INVITE-ONLY SCRIPT

업데이트됨 Market structure intraday ES futures strategy - BuySell Zones

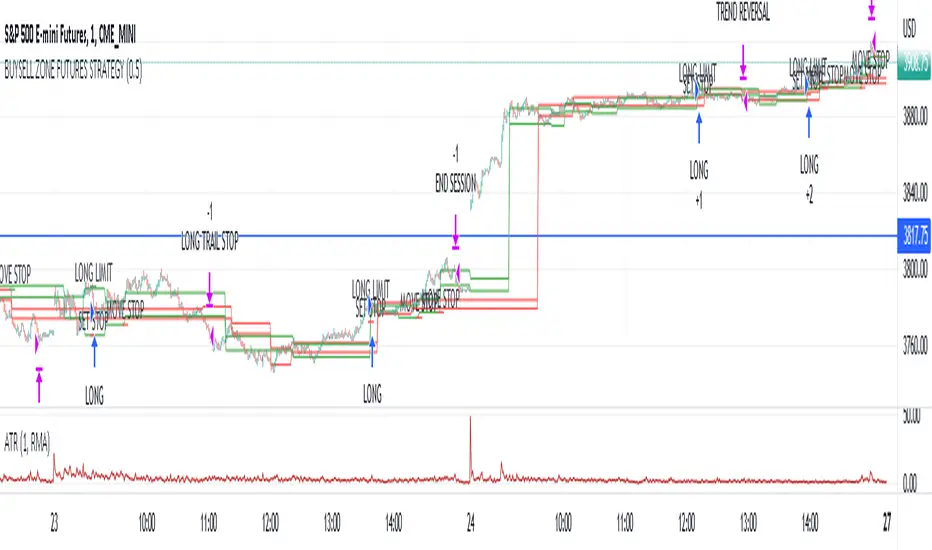

This market structure strategy for ES Mini Futures optimized for intraday market analysis ( RTH ).

Entry condition identified by bearish and bullish market structure.

Support level (Green Lines) is identified based on different variations of price fluctuations followed by the close above the range.

Resistance level (Red Lines) is identified based on different variations of price fluctuations followed by the close below the range.

The idea is to spot areas where market players were fighting for the best price and one side finally won.

Bullish trend is identified by consecutive series of support levels developing in upside direction.

Bearish trend is identified by consecutive series of resistance levels developing in downside direction.

When market develops bullish trend , strategy sets LONG limit order at fresh support level .

When market develops bearish trend , strategy sets SHORT limit order at fresh resistance level .

If there is an open position no new entries are performed.

For longs initial stop is set at previous support level adjusted by ATR.

For shorts stop is set at previous resistance level adjusted by ATR.

Stop trailing is also based on market structure.

If new support level is identified, stop moves to previous support level .

If new resistance level is identified, stop moves to previous resistance level .

There are no target. Strategy either gets stopped at current stop level or exits at session end.

Strategy calculates position size based on the previous market structure and ATR.

Strategy performs compounding position sizing so as account amount increases so does amount of traded contracts.

Usage:

Add script to your favorites and apply it on ES1! 1 minute time frame setting regular trading hours.

Script will print the limit order as well as stop levels according to the rules described above. As trade will progress, script will print levels to move the stop to.

Settings:

I added an option to disable the support and resistance lines printing if you prefer to have clean charts.

You can also change risk % to best fit your trading style.

If you just want to use the support and resistance levels as indicator you can also disable the strategy execution.

Support and Resistance indicator itself is universal and can be used on any market or timeframe.

If you want the strategy to be optimized for other markets or timeframes or have other rule set in mind feel free PM me, we will create the solution that best fits your needs and styles.

Real life trading is not get rich scheme. It is continuous process that involves various steps and dedication. If you are willing to take this path please PM me to enable the strategy for you.

Enjoy!

Entry condition identified by bearish and bullish market structure.

Support level (Green Lines) is identified based on different variations of price fluctuations followed by the close above the range.

