INVITE-ONLY SCRIPT

업데이트됨 ZERE Majors System [FahimK3]

ZERE Majors System [FahimK3]

This system introduces an innovative approach to crypto portfolio management through a dynamic matrix-based rotation methodology. At its core, the system utilizes a proprietary scoring matrix that directly compares the relative strength between BTC, ETH, and SOL, creating a more nuanced understanding of asset relationships than traditional indicators alone could provide.

The fundamental innovation lies in how the system evaluates cryptocurrencies. Rather than analyzing each asset independently, it employs a comprehensive matrix where each asset is scored against others through direct pair-wise comparisons. This creates a network of relationships that reveals underlying strength patterns that might be missed by conventional analysis methods. The scoring process incorporates both momentum and relative performance metrics, ensuring that capital is allocated to the truly strongest asset rather than just the one showing temporary strength.

While the exact scoring calculations remain proprietary, the system's framework combines relative strength principles with adaptive thresholds that automatically adjust to changing market conditions. This differs from standard relative strength approaches by considering the complete web of relationships between assets rather than isolated comparisons.

The regime filter serves as a secondary confirmation layer, using volatility and momentum metrics to validate the primary matrix signals. When market conditions become unfavorable, the system automatically moves to cash, providing an additional layer of capital protection.

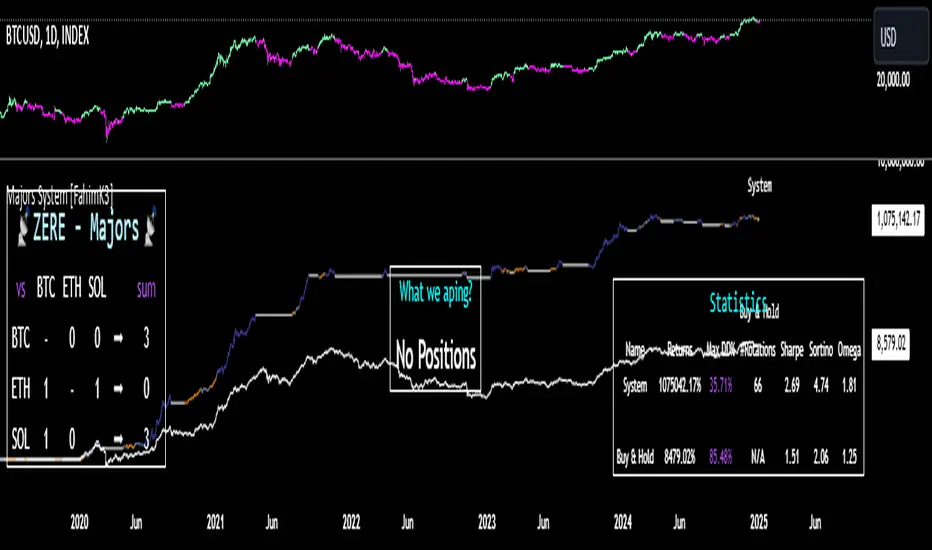

Performance tracking includes comprehensive metrics comparing the rotation strategy against a standard buy-and-hold approach. The visual interface displays the scoring matrix, current positions, and equity curves, allowing traders to understand position rationale in real-time.

Recommended Usage:

- Timeframe: Daily chart

- Starting Capital: Customizable for portfolio size

- Scoring Method: Choice between UNI.v2 and UNI.v3

Note: While this system incorporates some standard technical elements, its value lies in the unique matrix-based rotation methodology that provides a more complete picture of relative strength than traditional indicators used in isolation.

This system introduces an innovative approach to crypto portfolio management through a dynamic matrix-based rotation methodology. At its core, the system utilizes a proprietary scoring matrix that directly compares the relative strength between BTC, ETH, and SOL, creating a more nuanced understanding of asset relationships than traditional indicators alone could provide.

The fundamental innovation lies in how the system evaluates cryptocurrencies. Rather than analyzing each asset independently, it employs a comprehensive matrix where each asset is scored against others through direct pair-wise comparisons. This creates a network of relationships that reveals underlying strength patterns that might be missed by conventional analysis methods. The scoring process incorporates both momentum and relative performance metrics, ensuring that capital is allocated to the truly strongest asset rather than just the one showing temporary strength.

While the exact scoring calculations remain proprietary, the system's framework combines relative strength principles with adaptive thresholds that automatically adjust to changing market conditions. This differs from standard relative strength approaches by considering the complete web of relationships between assets rather than isolated comparisons.

The regime filter serves as a secondary confirmation layer, using volatility and momentum metrics to validate the primary matrix signals. When market conditions become unfavorable, the system automatically moves to cash, providing an additional layer of capital protection.

Performance tracking includes comprehensive metrics comparing the rotation strategy against a standard buy-and-hold approach. The visual interface displays the scoring matrix, current positions, and equity curves, allowing traders to understand position rationale in real-time.

Recommended Usage:

- Timeframe: Daily chart

- Starting Capital: Customizable for portfolio size

- Scoring Method: Choice between UNI.v2 and UNI.v3

Note: While this system incorporates some standard technical elements, its value lies in the unique matrix-based rotation methodology that provides a more complete picture of relative strength than traditional indicators used in isolation.

릴리즈 노트

Updated the scoring system to take into account every ratio variable for a more robust approach.릴리즈 노트

Updated the scoring system to take into account every ratio variable for a more robust approach.초대 전용 스크립트

이 스크립트는 작성자가 승인한 사용자만 접근할 수 있습니다. 사용하려면 요청 후 승인을 받아야 하며, 일반적으로 결제 후에 허가가 부여됩니다. 자세한 내용은 아래 작성자의 안내를 따르거나 FahimK3에게 직접 문의하세요.

트레이딩뷰는 스크립트의 작동 방식을 충분히 이해하고 작성자를 완전히 신뢰하지 않는 이상, 해당 스크립트에 비용을 지불하거나 사용하는 것을 권장하지 않습니다. 커뮤니티 스크립트에서 무료 오픈소스 대안을 찾아보실 수도 있습니다.

작성자 지시 사항

Shoot me a DM for access! :)

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

초대 전용 스크립트

이 스크립트는 작성자가 승인한 사용자만 접근할 수 있습니다. 사용하려면 요청 후 승인을 받아야 하며, 일반적으로 결제 후에 허가가 부여됩니다. 자세한 내용은 아래 작성자의 안내를 따르거나 FahimK3에게 직접 문의하세요.

트레이딩뷰는 스크립트의 작동 방식을 충분히 이해하고 작성자를 완전히 신뢰하지 않는 이상, 해당 스크립트에 비용을 지불하거나 사용하는 것을 권장하지 않습니다. 커뮤니티 스크립트에서 무료 오픈소스 대안을 찾아보실 수도 있습니다.

작성자 지시 사항

Shoot me a DM for access! :)

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.