INVITE-ONLY SCRIPT

업데이트됨 OptiRange | Fractalyst

What’s the purpose of this indicator?

This indicator is designed to integrate probabilities with liquidity levels, while also providing a mechanical method for identifying market structure by using Fractals by Williams.

----

How does this indicator identify market structure?

This script identifies breaks of market structure by analyzing candle closures above or below swing levels.

As soon as a candle has closed above or below the initial swing on your charts, the script validates that there is at least one swing preceding the break before confirming it as a structural break.

Once a break is occured then it assigns a numeric ID to the break starting from 1 and draws two extremities: one as liquidity and the other as invalidation (LIQ/INV).

----

What do the extremities show us on the charts?

you'll see two clear extremities on your charts:

1. The first extremity represents the structural liquidity level. (LIQ)

2. The other extremity indicates the level that, if price breaks through it, results in a structural shift to the opposite side. (INV)

----

How does it calculate probabilities?

Each break of market structure, denoted as X, is assigned a unique ID, starting from X1 for the first break, X2 for the second, and so on.

The probabilities are calculated based on breaks holding, meaning price closing through the liquidity level, rather than invalidation. This probability is then divided by the total count of similar numeric breaks.

For example, if 75 out of 100 bullish X1s become X2, then the probability of X1 becoming X2 on your charts will be displayed as 80% in the following format: ⬆ 75%

----

What are the Fractal blocks?

Fractal blocks refer to the most extreme swing candle within the latest break. They can serve as significant levels for price rejection and may guide movements toward the next break, often in confluence with probability analysis for added confirmation.

If the price retraces back to a bullish fractal block, we aim to look for buy/long positions. Conversely, if the price retraces back to a bearish fractal block, we aim to look for sell/short positions.

----

What are mitigations?

Mitigations refer to specific price action occurrences identified by the script:

1- When the price reaches the most recent fractal block and confirms a swing candle, the script automatically draws a line from the swing to the fractal block bar and labels it with a checkmark.

1- If the price wicks through the invalidation level and then retraces back to the fractal block while forming a swing candle, the script labels this as a double mitigation on the chart.

This level will serve as the next potential invalidation level if a break occurs in the same direction.

----

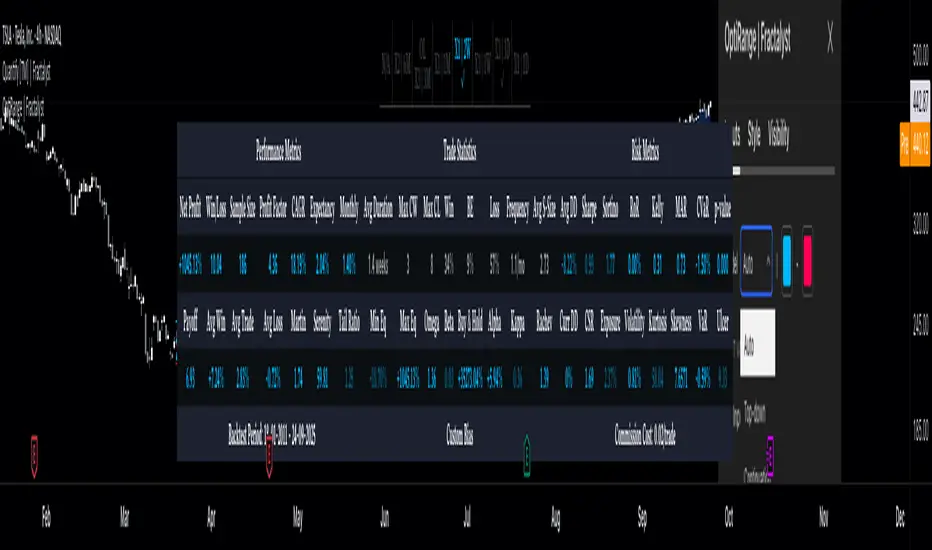

What does the bottom table display?

The bottom table presents numeric breaks across multiple timeframes, with the text color indicating the trend direction. Enabling traders to assess the higher timeframes market trend without needing to switch between timeframes manually.

----

How to use the indicator?

