INVITE-ONLY SCRIPT

Strategy Tester [Cometreon]

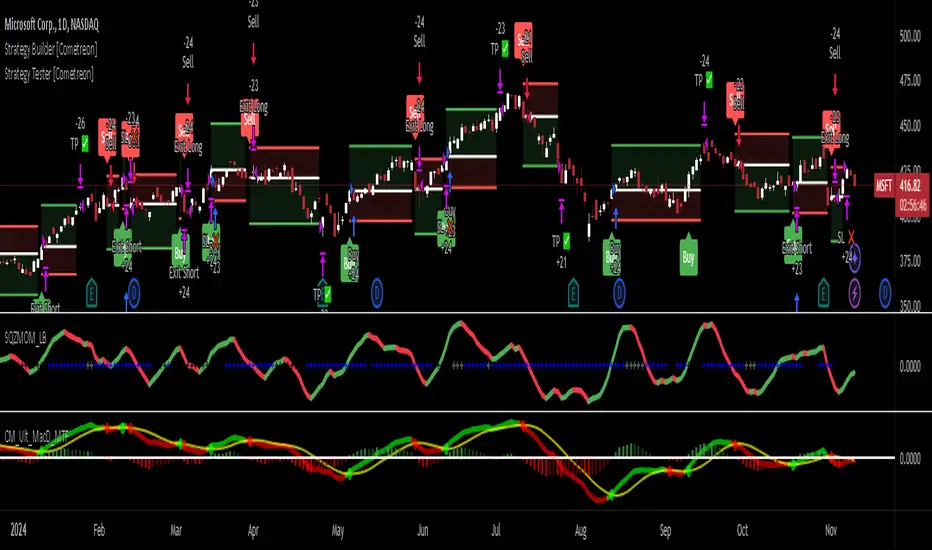

Strategy Tester [Cometreon] is a powerful backtesting engine designed to evaluate and optimize trading strategies built with the Strategy Builder or signals triggered by the Signal Tester.

It provides a full-featured environment for assessing strategy performance across symbols and timeframes, offering smart tools for risk management, capital allocation, and alert handling.

Whether you're refining a custom strategy or validating signals, Strategy Tester helps you test with confidence and clarity.

🔷 Key Features

🟩 Multi-Symbol, Multi-Timeframe Testing

Easily test strategies across different assets and timeframes to understand how they behave in diverse market conditions.

🟩 Advanced Risk Management

Implement multiple Take Profit and Stop Loss combinations, break-even, trailing systems, and exit rules tailored to your style.

🟩 Flexible Session and Capital Settings

Customize trading hours, session windows, and initial capital allocation for ultra-precise testing scenarios.

🟩 Custom Alerts

Generate personalized alerts for entries, exits, and SL/TP adjustments to simulate real-time execution.

🔷 Technical Details and Customizable Inputs

1️⃣ Source Entry Long and Short - Select entry conditions for the strategy from the "Signal Tester" or "Strategy Builder".

2️⃣ Source Exit Long and Short - Select exit conditions for the strategy from the "Signal Tester" or "Strategy Builder".

3️⃣ Trading Session - Choose the period in which the strategy will enter positions, selecting from: Months, Days, up to 3 hourly sessions, and the strategy's activity range, i.e., start and end date.

4️⃣ Alert Message - Set custom messages for each type of Alert, such as Entry Long, Exit Short, or Change SL Long.

5️⃣ Plot - Choose whether to show Long and Short positions on the chart.

🔷 Risk Management Settings

1️⃣ Initial Capital - Set the starting capital for the strategy.

2️⃣ Quantity - Choose the entry quantity for each type of position, selecting from: Contracts, USD, Percentage of equity, or percentage of initial capital.

3️⃣ Take Profit - Configure up to 4 Take Profits using one of the following types:

4️⃣ Stop Loss - Set the SL using the same types as TP for maximum flexibility.

5️⃣ Break Even - Automatically modify SL when price hits a TP level, adjusting by % / USD / Pip from entry.

6️⃣ Trailing Take Profit - Activates a dynamic TP when a condition is met, updating it as price evolves (e.g., new highs).

7️⃣ Trailing Stop Loss - Updates SL automatically when the market moves in your favor (e.g., new lows in long trades).

8️⃣ Exit Before End Session - Exit positions a few candles before the session ends to avoid overnight risks.

🔍 How to Use Strategy Tester

🧩 Add the Indicator:

Load Strategy Tester onto your chart and connect it to any Cometreon signal generator.

⚙️ Configure Risk Settings:

Set up capital, risk, SL/TP parameters, and time filters to match your strategy profile.

🧪 Run the Test:

Execute the backtest and analyze the visual + data output for insight.

📊 Optimize and Repeat:

Adjust key parameters and re-run until your strategy achieves optimal performance.

☄️ Take your trading to the next level with TradeLab Beta's Strategy Tester this powerful backtesting tool and start optimizing your trading strategies today.

👉 Don't waste any more time and visit the link to get access to all Cometreon indicators.

It provides a full-featured environment for assessing strategy performance across symbols and timeframes, offering smart tools for risk management, capital allocation, and alert handling.

