🤖💣 Alt-Season or Alt-Control-Delete.? 🧠📉

The market looks like it's about to rug someone... and it might just be Trump.

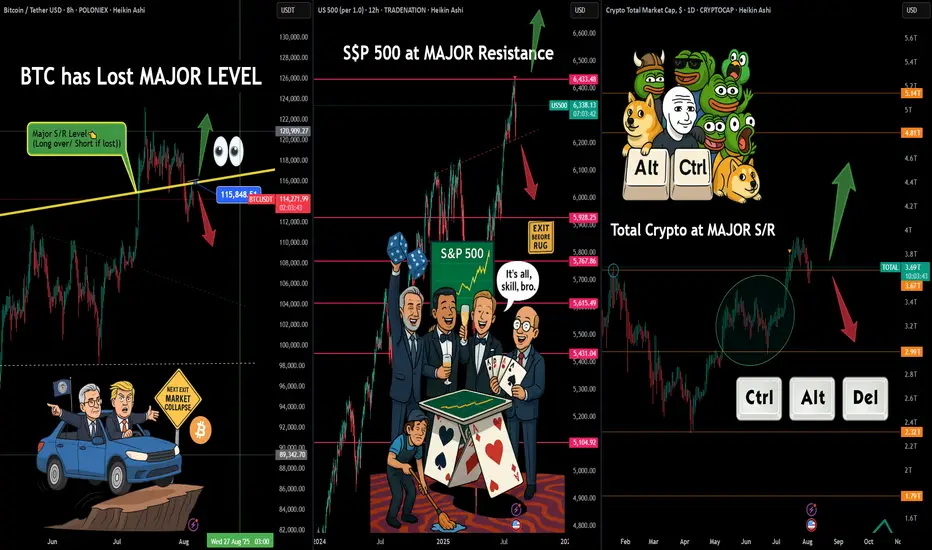

While President Trump narrows down his Fed Chair shortlist, the real driver — Powell — is still at the wheel. But the car? It's swerving dangerously near the edge. BTC has lost a key S/R level, the S&P 500 is at major resistance, and Total Crypto Market Cap is stalling at a crucial decision point.

Despite the hype around altcoins and "recovery rallies," I’m deeply cautious. JP Morgan and Bank of America stocks might dip after Trump’s public accusations — signaling that institutions might already be repositioning. Capital tends to exit before the narrative shifts... and that shift could be incoming.

The chart says it best:

👀 BTC beneath S/R

🎲 S&P 500 gamblers partying at resistance

🧠 Meme coin mania while total crypto hits S/R

🧨 Trump’s signaling right, but Powell might yank the wheel left...

This could all be the calm before a liquidity flush.

Stay sharp, don’t follow the crowd — follow the capital.

That said, Bitcoin remains my favorite asset — especially in times of systemic risk. Remember what history shows us: when banks stumble or go bust, Bitcoin tends to rise. If there's one asset in the world I want to carry through a storm, it's Bitcoin. The decentralized antidote to centralized chaos.

One Love,

The FXPROFESSOR 💙

ps. we might see a breakout and Fomo for good reasons...why not? but for now my charts are screaming: CAREFUL!

Disclosure: I am happy to be part of the Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis. Awesome broker, where the trader really comes first! 🌟🤝📈

The market looks like it's about to rug someone... and it might just be Trump.

While President Trump narrows down his Fed Chair shortlist, the real driver — Powell — is still at the wheel. But the car? It's swerving dangerously near the edge. BTC has lost a key S/R level, the S&P 500 is at major resistance, and Total Crypto Market Cap is stalling at a crucial decision point.

Despite the hype around altcoins and "recovery rallies," I’m deeply cautious. JP Morgan and Bank of America stocks might dip after Trump’s public accusations — signaling that institutions might already be repositioning. Capital tends to exit before the narrative shifts... and that shift could be incoming.

The chart says it best:

👀 BTC beneath S/R

🎲 S&P 500 gamblers partying at resistance

🧠 Meme coin mania while total crypto hits S/R

🧨 Trump’s signaling right, but Powell might yank the wheel left...

This could all be the calm before a liquidity flush.

Stay sharp, don’t follow the crowd — follow the capital.

That said, Bitcoin remains my favorite asset — especially in times of systemic risk. Remember what history shows us: when banks stumble or go bust, Bitcoin tends to rise. If there's one asset in the world I want to carry through a storm, it's Bitcoin. The decentralized antidote to centralized chaos.

One Love,

The FXPROFESSOR 💙

ps. we might see a breakout and Fomo for good reasons...why not? but for now my charts are screaming: CAREFUL!

Disclosure: I am happy to be part of the Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis. Awesome broker, where the trader really comes first! 🌟🤝📈

액티브 트레이드

Market sideways: Pumps on Powell rate cuts speech while everyone was worried, Dumps right after that while everyone was in Fomo...... patience now!📣 Telegram: t.me/fxprofessor88

🌍 Subscribe via web at fxprofessor.com

🤖 Subscribe via Telegram Bot: t.me/FXPROFESSOR_bot

🌍 Subscribe via web at fxprofessor.com

🤖 Subscribe via Telegram Bot: t.me/FXPROFESSOR_bot

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.

📣 Telegram: t.me/fxprofessor88

🌍 Subscribe via web at fxprofessor.com

🤖 Subscribe via Telegram Bot: t.me/FXPROFESSOR_bot

🌍 Subscribe via web at fxprofessor.com

🤖 Subscribe via Telegram Bot: t.me/FXPROFESSOR_bot

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.