin and crypto tends to bullish conditions.

Features:

1. Global Liquidity Calculation

Data Integration: Combines multiple market data sources using a ratio-based formula to produce a unique liquidity measure.

Custom Metric: This liquidity metric serves as the foundational input for further technical analysis.

2. Timeframe Customization

User-Selected Period: Users can select the data timeframe (default is 2 months) to ensure consistency and flexibility in analysis.

3. Additional Technical Indicators

RSI, Momentum, ROC, MACD, and Stochastic:

Each indicator is computed using the Global Liquidity series rather than price.

User-selectable toggles allow for enabling or disabling each individual indicator as desired.

4. Enhanced MACD Visualization

Dynamic Histogram Coloring:

The MACD histogram color adjusts dynamically: brighter hues indicate rising histogram values while darker hues indicate falling values.

When the histogram is above zero, green is used; when below zero, red is applied, offering immediate visual insight into momentum shifts.

Conclusion

This indicator is an enlightening tool for understanding liquidity dynamics, aiding in macroeconomic analysis and investment decision-making by highlighting shifts in liquidity conditions and market momentum.

[EmreKb] Pinbar AnalysisDescription

The Pinbar Analyzer tool will count how many ltf candles are inside the wick and the total volume inside the wick.

How it works?

Calculate candle count of inside wick and volumes. Than display like below image

T/iW: Total Candle / Total inside Wick

ROiW: Rate of inside wick candle count

TV/WV: Total volume / Wick volume

Combined SmartComment & Dynamic S/R LevelsDescription:

The Combined SmartComment & Dynamic S/R Levels script is designed to provide valuable insights for traders using TradingView. It integrates dynamic support and resistance levels with a powerful Intelligent Comment system to enhance decision-making. The Intelligent Comment feature generates market commentary based on key technical indicators, delivering real-time actionable feedback that helps optimize trading strategies.

Intelligent Comment Feature:

The Intelligent Comment function continuously analyzes market conditions and offers relevant insights based on combinations of various technical indicators such as RSI, ATR, MACD, WMA, and others. These comments help traders identify potential price movements, highlighting opportunities to buy, sell, or wait.

Examples of the insights provided by the system include:

RSI in overbought/oversold and price near resistance/support: Indicates potential price reversal points.

Price above VAH and volume increasing: Suggests a strengthening uptrend.

Price near dynamic support/resistance: Alerts when price approaches critical support or resistance zones.

MACD crossovers and RSI movements: Provide signals for potential trend shifts or continuations.

Indicators Used:

RSI (Relative Strength Index)

ATR (Average True Range)

MACD (Moving Average Convergence Divergence)

WMA (Weighted Moving Average)

POC (Point of Control)

Bollinger Bands

SuperSignal

Volume

EMA (Exponential Moving Average)

Dynamic Support/Resistance Levels

How It Works:

The script performs real-time market analysis, assessing multiple technical indicators to generate Intelligent Comments. These comments provide traders with timely guidance on potential market movements, assisting with decision-making in a dynamic market environment. The script also integrates dynamic support and resistance levels to further enhance trading accuracy.

TVMC - Composite Indicator with Technical RatingsDescription:

The TVMC (Trend, Volume, Momentum, Composite) indicator is a powerful multi-component tool designed to provide traders with a comprehensive understanding of market conditions. By combining four essential technical analysis components—trend, momentum, volume, and volatility—this indicator offers clear and actionable insights to assist in decision-making.

Key Features:

1. Trend Component (TC):

* Based on MACD (Moving Average Convergence Divergence), this component analyzes the relationship between two exponential moving averages (fast and slow) to determine the prevailing market trend.

* The MACD signal is normalized to a range of -1 to +1 for consistency and clarity.

2. Momentum Component (MC):

* Utilizes RSI (Relative Strength Index) to measure the strength and speed of price movements.

* This component highlights overbought or oversold conditions, which may indicate potential market reversals.