1. Add "OptiRange | Fractalyst" to your TradingView chart.

2. Choose the pair you want to analyze or trade.

3. Start with the 12-month timeframe.

4. Use the table bias with the maximal settings to find the lowest timeframe that’s showing you the mitigation (✓)

5. Confirm that the probability of the current liquidity is higher than 50%.

6. Place your limit order at the Fibonacci level of 0.618 of the mitigation candle.

7. Set your stop-loss at the mitigation level.

8. Determine your take profit based on the liquidity of the current timeframe, or if possible, the liquidity of a higher timeframe in the same direction; otherwise, use the liquidity of the current timeframe.

9. Risk adjustment and Trade management based on your personal preferences.

Example:

----

User-input settings and customizations

----

What makes this indicator original?

- This script leverages Fractals, a fundamental concept in many trading methodologies.

- For a break to be considered valid, price must have at least two swings:

a swing high followed by a swing low for bullish breaks and a swing low follow by a swing high for bearish breaks.

- This means that each swing point is confirmed by the formation of two candles on its left and two candles on its right, totaling 5 candles for each swing high and swing low, thus requiring 10 candles overall. (This strict rule ensures a thorough assessment of market structure before confirming a break.)

- The script assigns a unique numerical ID to each break of structure, starting from 1.

This numbering system enables the script to calculate the probability of the most recent break becoming the next break, while also factoring in the trend direction.

- Additionally, this script provides insights into higher timeframes' break IDs in the bottom/top centre table, keeping traders informed about the overall higher timeframe picture.

- By integrating these methodologies, the script introduces a unique and systematic method for identifying market structure, thereby enhancing its originality in guiding trading decisions.

Terms and Conditions | Disclaimer

Our charting tools are provided for informational and educational purposes only and should not be construed as financial, investment, or trading advice. They are not intended to forecast market movements or offer specific recommendations. Users should understand that past performance does not guarantee future results and should not base financial decisions solely on historical data. By utilizing our charting tools, the buyer acknowledges that neither the seller nor the creator assumes responsibility for decisions made using the information provided. The buyer assumes full responsibility and liability for any actions taken and their consequences, including potential financial losses. Therefore, by purchasing these charting tools, the customer acknowledges that neither the seller nor the creator is liable for any unfavorable outcomes resulting from the development, sale, or use of the products.

The buyer is responsible for canceling their subscription if they no longer wish to continue at the full retail price. Our policy does not include reimbursement, refunds, or chargebacks once the Terms and Conditions are accepted before purchase.

This indicator is designed to integrate probabilities with liquidity levels, while also providing a mechanical method for identifying market structure by using Fractals by Williams.

----

How does this indicator identify market structure?

This script identifies breaks of market structure by analyzing candle closures above or below swing levels.

As soon as a candle has closed above or below the initial swing on your charts, the script validates that there is at least one swing preceding the break before confirming it as a structural break.

Once a break is occured then it assigns a numeric ID to the break starting from 1 and draws two extremities: one as liquidity and the other as invalidation (LIQ/INV).

----

What do the extremities show us on the charts?

you'll see two clear extremities on your charts:

1. The first extremity represents the structural liquidity level. (LIQ)

2. The other extremity indicates the level that, if price breaks through it, results in a structural shift to the opposite side. (INV)

----

How does it calculate probabilities?

Each break of market structure, denoted as X, is assigned a unique ID, starting from X1 for the first break, X2 for the second, and so on.

The probabilities are calculated based on breaks holding, meaning price closing through the liquidity level, rather than invalidation. This probability is then divided by the total count of similar numeric breaks.

For example, if 75 out of 100 bullish X1s become X2, then the probability of X1 becoming X2 on your charts will be displayed as 80% in the following format: ⬆ 75%

----

What are the Fractal blocks?

Fractal blocks refer to the most extreme swing candle within the latest break. They can serve as significant levels for price rejection and may guide movements toward the next break, often in confluence with probability analysis for added confirmation.

If the price retraces back to a bullish fractal block, we aim to look for buy/long positions. Conversely, if the price retraces back to a bearish fractal block, we aim to look for sell/short positions.

