PROTECTED SOURCE SCRIPT

Price Action [SignalCave]

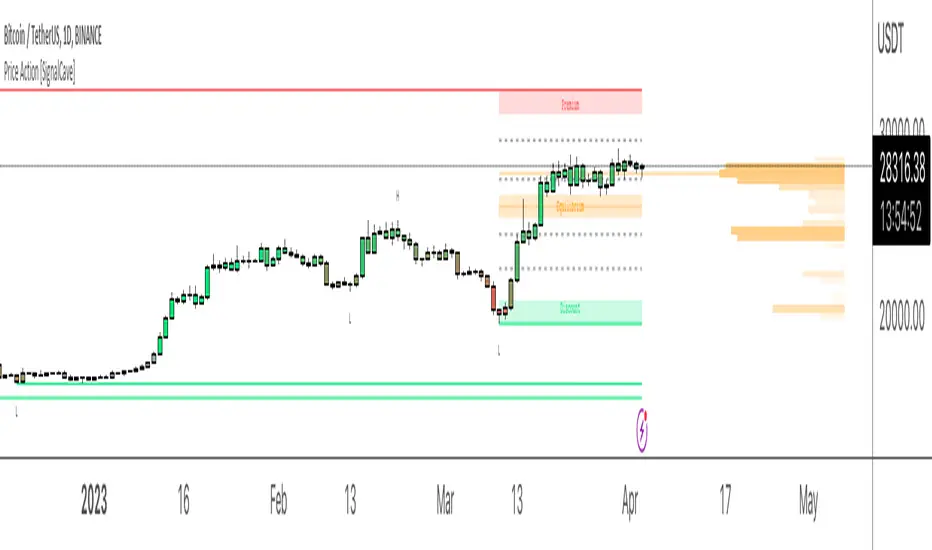

Liquidation prices are calculated with Higher Timeframe usage of "Williams Fractals" indicator.

Sell side liquidity levels are shown with "L" text and a green solid lines.

Buy side liquidity levels are shown with "H" text and a red solid lines.

Premium and Discount zones are determined with latest untested buy/sell liquidity levels.

"Premium" means the asset price is overvalued, "Discount" means the asset is undervalued.

Once price hits any active liquidity level, "Premium and Discount" zone will be recalculated.

Premium and Discount have "Equilibrium" area which is center area of the whole zone.

Extra Support & Resistance levels calculation are based on Fibonacci. Levels are 23.6%, 38.2%, 61.8% and 78.6%.

Bars are painted based on asset's momentum. The asset momentum is calculated by the RSI and ADX indicators.

Volume profile shows trade activity during the "Premium and Discount" zone.

Sell side liquidity levels are shown with "L" text and a green solid lines.

Buy side liquidity levels are shown with "H" text and a red solid lines.

Premium and Discount zones are determined with latest untested buy/sell liquidity levels.

"Premium" means the asset price is overvalued, "Discount" means the asset is undervalued.

Once price hits any active liquidity level, "Premium and Discount" zone will be recalculated.

Premium and Discount have "Equilibrium" area which is center area of the whole zone.

Extra Support & Resistance levels calculation are based on Fibonacci. Levels are 23.6%, 38.2%, 61.8% and 78.6%.

Bars are painted based on asset's momentum. The asset momentum is calculated by the RSI and ADX indicators.

Volume profile shows trade activity during the "Premium and Discount" zone.

보호된 스크립트입니다

이 스크립트는 비공개 소스로 게시됩니다. 하지만 이를 자유롭게 제한 없이 사용할 수 있습니다 – 자세한 내용은 여기에서 확인하세요.

Pine Script Code Generator:

getpinescript.com/

Optimize Your TradingView Strategies:

pinetune.app

Trading Simulation Game:

Dare2Trade.com

Pine Script Job Proposals:

t.me/kriswaters

getpinescript.com/

Optimize Your TradingView Strategies:

pinetune.app

Trading Simulation Game:

Dare2Trade.com

Pine Script Job Proposals:

t.me/kriswaters

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

보호된 스크립트입니다

이 스크립트는 비공개 소스로 게시됩니다. 하지만 이를 자유롭게 제한 없이 사용할 수 있습니다 – 자세한 내용은 여기에서 확인하세요.

Pine Script Code Generator:

getpinescript.com/

Optimize Your TradingView Strategies:

pinetune.app

Trading Simulation Game:

Dare2Trade.com

Pine Script Job Proposals:

t.me/kriswaters

getpinescript.com/

Optimize Your TradingView Strategies:

pinetune.app

Trading Simulation Game:

Dare2Trade.com

Pine Script Job Proposals:

t.me/kriswaters

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.