3. Volume Confirmation (VC):

* Compares the current trading volume to its moving average over a specified period.

* High volume relative to the average confirms the validity of the current trend.

4. Volatility Filter (VF):

* Uses ATR (Average True Range) to gauge market volatility.

* Adjusts and smooths signals to reduce noise during periods of high volatility.

5. Technical Ratings Integration:

* Incorporates TradingView’s Technical Ratings, allowing users to validate signals using moving averages, oscillators, or a combination of both.

* Users can choose their preferred source of ratings for enhanced signal confirmation.

How It Works:

The TVMC indicator combines the weighted contributions of the Trend, Momentum, and Volume components, further refined by the Volatility Filter. Each component plays a specific role:

* Trend: Identifies whether the market is bullish, bearish, or neutral.

* Momentum: Highlights the strength of price action.

* Volume: Confirms whether the current price action is supported by sufficient trading activity.

* Volatility: Filters out excessive noise in volatile market conditions, providing a smoother and more reliable output.

Visualization:

1. Bullish Signals:

* The indicator line turns green and remains above the zero line, indicating upward momentum.

2. Bearish Signals:

* The indicator line turns red and falls below the zero line, signaling downward momentum.

3. Neutral Signals:

* The line is orange and stays near zero, indicating a lack of strong trend or momentum.

4. Zones:

* Horizontal lines at +30 and -30 mark strong bullish and bearish zones, respectively.

* A zero line is included for clear separation between bullish and bearish signals.

Recommended Usage:

* Best Timeframes: The indicator is optimized for higher timeframes such as 4-hour (H4) and daily (D1) charts.

* Trading Style: Suitable for swing and positional trading.

* Customization: The indicator allows users to adjust all major parameters (e.g., MACD, RSI, volume, and ATR settings) to fit their trading preferences.

Customization Options:

* Adjustable weights for Trend, Momentum, and Volume components.

* Fully configurable settings for MACD, RSI, Volume SMA, and ATR periods.

* Timeframe selection for multi-timeframe analysis.

Important Notes:

1. Originality: The TVMC indicator combines multiple analysis methods into a unique framework. It does not replicate or minimally modify existing indicators.

2. Transparency: The description is detailed enough for users to understand the methodology without requiring access to the code.

3. Clarity: The indicator is explained in a way that is accessible even to users unfamiliar with complex technical analysis tools.

Compliance with TradingView Rules:

* The indicator is written in Pine Script version 5, adhering to TradingView’s language standards.

* The description is written in English to ensure accessibility to the global community, with a clear explanation of all components and functionality.

* No promotional content, links, or unrelated references are included.

* The chart accompanying the indicator is clean and demonstrates its intended use clearly, with no additional indicators unless explicitly explained.

Enhanced Cumulative Volume Delta + MAThe Enhanced Cumulative Volume Delta (CVD) indicator is designed to help traders analyze the cumulative buying and selling pressure in the market by examining the delta between the up and down volume. By tracking this metric, traders can gain insights into the strength of a trend and potential reversals. This indicator uses advanced volume analysis combined with customizable moving averages to provide a more detailed view of market dynamics.

How to Use This Indicator:

Volume Delta Visualization:

The indicator plots the cumulative volume delta (CVD) using color-coded candles, where teal represents positive delta (buying pressure) and soft red represents negative delta (selling pressure).

Moving Averages:

Use the moving averages to smooth the CVD data and identify long-term trends. You can choose between SMA and EMA for each of the three available moving averages. The first and third moving averages are typically used for short-term and long-term trend analysis, respectively, while the second moving average can serve as a medium-term filter.

Arrow Markers:

The indicator will display arrows (green triangle up for crossing above, red triangle down for crossing below) when the CVD volume crosses the 3rd moving average. You can control the visibility of these arrows through the input parameters.

Volume Data:

The indicator provides error handling in case no volume data is available for the selected symbol, ensuring that you're not misled by incomplete data.