----

What are mitigations?

Mitigations refer to specific price action occurrences identified by the script:

1- When the price reaches the most recent fractal block and confirms a swing candle, the script automatically draws a line from the swing to the fractal block bar and labels it with a checkmark.

1- If the price wicks through the invalidation level and then retraces back to the fractal block while forming a swing candle, the script labels this as a double mitigation on the chart.

This level will serve as the next potential invalidation level if a break occurs in the same direction.

----

What does the bottom table display?

The bottom table presents numeric breaks across multiple timeframes, with the text color indicating the trend direction. Enabling traders to assess the higher timeframes market trend without needing to switch between timeframes manually.

----

How to use the indicator?

1. Add "OptiRange | Fractalyst" to your TradingView chart.

2. Choose the pair you want to analyze or trade.

3. Start with the 12-month timeframe.

4. Use the table bias with the maximal settings to find the lowest timeframe that’s showing you the mitigation (✓)

5. Confirm that the probability of the current liquidity is higher than 50%.

6. Place your limit order at the Fibonacci level of 0.618 of the mitigation candle.

7. Set your stop-loss at the mitigation level.

8. Determine your take profit based on the liquidity of the current timeframe, or if possible, the liquidity of a higher timeframe in the same direction; otherwise, use the liquidity of the current timeframe.

9. Risk adjustment and Trade management based on your personal preferences.

Example:

----

User-input settings and customizations

----

What makes this indicator original?

- This script leverages Fractals, a fundamental concept in many trading methodologies.

- For a break to be considered valid, price must have at least two swings:

a swing high followed by a swing low for bullish breaks and a swing low follow by a swing high for bearish breaks.

- This means that each swing point is confirmed by the formation of two candles on its left and two candles on its right, totaling 5 candles for each swing high and swing low, thus requiring 10 candles overall. (This strict rule ensures a thorough assessment of market structure before confirming a break.)

- The script assigns a unique numerical ID to each break of structure, starting from 1.

This numbering system enables the script to calculate the probability of the most recent break becoming the next break, while also factoring in the trend direction.

- Additionally, this script provides insights into higher timeframes' break IDs in the bottom/top centre table, keeping traders informed about the overall higher timeframe picture.

- By integrating these methodologies, the script introduces a unique and systematic method for identifying market structure, thereby enhancing its originality in guiding trading decisions.

Terms and Conditions | Disclaimer

Our charting tools are provided for informational and educational purposes only and should not be construed as financial, investment, or trading advice. They are not intended to forecast market movements or offer specific recommendations. Users should understand that past performance does not guarantee future results and should not base financial decisions solely on historical data. By utilizing our charting tools, the buyer acknowledges that neither the seller nor the creator assumes responsibility for decisions made using the information provided. The buyer assumes full responsibility and liability for any actions taken and their consequences, including potential financial losses. Therefore, by purchasing these charting tools, the customer acknowledges that neither the seller nor the creator is liable for any unfavorable outcomes resulting from the development, sale, or use of the products.

The buyer is responsible for canceling their subscription if they no longer wish to continue at the full retail price. Our policy does not include reimbursement, refunds, or chargebacks once the Terms and Conditions are accepted before purchase.

- By continuing to use our charting tools, the user acknowledges and accepts the Terms and Conditions outlined in this legal disclaimer.

릴리즈 노트

- Decreased loading time by utilizing Pine Profiler.- Added Minimal and Maximal options to Blocks, allowing customization within fractal blocks.

- Added Minimal and Maximal options to the bias table, allowing customization of the group of timeframes and their mitigations.

- Bug fixes.

릴리즈 노트

- Improved code logic for faster range and block calculation, enhancing performance and responsiveness.- Fixed a known issue where the liquidity line was being drawn too far to the left, resulting in incorrect visual representation.

릴리즈 노트

- Optimized script for faster calculations.릴리즈 노트

- Optimized code to minimize calculations and improve performance.릴리즈 노트

- Added an option to switch between displaying break count/probabilities or BOS labels. This enhancement allows for a cleaner chart view and improved customization to suit different trading strategies and preferences.