Whether you're refining a custom strategy or validating signals, Strategy Tester helps you test with confidence and clarity.

🔷 Key Features

🟩 Multi-Symbol, Multi-Timeframe Testing

Easily test strategies across different assets and timeframes to understand how they behave in diverse market conditions.

🟩 Advanced Risk Management

Implement multiple Take Profit and Stop Loss combinations, break-even, trailing systems, and exit rules tailored to your style.

🟩 Flexible Session and Capital Settings

Customize trading hours, session windows, and initial capital allocation for ultra-precise testing scenarios.

🟩 Custom Alerts

Generate personalized alerts for entries, exits, and SL/TP adjustments to simulate real-time execution.

🔷 Technical Details and Customizable Inputs

1️⃣ Source Entry Long and Short - Select entry conditions for the strategy from the "Signal Tester" or "Strategy Builder".

2️⃣ Source Exit Long and Short - Select exit conditions for the strategy from the "Signal Tester" or "Strategy Builder".

3️⃣ Trading Session - Choose the period in which the strategy will enter positions, selecting from: Months, Days, up to 3 hourly sessions, and the strategy's activity range, i.e., start and end date.

4️⃣ Alert Message - Set custom messages for each type of Alert, such as Entry Long, Exit Short, or Change SL Long.

5️⃣ Plot - Choose whether to show Long and Short positions on the chart.

🔷 Risk Management Settings

1️⃣ Initial Capital - Set the starting capital for the strategy.

2️⃣ Quantity - Choose the entry quantity for each type of position, selecting from: Contracts, USD, Percentage of equity, or percentage of initial capital.

3️⃣ Take Profit - Configure up to 4 Take Profits using one of the following types:

- %: Percentage from the entry price

- USD: Distance in dollars

- Pip: Distance in Pips

- ATR: Based on ATR multiplier

- Swing: Uses swing length

- Risk Reward: Linked to Stop Loss or vice versa

4️⃣ Stop Loss - Set the SL using the same types as TP for maximum flexibility.

5️⃣ Break Even - Automatically modify SL when price hits a TP level, adjusting by % / USD / Pip from entry.

6️⃣ Trailing Take Profit - Activates a dynamic TP when a condition is met, updating it as price evolves (e.g., new highs).

7️⃣ Trailing Stop Loss - Updates SL automatically when the market moves in your favor (e.g., new lows in long trades).

8️⃣ Exit Before End Session - Exit positions a few candles before the session ends to avoid overnight risks.

🔍 How to Use Strategy Tester

🧩 Add the Indicator:

Load Strategy Tester onto your chart and connect it to any Cometreon signal generator.

⚙️ Configure Risk Settings:

Set up capital, risk, SL/TP parameters, and time filters to match your strategy profile.

🧪 Run the Test:

Execute the backtest and analyze the visual + data output for insight.

📊 Optimize and Repeat:

Adjust key parameters and re-run until your strategy achieves optimal performance.

☄️ Take your trading to the next level with TradeLab Beta's Strategy Tester this powerful backtesting tool and start optimizing your trading strategies today.

👉 Don't waste any more time and visit the link to get access to all Cometreon indicators.

초대 전용 스크립트

이 스크립트는 작성자가 승인한 사용자만 접근할 수 있습니다. 사용하려면 요청을 보내고 승인을 받아야 합니다. 일반적으로 결제 후에 승인이 이루어집니다. 자세한 내용은 아래 작성자의 지침을 따르거나 Cometreon에게 직접 문의하세요.

트레이딩뷰는 스크립트 작성자를 완전히 신뢰하고 스크립트 작동 방식을 이해하지 않는 한 스크립트 비용을 지불하거나 사용하지 않는 것을 권장하지 않습니다. 무료 오픈소스 대체 스크립트는 커뮤니티 스크립트에서 찾을 수 있습니다.

작성자 지시 사항

Visit our website using the link below and select the subscription plan that best fits your needs to gain access to all Cometreon indicators:

https://cometreon.com

Advanced trading tools that simplify complex analysis into actionable insights. Save time and trade smarter with precision indicators.

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.

초대 전용 스크립트

이 스크립트는 작성자가 승인한 사용자만 접근할 수 있습니다. 사용하려면 요청을 보내고 승인을 받아야 합니다. 일반적으로 결제 후에 승인이 이루어집니다. 자세한 내용은 아래 작성자의 지침을 따르거나 Cometreon에게 직접 문의하세요.

트레이딩뷰는 스크립트 작성자를 완전히 신뢰하고 스크립트 작동 방식을 이해하지 않는 한 스크립트 비용을 지불하거나 사용하지 않는 것을 권장하지 않습니다. 무료 오픈소스 대체 스크립트는 커뮤니티 스크립트에서 찾을 수 있습니다.

작성자 지시 사항

Visit our website using the link below and select the subscription plan that best fits your needs to gain access to all Cometreon indicators:

https://cometreon.com

Advanced trading tools that simplify complex analysis into actionable insights. Save time and trade smarter with precision indicators.

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.