Practical Applications:

Trend Confirmation: Use the CVD and moving averages to confirm the overall trend direction and strength. Positive delta and a rising CVD can confirm an uptrend, while negative delta and a falling CVD indicate a downtrend.

Volume Breakouts: The arrows marking when the CVD crosses the 3rd moving average can help you spot potential volume breakouts or reversals, making them useful for entry or exit signals.

Volume Divergence: Pay attention to divergences between price and CVD, as these can often signal potential trend reversals or weakening momentum.

RSI OB/OS Strategy Analyzer█ OVERVIEW

The RSI OB/OS Strategy Analyzer is a comprehensive trading tool designed to help traders identify and evaluate overbought/oversold reversal opportunities using the Relative Strength Index (RSI). It provides visual signals, performance metrics, and a detailed table to analyze the effectiveness of RSI-based strategies over a user-defined lookback period.

█ KEY FEATURES

RSI Calculation

Calculates RSI with customizable period (default 14)

Plots dynamic overbought (70) and oversold (30) levels

Adds background coloring for OB/OS regions

Reversal Signals

Identifies signals based on RSI crossing OB/OS levels

Two entry strategies available:

Revert Cross: Triggers when RSI exits OB/OS zone

Cross Threshold: Triggers when RSI enters OB/OS zone

Trade Direction

Users can select a trade bias:

Long: Focuses on oversold reversals (bullish signals)

Short: Focuses on overbought reversals (bearish signals)

Performance Metrics

Calculates three key statistics for each lookback period:

Win Rate: Percentage of profitable trades

Mean Return: Average return across all trades

Median Return: Median return across all trades

Metrics calculated as percentage changes from entry price

Visual Signals

Dual-layer signal display:

BUY: Green triangles + text labels below price

SELL: Red triangles + text labels above price

Semi-transparent background highlighting in OB/OS zones

Performance Table

Interactive table showing metrics for each lookback period

Color-coded visualization:

Win Rate: Gradient from red (low) to green (high)

Returns: Green for positive, red for negative

Time Filtering

Users can define a specific time window for the indicator to analyze trades, ensuring that performance metrics are calculated only for the desired period.

Customizable Display

Adjustable table font sizes: Auto/Small/Normal/Large

Toggle option for table visibility

█ PURPOSE

The RSI OB/OS Strategy Analyzer helps traders:

Identify mean-reversion opportunities through RSI extremes

Backtest entry strategy effectiveness across multiple time horizons

Optimize trade timing through visual historical performance data

Quickly assess strategy robustness with color-coded metrics

█ IDEAL USERS

Counter-Trend Traders: Looking to capitalize on RSI extremes

Systematic Traders: Needing quantitative strategy validation

Educational Users: Studying RSI behavior in different market conditions

Multi-Timeframe Analysts: Interested in forward returns analysis

Bollinger Bands Reversal Strategy Analyzer█ OVERVIEW

The Bollinger Bands Reversal Overlay is a versatile trading tool designed to help traders identify potential reversal opportunities using Bollinger Bands. It provides visual signals, performance metrics, and a detailed table to analyze the effectiveness of reversal-based strategies over a user-defined lookback period.

█ KEY FEATURES

Bollinger Bands Calculation

The indicator calculates the standard Bollinger Bands, consisting of:

A middle band (basis) as the Simple Moving Average (SMA) of the closing price.

An upper band as the basis plus a multiple of the standard deviation.

A lower band as the basis minus a multiple of the standard deviation.

Users can customize the length of the Bollinger Bands and the multiplier for the standard deviation.

Reversal Signals

The indicator identifies potential reversal signals based on the interaction between the price and the Bollinger Bands.

Two entry strategies are available:

Revert Cross: Waits for the price to close back above the lower band (for longs) or below the upper band (for shorts) after crossing it.

