OPEN-SOURCE SCRIPT

Institutional MACD (Z-Score Edition) [VolumeVigilante]

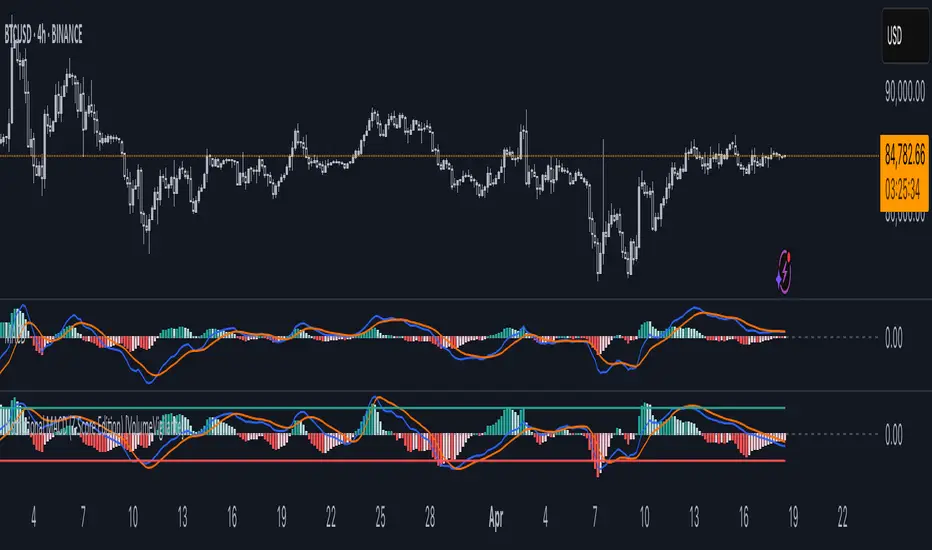

📈 Institutional MACD (Z-Score Edition) — Professional-Grade Momentum Signal

This is not your average MACD.

The Institutional MACD (Z-Score Edition) is a statistically enhanced momentum tool, purpose-built for serious traders and breakout hunters. By applying Z-Score normalization to the classic MACD structure, this indicator uncovers statistically significant momentum shifts, enabling cleaner reads on price extremes, trend continuation, and potential reversals.

💡 Why It Matters

The classic MACD is powerful — but raw momentum values can be noisy and relative, especially on volatile assets like BTC/USD. By transforming the MACD line, signal line, and histogram into Z-scores, we anchor these signals in statistical context. This makes the Institutional MACD:

✔️ Timeframe-agnostic and asset-normalized

✔️ Ideal for spotting true breakouts, not false flags

✔️ A reliable tool for detecting momentum divergence and exhaustion

🧪 Key Features

✅ Full Z-Score normalization (MACD, Signal, Histogram)

✅ Highlighted ±Z threshold bands for overbought/oversold zones

✅ Customizable histogram coloring for visual momentum shifts

✅ Built-in alerts for zero-crosses and Z-threshold breaks

✅ Clean overlay with optional display toggles

🔁 Strategy Tip: Mean Reversion Signals with Statistical Confidence

This indicator isn't just for spotting breakouts — it also shines as a mean reversion tool, thanks to its Z-Score normalization.

When the Z-Score histogram crosses beyond ±2, it marks a statistically significant deviation from the mean — often signaling that momentum is overstretched and the asset may be due for a pullback or reversal.

📌 How to use it:

🎯 Combine Z-Score extremes with:

Unlike the raw MACD, this version delivers statistical thresholds, not guesswork — helping traders make decisions rooted in probability, not emotion.

📢 Trade Smart. Trade Vigilantly.

Published by VolumeVigilante

This is not your average MACD.

The Institutional MACD (Z-Score Edition) is a statistically enhanced momentum tool, purpose-built for serious traders and breakout hunters. By applying Z-Score normalization to the classic MACD structure, this indicator uncovers statistically significant momentum shifts, enabling cleaner reads on price extremes, trend continuation, and potential reversals.

💡 Why It Matters

The classic MACD is powerful — but raw momentum values can be noisy and relative, especially on volatile assets like BTC/USD. By transforming the MACD line, signal line, and histogram into Z-scores, we anchor these signals in statistical context. This makes the Institutional MACD:

✔️ Timeframe-agnostic and asset-normalized

✔️ Ideal for spotting true breakouts, not false flags

✔️ A reliable tool for detecting momentum divergence and exhaustion

🧪 Key Features

✅ Full Z-Score normalization (MACD, Signal, Histogram)

✅ Highlighted ±Z threshold bands for overbought/oversold zones

✅ Customizable histogram coloring for visual momentum shifts

✅ Built-in alerts for zero-crosses and Z-threshold breaks

✅ Clean overlay with optional display toggles

🔁 Strategy Tip: Mean Reversion Signals with Statistical Confidence

This indicator isn't just for spotting breakouts — it also shines as a mean reversion tool, thanks to its Z-Score normalization.

When the Z-Score histogram crosses beyond ±2, it marks a statistically significant deviation from the mean — often signaling that momentum is overstretched and the asset may be due for a pullback or reversal.

📌 How to use it:

- Z > +2 → Price action is in overbought territory. Watch for exhaustion or short setups.

- Z < -2 → Momentum is deeply oversold. Look for reversal confirmation or long opportunities.

- These zones often precede snap-back moves, especially in range-bound or corrective markets.

🎯 Combine Z-Score extremes with:

- Candlestick confirmation

- Support/resistance zones

- Volume or price divergence

- Other mean reversion tools (e.g., RSI, Bollinger Bands)

Unlike the raw MACD, this version delivers statistical thresholds, not guesswork — helping traders make decisions rooted in probability, not emotion.

📢 Trade Smart. Trade Vigilantly.

Published by VolumeVigilante

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

Trade Smart | Trade Vigilantly | Get Funded → link in bio 🌐

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

Trade Smart | Trade Vigilantly | Get Funded → link in bio 🌐

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.