- Enhanced the overall performance and efficiency of the indicator by optimizing the underlying code logic.

This results in faster execution and more reliable outputs.

릴리즈 노트

- Optimized Range Minimal Mode:Previous break of structure lines and labels are now faded gray to improve clarity.

릴리즈 노트

- Expanded the max available lines and labels on charts to 500- Improved performance and efficiency of Minimal Range Mode.

릴리즈 노트

Added a screener functionality:- Provides instant market context and bias.

- Guides trading decisions based on a comprehensive, top-down analysis of multiple timeframes.

- Alerts users to suitable trading opportunities and advises when to avoid trading due to market conditions like low liquidity or overextension.

릴리즈 노트

Improved Screener Accuracy:Offers clearer guidance on which timeframe to use for entry or when to stay away.

- Specifies the exact hourly timeframe(s) to use for your entries.

- Instructs when to wait for the market structure to shift towards the higher timeframe (HTF) liquidity level before considering any entry.

- Added hourly timeframes to the bias table for more detailed analysis.

릴리즈 노트

- Added Buyside and Sellside liquidity labels for instant determination of range liquidity and invalidation price.릴리즈 노트

Improved Table Logic:- Added two new options for top-down market analysis:

⧉: Analyzes market structure and fractal blocks from a top-down perspective.

%: Analyzes market structure and orderflow (probabilities) from a top-down perspective.

Enhanced Screener Logic:

- Depending on your selected table type, the indicator now provides guidance on the exact timeframes and levels to use for entries.

릴리즈 노트

New Feature: - Added HTF functionality to display higher timeframe liquidity levels using lines and labels on your charts. Now, you can see HTF liquidity levels without switching between timeframes.

Improvement

- Enhanced screener accuracy for better trade identification and performance based on multi-timeframe probabilities.

릴리즈 노트

Improved Higher Timeframe Calculation Efficiency: Optimized the security function for calculating higher timeframe data to enhance performance and accuracy.Added Range Box: Implemented a range box feature allowing users to visualize the current range and equilibrium for entry using the probability (%) method.

Hourly Timeframes Added: Converted minute-based labels to hourly timeframes for better readability and user convenience.

New Alerts: Introduced alerts for Equilibrium and Buyside/Sellside level for entry notifications.

릴리즈 노트

- Implemented comprehensive tooltips for each component of the indicator's user-input section to assist new users. These tooltips provide clear explanations of the settings and their functions, enhancing the user experience by making it easier to understand and customize the indicator.릴리즈 노트

Added tooltips to the bias table for hourly timeframes, allowing users to hover mouse over them to view higher hourly timeframe levels needed for setting orders. This enhancement streamlines the process by providing necessary information without the need to switch between timeframes.릴리즈 노트

Overlapped Ranges: Introduced overlapped ranges to the indicator, allowing it to calculate fractal ranges that overlap with each other. This enhancement provides a more accurate top-down analysis in the screener table, offering deeper insights into market structure and its context.Screener: The updated top-down analysis now provides a clearer view of which timeframes are holding the market context. This helps traders identify the most relevant timeframe for entering the highest probability setups, enhancing strategy precision and effectiveness.

Enhanced Tooltips: Added more informative tooltips for tables and labels. Hover your mouse over these elements to explore additional details and guidance, enhancing user experience and understanding.

릴리즈 노트

New Features- The indicator now includes the 3-hour (3H) and 10-hour (10H) timeframes.

- These additions enhance the ability to identify high probability setups by providing more granular analysis amongst the existing 8 hourly timeframes.

- Supported timeframes now include: 12H, 10H, 8H, 6H, 4H, 3H, 2H, and 1H.

Improvements

- Improved the top-down analysis logic to provide more accurate and efficient multi-timeframe analysis.

- This enhancement ensures better alignment and synchronization across different timeframes.

Bug Fixes

- Minor bug fixes and performance improvements to ensure smooth operation and accurate data representation across all timeframes.

릴리즈 노트

Enhanced tooltips, allowing users to easily identify the highest probability setups, along with clear entry, stop-loss, and target levels.릴리즈 노트

- Introduced new options for table size customization, allowing users to select their preferred display size.- Implemented maximal and minimal modes to enhance user control over table appearance.