Cross Threshold: Triggers a signal as soon as the price crosses the lower band (for longs) or the upper band (for shorts).

Trade Direction

Users can select a trade bias:

Long: Focuses on bullish reversal signals.

Short: Focuses on bearish reversal signals.

Performance Metrics

The indicator calculates and displays the performance of trades over a user-defined lookback period ( barLookback ).

Metrics include:

Win Rate: The percentage of trades that were profitable.

Mean Return: The average return across all trades.

Median Return: The median return across all trades.

These metrics are calculated for each bar in the lookback period, providing insights into the strategy's performance over time.

Visual Signals

The indicator plots buy and sell signals on the chart:

Buy Signals: Displayed as green triangles below the price bars.

Sell Signals: Displayed as red triangles above the price bars.

Performance Table

A customizable table is displayed on the chart, showing the performance metrics for each bar in the lookback period.

The table includes:

Win Rate: Highlighted with gradient colors (green for high win rates, red for low win rates).

Mean Return: Colored based on profitability (green for positive returns, red for negative returns).

Median Return: Colored similarly to the mean return.

Time Filtering

Users can define a specific time window for the indicator to analyze trades, ensuring that performance metrics are calculated only for the desired period.

Customizable Display

The table's font size can be adjusted to suit the user's preference, with options for "Auto," "Small," "Normal," and "Large."

█ PURPOSE

The Bollinger Bands Reversal Overlay is designed to:

Help traders identify high-probability reversal opportunities using Bollinger Bands.

Provide actionable insights into the performance of reversal-based strategies.

Enable users to backtest and optimize their trading strategies by analyzing historical performance metrics.

█ IDEAL USERS

Swing Traders: Looking for reversal opportunities within a trend.

Mean Reversion Traders: Interested in trading price reversals to the mean.

Strategy Developers: Seeking to backtest and refine Bollinger Bands-based strategies.

Performance Analysts: Wanting to evaluate the effectiveness of reversal signals over time.

Relative Volume Index [PhenLabs]Relative Volume Index (RVI)

Version: PineScript™ v6

Description

The Relative Volume Index (RVI) is a sophisticated volume analysis indicator that compares real-time trading volume against historical averages for specific time periods. By analyzing volume patterns and statistical deviations, it helps traders identify unusual market activity and potential trading opportunities. The indicator uses dynamic color visualization and statistical overlays to provide clear, actionable volume analysis.

Components

• Volume Comparison: Real-time volume relative to historical averages

• Statistical Bands: Upper and lower deviation bands showing volume volatility

• Moving Average Line: Smoothed trend of relative volume

• Color Gradient Display: Visual representation of volume strength

• Statistics Dashboard: Real-time metrics and calculations

Usage Guidelines

Volume Strength Analysis:

• Values > 1.0 indicate above-average volume

• Values < 1.0 indicate below-average volume

• Watch for readings above the threshold (default 6.5x) for exceptional volume

Trading Signals:

• Strong volume confirms price moves

• Divergences between price and volume suggest potential reversals

• Use extreme readings as potential reversal signals

Optimal Settings:

• Start with default 15-bar lookback for general analysis

• Adjust threshold (6.5x) based on market volatility

• Use with multiple timeframes for confirmation

Best Practices:

• Combine with price action and other indicators

• Monitor deviation bands for volatility expansion

• Use the statistics panel for precise readings

• Pay attention to color gradients for quick assessment

Limitations

• Requires quality volume data for accurate calculations

• May produce false signals during pre/post market hours

• Historical comparisons may be skewed during unusual market conditions

• Best suited for liquid markets with consistent volume patterns

Note: For optimal results, use in conjunction with price action analysis and other technical indicators. The indicator performs best during regular market hours on liquid instruments.