Resistance level (Red Lines) is identified based on different variations of price fluctuations followed by the close below the range.

The idea is to spot areas where market players were fighting for the best price and one side finally won.

Bullish trend is identified by consecutive series of support levels developing in upside direction.

Bearish trend is identified by consecutive series of resistance levels developing in downside direction.

When market develops bullish trend , strategy sets LONG limit order at fresh support level .

When market develops bearish trend , strategy sets SHORT limit order at fresh resistance level .

If there is an open position no new entries are performed.

For longs initial stop is set at previous support level adjusted by ATR.

For shorts stop is set at previous resistance level adjusted by ATR.

Stop trailing is also based on market structure.

If new support level is identified, stop moves to previous support level .

If new resistance level is identified, stop moves to previous resistance level .

There are no target. Strategy either gets stopped at current stop level or exits at session end.

Strategy calculates position size based on the previous market structure and ATR.

Strategy performs compounding position sizing so as account amount increases so does amount of traded contracts.

Usage:

Add script to your favorites and apply it on ES1! 1 minute time frame setting regular trading hours.

Script will print the limit order as well as stop levels according to the rules described above. As trade will progress, script will print levels to move the stop to.

Settings:

I added an option to disable the support and resistance lines printing if you prefer to have clean charts.

You can also change risk % to best fit your trading style.

If you just want to use the support and resistance levels as indicator you can also disable the strategy execution.

Support and Resistance indicator itself is universal and can be used on any market or timeframe.

If you want the strategy to be optimized for other markets or timeframes or have other rule set in mind feel free PM me, we will create the solution that best fits your needs and styles.

Real life trading is not get rich scheme. It is continuous process that involves various steps and dedication. If you are willing to take this path please PM me to enable the strategy for you.

Enjoy!

릴리즈 노트

Added control for position sizing to change base capital after every trade.Added previous trading setup cancellation when new trading setup is identified.

릴리즈 노트

Updated default settings릴리즈 노트

Fixed bearish opposing zone filter.Set the end of session to 3pm central to match the stock market.

릴리즈 노트

Updated default values릴리즈 노트

Fixed bearish Stop Loss Logic릴리즈 노트

Fixed re-entry after previous trade was stopped on confirmation bar릴리즈 노트

Fixed after hours entry릴리즈 노트

Added more room to trailed stop릴리즈 노트

Chart adjustment릴리즈 노트

Added exit on Trend reversal릴리즈 노트

Changed ATR to 40Added ATR based stop padding

릴리즈 노트

Added filter by Rollover Week초대 전용 스크립트

이 스크립트는 작성자가 승인한 사용자만 접근할 수 있습니다. 사용하려면 요청 후 승인을 받아야 하며, 일반적으로 결제 후에 허가가 부여됩니다. 자세한 내용은 아래 작성자의 안내를 따르거나 cyberninjadroid에게 직접 문의하세요.

트레이딩뷰는 스크립트의 작동 방식을 충분히 이해하고 작성자를 완전히 신뢰하지 않는 이상, 해당 스크립트에 비용을 지불하거나 사용하는 것을 권장하지 않습니다. 커뮤니티 스크립트에서 무료 오픈소스 대안을 찾아보실 수도 있습니다.

작성자 지시 사항

Please PM me for access

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

초대 전용 스크립트

이 스크립트는 작성자가 승인한 사용자만 접근할 수 있습니다. 사용하려면 요청 후 승인을 받아야 하며, 일반적으로 결제 후에 허가가 부여됩니다. 자세한 내용은 아래 작성자의 안내를 따르거나 cyberninjadroid에게 직접 문의하세요.

트레이딩뷰는 스크립트의 작동 방식을 충분히 이해하고 작성자를 완전히 신뢰하지 않는 이상, 해당 스크립트에 비용을 지불하거나 사용하는 것을 권장하지 않습니다. 커뮤니티 스크립트에서 무료 오픈소스 대안을 찾아보실 수도 있습니다.

작성자 지시 사항

Please PM me for access

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.