In the dynamic landscape of financial markets, the Adaptive Trend Finder (log) stands out as an example of precision and professionalism. This advanced tool, equipped with a unique feature, offers traders a sophisticated approach to market trend analysis: the choice between automatic detection of the long-term or short-term trend channel.

Key Features:

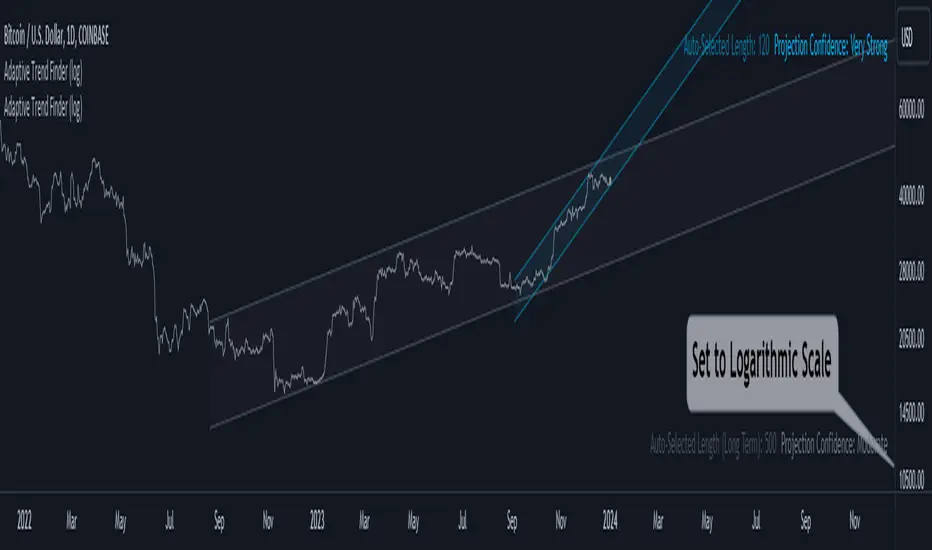

1. Choice Between Long-Term or Short-Term Trend Channel Detection: Positioned first, this distinctive feature of the Adaptive Trend Finder (log) allows traders to customize their analysis by choosing between the automatic detection of the long-term or short-term trend channel. This increased flexibility adapts to individual trading preferences and changing market conditions.

2. Autonomous Trend Channel Detection: Leveraging the robust statistical measure of the Pearson coefficient, the Adaptive Trend Finder (log) excels in autonomously locating the optimal trend channel. This data-driven approach ensures objective trend analysis, reducing subjective biases, and enhancing overall precision.

3. Precision of Logarithmic Scale: A distinctive characteristic of our indicator is its strategic use of the logarithmic scale for regression channels. This approach enables nuanced analysis of linear regression channels, capturing the subtleties of trends while accommodating variations in the amplitude of price movements.

4. Length and Strength Visualization: Traders gain a comprehensive view of the selected trend channel, with the revelation of its length and quantification of trend strength. These dual pieces of information empower traders to make informed decisions, providing insights into both the direction and intensity of the prevailing trend.

In the demanding universe of financial markets, the Adaptive Trend Finder (log) asserts itself as an essential tool for traders, offering an unparalleled combination of precision, professionalism, and customization. Highlighting the choice between automatic detection of the long-term or short-term trend channel in the first position, this indicator uniquely caters to the specific needs of each trader, ensuring informed decision-making in an ever-evolving financial environment.

Key Features:

1. Choice Between Long-Term or Short-Term Trend Channel Detection: Positioned first, this distinctive feature of the Adaptive Trend Finder (log) allows traders to customize their analysis by choosing between the automatic detection of the long-term or short-term trend channel. This increased flexibility adapts to individual trading preferences and changing market conditions.

2. Autonomous Trend Channel Detection: Leveraging the robust statistical measure of the Pearson coefficient, the Adaptive Trend Finder (log) excels in autonomously locating the optimal trend channel. This data-driven approach ensures objective trend analysis, reducing subjective biases, and enhancing overall precision.

3. Precision of Logarithmic Scale: A distinctive characteristic of our indicator is its strategic use of the logarithmic scale for regression channels. This approach enables nuanced analysis of linear regression channels, capturing the subtleties of trends while accommodating variations in the amplitude of price movements.

4. Length and Strength Visualization: Traders gain a comprehensive view of the selected trend channel, with the revelation of its length and quantification of trend strength. These dual pieces of information empower traders to make informed decisions, providing insights into both the direction and intensity of the prevailing trend.

In the demanding universe of financial markets, the Adaptive Trend Finder (log) asserts itself as an essential tool for traders, offering an unparalleled combination of precision, professionalism, and customization. Highlighting the choice between automatic detection of the long-term or short-term trend channel in the first position, this indicator uniquely caters to the specific needs of each trader, ensuring informed decision-making in an ever-evolving financial environment.

릴리즈 노트

Tooltip added릴리즈 노트

Minor changes릴리즈 노트

Color adjustment릴리즈 노트

Tooltips updated릴리즈 노트

Check out the latest optimized version of my TradingView script. It's faster, smoother, and packed with new features. Big thanks to an anonymous contributor for the help.

Explore the changes in the script and share your thoughts.

Appreciate your support!

릴리즈 노트

minor upgrade릴리즈 노트

Update:* Adjusting lengths, with the addition of intermediate lengths for increased precision.

* Text Size option

릴리즈 노트

UpdateIn response to a request, I reverted to the color options from the original version, which were more functional.

릴리즈 노트

Minor bug fixed릴리즈 노트

inputs reorganization릴리즈 노트

Major UpdateThe code is really clean now.

After some big changes, the script runs smoothly with simplified calculations, revamped code, and a stronger structure, bringing optimized performance and exceptional speed.

릴리즈 노트

Minor update: The long-term length range has been modified to prevent similarity with the default channel, and the term "Projection Confidence" has been replaced with "Trend Strength.the term "Projection Confidence" has been replaced with "Trend Strength.릴리즈 노트

Minor update: The long-term length range has been modified to prevent similarity with the default channel, and the term "Projection Confidence" has been replaced with "Trend Strength.릴리즈 노트

Minor update릴리즈 노트

Minor Update: I've added the option to choose the color of the Mid Line in the settings.릴리즈 노트

The Annualized Return corresponding to the period of the Selected Trend drawn by the indicator has been added. This feature is currently displayed only in the Daily timeframe.릴리즈 노트

Update: Added 'Small' text size for table.릴리즈 노트

Shorttitle added릴리즈 노트

Major Update:This update introduces the 'Most Active Levels' feature.

Users can now visualize the price level with the highest trading activity within the trend channel.

This level is calculated based on either the number of price touches or trading volume.

To achieve this, the indicator divides the trend channel into multiple levels (user-defined).

릴리즈 노트

Finally, I decided to revert the code to how it was previously. If you need to display the most active levels, use the 'Linear Regression Channel Ultimate' indicator separately.

릴리즈 노트

Now updated for Pine Script v6오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

Plan the trade ⚡ Trade the plan

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

Plan the trade ⚡ Trade the plan

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.