Normalized Price ComparisonNormalized Price Comparison Indicator Description

The "Normalized Price Comparison" indicator is designed to provide traders with a visual tool for comparing the price movements of up to three different financial instruments on a common scale, despite their potentially different price ranges. Here's how it works:

Features:

Normalization: This indicator normalizes the closing prices of each symbol to a scale between 0 and 1 over a user-defined period. This normalization process allows for the comparison of price trends regardless of the absolute price levels, making it easier to spot relative movements and trends.

Crossing Alert: It features an alert functionality that triggers when the normalized price lines of the first two symbols (Symbol 1 and Symbol 2) cross each other. This can be particularly useful for identifying potential trading opportunities when one asset's relative performance changes against another.

Customization: Users can input up to three symbols for analysis. The normalization period can be adjusted, allowing flexibility in how historical data is considered for the scaling process. This period determines how many past bars are used to calculate the minimum and maximum prices for normalization.

Visual Representation: The indicator plots these normalized prices in a separate pane below the main chart. Each symbol's normalized price is represented by a distinct colored line:

Symbol 1: Blue line

Symbol 2: Red line

Symbol 3: Green line

Use Cases:

Relative Performance Analysis: Ideal for investors or traders who want to compare how different assets are performing relative to each other over time, without the distraction of absolute price differences.

Divergence Detection: Useful for spotting divergences where one asset might be outperforming or underperforming compared to others, potentially signaling changes in market trends or investment opportunities.

Crossing Strategy: The alert for when Symbol 1 and Symbol 2's normalized lines cross can be used as a part of a trading strategy, signaling potential entry or exit points based on relative price movements.

Limitations:

Static Alert Messages: Due to Pine Script's constraints, the alert messages cannot dynamically include the names of the symbols being compared. The alert will always mention "Symbol 1" and "Symbol 2" crossing.

Performance: Depending on the timeframe and the number of symbols, performance might be affected, especially on lower timeframes with high data frequency.

This indicator is particularly beneficial for those interested in multi-asset analysis, offering a streamlined way to observe and react to relative price movements in a visually coherent manner. It's a powerful tool for enhancing your trading or investment analysis by focusing on trends and relationships rather than raw price data.

Relative Performance Indicator by ComLucro - 2025_V01The "Relative Performance Indicator by ComLucro - 2025_V01" is a powerful tool designed to analyze an asset's performance relative to a benchmark index over multiple timeframes. This indicator provides traders with a clear view of how their chosen asset compares to a market index in short, medium, and long-term periods.

Key Features:

Customizable Lookback Periods: Analyze performance across three adjustable periods (default: 20, 50, and 200 bars).

Relative Performance Analysis: Calculate and visualize the difference in percentage performance between the asset and the benchmark index.

Dynamic Summary Label: Displays a detailed breakdown of the asset's and index's performance for the latest bar.

User-Friendly Interface: Includes customizable colors and display options for clear visualization.

How It Works:

The script fetches closing prices of both the asset and a benchmark index.

It calculates percentage changes over the selected lookback periods.

The indicator then computes the relative performance difference between the asset and the index, plotting it on the chart for easy trend analysis.

Who Is This For?:

Traders and investors who want to compare an asset’s performance against a benchmark index.

Those looking to identify trends and deviations between an asset and the broader market.

Disclaimer:

This tool is for educational purposes only and does not constitute financial or trading advice. Always use it alongside proper risk management strategies and backtest thoroughly before applying it to live trading.

Chart Recommendation:

Use this script on clean charts for better clarity. Combine it with other technical indicators like moving averages or trendlines to enhance your analysis. Ensure you adjust the lookback periods to match your trading style and the timeframe of your analysis.

Additional Notes:

For optimal performance, ensure the benchmark index's data is available on your TradingView subscription. The script uses fallback mechanisms to avoid interruptions when index data is unavailable. Always validate the settings and test them to suit your trading strategy.

Social SentimentThe Social Sentiment Indicator aggregates social sentiment data from Telegram and LunarCrush , normalizing and smoothing the data to create an intuitive, adaptive sentiment signal. By comparing positive and negative sentiment from Telegram with LunarCrush's sentiment percentages, this indicator provides a visual representation of aggregated market sentiment.

