PROTECTED SOURCE SCRIPT

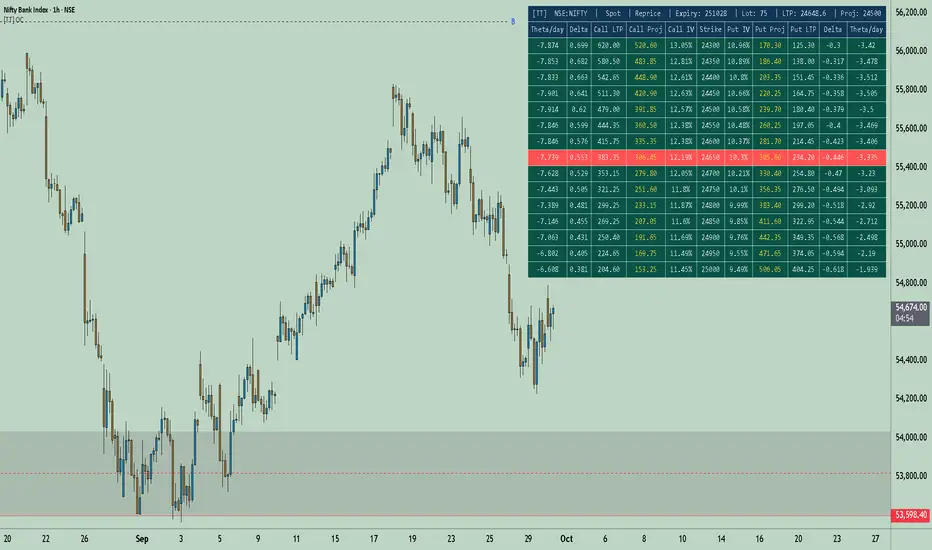

업데이트됨 [TT] Option Chain

✅Option Geeks for NSE India

Option Geeks is a powerful tool designed for options traders on the NSE (National Stock Exchange of India). It provides real-time visualization and insights based on key option greeks such as Delta, Gamma, Theta, and Implied Volatility (IV) — enabling traders to make more informed decisions when analyzing option chains and positions.

✅What This Script Does:

Calculates and displays the main option greeks for both Call and Put options.

Highlights sensitivity of option prices to changes in:

Underlying price (Delta, Gamma)

Time decay (Theta)

Implied Volatility Calculation.

Tracks live changes in IV and allows comparison across strikes and expiries.

Helps identify favorable option setups and hedging opportunities.

Designed for Bank Nifty, Nifty 50, and top NSE FnO stocks.

✅ How It Works (Conceptually):

Uses a simplified Black-Scholes model adapted for Indian markets.

Takes into account underlying price, strike, days to expiry, interest rate, and volatility to compute the Greeks. Plots real-time values on chart

Manually You need to input the ATM Strike and nearest expiry to update Greeks accordingly.

✅ Who Should Use It:

Options traders seeking deeper insight beyond price charts.

Scalpers and positional traders looking to understand how their trades react to time, price, and volatility.

Anyone trading on NSE’s F&O segment who wants to make smarter trades based on calculated risk metrics

Option Geeks is a powerful tool designed for options traders on the NSE (National Stock Exchange of India). It provides real-time visualization and insights based on key option greeks such as Delta, Gamma, Theta, and Implied Volatility (IV) — enabling traders to make more informed decisions when analyzing option chains and positions.

✅What This Script Does:

Calculates and displays the main option greeks for both Call and Put options.

Highlights sensitivity of option prices to changes in:

Underlying price (Delta, Gamma)

Time decay (Theta)

Implied Volatility Calculation.

Tracks live changes in IV and allows comparison across strikes and expiries.

Helps identify favorable option setups and hedging opportunities.

Designed for Bank Nifty, Nifty 50, and top NSE FnO stocks.

✅ How It Works (Conceptually):

Uses a simplified Black-Scholes model adapted for Indian markets.

Takes into account underlying price, strike, days to expiry, interest rate, and volatility to compute the Greeks. Plots real-time values on chart

Manually You need to input the ATM Strike and nearest expiry to update Greeks accordingly.

✅ Who Should Use It:

Options traders seeking deeper insight beyond price charts.

Scalpers and positional traders looking to understand how their trades react to time, price, and volatility.

Anyone trading on NSE’s F&O segment who wants to make smarter trades based on calculated risk metrics

릴리즈 노트

Now you can Project the Option price Every input is given a tooltip read it to understand how to use the indicator

보호된 스크립트입니다

이 스크립트는 비공개 소스로 게시됩니다. 하지만 이를 자유롭게 제한 없이 사용할 수 있습니다 – 자세한 내용은 여기에서 확인하세요.

TeamTaurus

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

보호된 스크립트입니다

이 스크립트는 비공개 소스로 게시됩니다. 하지만 이를 자유롭게 제한 없이 사용할 수 있습니다 – 자세한 내용은 여기에서 확인하세요.

TeamTaurus

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.