This script provides context for market sentiment, helping traders understand crowd psychology and its potential impact on price action. It excels at identifying moments of extreme optimism or pessimism, which can act as confirmations or warnings in a broader trading strategy.

This tool provides context but lacks direct buy/sell signals. Works best in trending or volatile markets but should be combined with other indicators for a complete trading strategy.

Daily PlayDaily Play Indicator

The Daily Play Indicator is a clean and versatile tool designed to help traders organize and execute their daily trading plan directly on their charts. This indicator simplifies your workflow by visually displaying key inputs like market trend, directional bias, and key levels, making it easier to focus on your trading strategy.

Features

Dropdown Selection for Trend and Bias:

• Set the overall market trend (Bullish, Bearish, or Neutral) and your directional bias (Long, Short, or Neutral) using intuitive dropdown menus. No more manual typing or guesswork!

Key Levels:

Quickly input and display the Previous Day High and Previous Day Low. These levels are essential for many trading strategies, such as breakouts.

Real-Time News Notes:

Add a quick note about impactful news or market events (e.g., “Fed meeting today” or “Earnings season”) to keep contextual awareness while trading.

Simple On-Chart Display:

The indicator creates a “table-like” structure on the chart, aligning your inputs in an easy-to-read format. The data is positioned dynamically so it doesn’t obstruct the price action.

Customisable Visual Style:

Simple labels with clear text to ensure that your chart remains neat and tidy.

----

Use Case

The Daily Play Indicator is ideal for:

• Day traders and scalpers who rely on precise planning and real-time execution.

• Swing traders looking to mark critical levels and develop a trade plan before the session begins.

• Anyone who needs a structured way to stay focused and disciplined during volatile market conditions.

By integrating this tool into your workflow, you can easily align your daily preparation with live market action.

----

How to Use

Open the indicator settings to configure your inputs:

• Trend: Use the dropdown to choose between Bullish, Bearish, or Neutral.

• Bias: Select Long, Short, or Neutral to align your personal bias with the market.

• Previous Day Levels: Enter the High and Low of the previous trading session for key reference points.

• News: Add a short description of any relevant market-moving events.

GP - SRSI ChannelGP - SRSI Channel Indicator

The GP - SRSI Channel is a channel indicator derived from the Stochastic RSI (SRSI) oscillator. It combines SRSI data from multiple timeframes to analyze minimum, maximum, and closing values, forming a channel based on these calculations. The goal is to identify overbought and oversold zones with color coding and highlight potential trading opportunities by indicating trend reversal points.

How It Works

SRSI Calculation: The indicator calculates the Stochastic RSI values using open, high, low, and close prices from the selected timeframes.

Channel Creation: Minimum and maximum values derived from these calculations are combined across multiple timeframes. The midpoint is calculated as the average of these values.

Color Coding: Zones within the channel are color-coded with a gradient from red to green based on the ratios. Green zones typically indicate selling opportunities, while red zones suggest buying opportunities.

Visual Elements:

The channel boundaries (min/max) are displayed as lines.

Overbought/oversold regions (95-100 and 0-5) are highlighted with shaded areas.

Additional explanatory labels are placed on key levels to guide users.

How to Use

Trading Strategy: This indicator can be used for both trend following and identifying reversal points. Selling opportunities can be evaluated when the channel reaches the upper green zone, while buying opportunities can be considered in the lower red zone.

Timeframe Selection: Users can analyze multiple timeframes simultaneously to gain a broader perspective.

Customization: RSI and Stochastic RSI parameters are adjustable, allowing users to tailor the indicator to their trading strategies.

Important Note

This indicator is for informational purposes only and should not be used as a sole basis for trading decisions. Please validate the results of the indicator with your own analysis.

Dynamic Market Correlation Analyzer (DMCA) v1.0Description

The Dynamic Market Correlation Analyzer (DMCA) is an advanced TradingView indicator designed to provide real-time correlation analysis between multiple assets. It offers a comprehensive view of market relationships through correlation coefficients, technical indicators, and visual representations.

Key Features

- Multi-asset correlation tracking (up to 5 symbols)

- Dynamic correlation strength categorization

- Integrated technical indicators (RSI, MACD, DX)

- Customizable visualization options

- Real-time price change monitoring

- Flexible timeframe selection

## Use Cases

1. **Portfolio Diversification**

- Identify highly correlated assets to avoid concentration risk

- Find negatively correlated assets for hedging strategies

- Monitor correlation changes during market events

2. Pairs Trading

- Detect correlation breakdowns for potential trading opportunities

- Track correlation strength for pair selection

- Monitor technical indicators for trade timing

3. Risk Management

- Assess portfolio correlation risk in real-time

- Monitor correlation shifts during market stress

- Identify potential portfolio vulnerabilities

4. **Market Analysis**

- Study sector relationships and rotations

- Analyze cross-asset correlations (e.g., stocks vs. commodities)

- Track market regime changes through correlation patterns

Components

Input Parameters

- **Timeframe**: Custom timeframe selection for analysis

- **Length**: Correlation calculation period (default: 20)

- **Source**: Price data source selection

- **Symbol Selection**: Up to 5 customizable symbols

- **Display Options**: Table position, text color, and size settings

Technical Indicators

1. **Correlation Coefficient**

- Range: -1 to +1

- Strength categories: Strong/Moderate/Weak (Positive/Negative)

2. **RSI (Relative Strength Index)**

- 14-period default setting

- Momentum comparison across assets

3. **MACD (Moving Average Convergence Divergence)**

- Standard settings (12, 26, 9)

- Trend direction indicator

4. **DX (Directional Index)**

- Trend strength measurement

- Based on DMI calculations

Visual Components

1. **Correlation Table**

- Symbol identifiers

- Correlation coefficients

- Correlation strength descriptions

- Price change percentages

- Technical indicator values

2. **Correlation Plot**

- Real-time correlation visualization

- Multiple correlation lines

- Reference levels at -1, 0, and +1

- Color-coded for easy identification

Installation and Setup

1. Load the indicator on TradingView

2. Configure desired symbols (up to 5)

3. Adjust timeframe and calculation length

4. Customize display settings

5. Enable/disable desired components (table, plot, RSI)

Best Practices

1. **Symbol Selection**

- Choose related but distinct assets

- Include a mix of asset classes

- Consider market cap and liquidity

2. **Timeframe Selection**

- Match timeframe to trading strategy

- Consider longer timeframes for strategic analysis

- Use shorter timeframes for tactical decisions

3. **Interpretation**

- Monitor correlation changes over time

- Consider multiple timeframes

- Combine with other technical analysis tools

- Account for market conditions and volatility

Performance Notes

- Calculations update in real-time

- Resource usage scales with number of active symbols

- Historical data availability may affect initial calculations

Version History

- v1.0: Initial release with core functionality

- Multi-symbol correlation analysis

- Technical indicator integration

- Customizable display options

Future Enhancements (Planned)

- Additional technical indicators

- Advanced correlation algorithms

- Enhanced visualization options

- Custom alert conditions

- Statistical significance testing

DSL Trend Analysis [ChartPrime]The DSL Trend Analysis indicator utilizes Discontinued Signal Lines (DSL) deployed directly on price, combined with dynamic bands, to analyze the trend strength and momentum of price movements. By tracking the high and low price values and comparing them to the DSL bands, it provides a visual representation of trend momentum, highlighting both strong and weakening phases of market direction.

⯁ KEY FEATURES AND HOW TO USE

⯌ DSL-Based Trend Detection :

This indicator uses Discontinued Signal Lines (DSL) to evaluate price action. When the high stays above the upper DSL band, the line turns lime, indicating strong upward momentum. Similarly, when the low stays below the lower DSL band, the line turns orange, indicating strong downward momentum. Traders can use these visual signals to identify strong trends in either direction.

⯌ Bands for Trend Momentum :

The indicator plots dynamic bands around the DSL lines based on ATR (Average True Range). These bands provide a range within which price can fluctuate, helping to distinguish between strong and weakening trends. If the high remains within the upper band, the lime-colored line becomes transparent, showing weakening upward momentum. The same concept applies for the lower band, where the line turns orange with transparency, indicating weakening downward momentum.

If high and low stays between bands line has no color

to make sure indicator catches only strong momentum of price

⯌ Real-Time Band Price Labels :

The indicator places two labels on the chart, one at the upper DSL band and one at the lower DSL band, displaying the real-time price values of these bands. These labels help traders track the current price relative to the key bands, which are essential in determining potential breakout or reversal zones.

⯌ Visual Confirmation of Momentum Shifts :

By monitoring the relationship between the high and low values of the price relative to the DSL bands, this indicator provides a reliable way to confirm whether the trend is gaining or losing strength. This allows traders to act accordingly, whether it's to enter or exit positions based on trend strength or weakness.

⯁ USER INPUTS

Length : Defines the period used to calculate the DSL lines, influencing the sensitivity of the trend detection.

Offset : Adjusts the offset applied to the upper and lower DSL bands, affecting how the thresholds for strong or weak momentum are set.

Width (ATR Multiplier) : Determines the width of the DSL bands based on an ATR multiplier, providing a dynamic range around the price for momentum analysis.

⯁ CONCLUSION

The DSL Trend Analysis indicator is a powerful tool for assessing price momentum and trend strength. By combining Discontinued Signal Lines with dynamically calculated bands, traders can easily spot key moments when momentum shifts from strong to weak or vice versa. The color-coded lines and real-time price labels provide valuable insights for trading decisions in both trending and ranging markets.

CAPE / Shiller PE RatioThe CAPE (Cyclically Adjusted Price-to-Earnings) or Shiller PE ratio is a popular valuation measure used by investors to assess whether a stock or index is over or undervalued relative to its historical earnings. Unlike the traditional P/E ratio, the CAPE ratio smooths earnings over ten years, adjusting for inflation and providing a more stable and long-term view of valuation.

This indicator lets you quickly calculate and visualize the CAPE ratio for any stock on TradingView, helping you make informed decisions about the sustainability of current price levels. With its clear presentation and intuitive setup, you can compare historical CAPE levels and identify potential opportunities for long-term investments or avoid overvalued markets.

Advantages of the CAPE Ratio:

Long-Term Focus : Smooth earnings over ten years, reducing the impact of short-term volatility.

Inflation-Adjusted : Provides a more precise, inflation-adjusted valuation measure over time.

Historical Comparison : Allows for benchmarking against long-term historical averages.

Market Sentiment Indicator : Can highlight overvalued or undervalued markets for long-term investors.

Reduces Noise : Filters out short-term earnings fluctuations, offering a more stable view.

Disadvantages of the CAPE Ratio:

Ignores Recent Earnings : Misses short-term earnings changes, which can affect current valuations.

Outdated Data : Relies on old earnings data that may not reflect recent company performance.

Less Effective for Growth Stocks : May undervalue high-growth stocks focused on future earnings.

Sector Limitations : Works best for broad markets, less so for fast-changing industries.

Debated Predictive Power : It’s unreliable for timing short-term market movements.

In short, the CAPE ratio is excellent for long-term valuation but has limitations for short-term or growth-focused investing.

Disclaimer

Please remember that past performance may not be indicative of future results.

Due to various factors, including changing market conditions, the strategy may no longer perform as well as in historical backtesting.

This post and the script don’t provide any financial advice.