릴리즈 노트

- Improved the logic for analyzing multi-timeframe ranges, resulting in faster opportunity detection.릴리즈 노트

- Improved tooltips for detailed exploration of hourly timeframes, helping traders identify optimal entry setups more effectively.- Equilibrium alert bug fix

릴리즈 노트

- Improved range probability calculation for increased accuracy.릴리즈 노트

- Added customizable bar colors to highlight price entries and liquidity taps (disabled by default).- New tooltips on structure breaks showing historical probabilities.

릴리즈 노트

- Enhanced text variations within labels to better reflect specific market conditions릴리즈 노트

- Added a font customization option. Users can now input their preferred font type, enhancing readability and aesthetic customization according to personal visibility needs.- Refined the indicator for calculating range probabilities.

- Optimized the underlying code logic to reduce execution time.

- Labels now dynamically adjust based on contextual market bias.

릴리즈 노트

Confidence Level Integration:Introduced a confidence level feature that quantifies the reliability of the probabilities generated by the indicator.

Visual representation of confidence levels (★) for each probability, allowing traders to assess the strength and reliability of predictions.

릴리즈 노트

New Features- Custom Pivot with RR Adjustment: Introduced a custom pivot option that allows users to adopt a more aggressive trade entry. Leveraging real-time calculated positive expected values to confirm trading setups.

- Enhanced Screener Table: The screener table has been updated to compare all timeframes and their respective positive expected values. This enhancement guides users on which timeframes to focus on for optimal positioning, aligning with a multi-timeframe top-down approach facilitated by the indicator's engine.

Improvements

- Expected Value Labels: Added informative labels on charts displaying the expected value of every setup. This feature helps traders make more informed decisions based on the potential profitability of their setups.

- Overall Efficiency Enhancements: Improved the overall efficiency of the indicator, ensuring faster calculations and smoother user experience.

릴리즈 노트

- Minor visual improvements릴리즈 노트

- Enhanced Probabilities Table Tooltips: Users can now view higher hourly timeframes expected value and confidence level of current setup in tooltips.릴리즈 노트

New FeaturesQuantitative Mode: Provides a detailed numerical breakdown of Higher Time Frame (HTF) biases, Lower Time Frame (LTF) entries, and their probabilities. This mode is color-coded for quick visual analysis, enabling traders to identify potential setups efficiently.

Interpretive Mode: Introduces a narrative-based interpretation of the market. This mode translates the raw data into comprehensible insights, offering a story behind the numbers.

릴리즈 노트

- Enhanced tooltips for clearer feature understanding릴리즈 노트

HTF Probability Table:- Enhanced readability with a new layout and color scheme for better user experience.

- Optimized data presentation for higher time frames to provide clearer insights at a glance.

릴리즈 노트

- Improved range minimal mode to display the last oppposite BOS/X as "⏎" on charts.릴리즈 노트

- Improved the Probability Table functionality to now display the expected value for all hourly timeframes directly on user charts.- User Interface: The updated interface now seamlessly integrates the expected value data, allowing for instant visibility without the need for additional clicks or navigation.

- Performance: Optimized backend processing to ensure that the real-time data updates do not impact the overall performance of the charting tool.

릴리즈 노트

- Updated special characters to a readable format across all devices for improved visualization.- Enhanced timeframe readability logic.

릴리즈 노트

- Enhanced code logic for improved performance. - Added new font customization options for better visual clarity.

릴리즈 노트

- Quick label bug fix.릴리즈 노트

- Improved the functionality and aesthetics of the multi-timeframe table when the custom pivot level is selected.릴리즈 노트

Enhanced the range calculation logic to provide more precise measurements of probabilities.릴리즈 노트

- Minor improvements릴리즈 노트

- Improved probability logic calculation for custom pivot levels.- Prepared backend logic for the next coming update.

릴리즈 노트

New Features:Dynamic Pivot Detection Mechanism:

Introduced a sophisticated algorithm that dynamically identifies optimal trading setups across all displayed hourly timeframes within the multi-timeframe table.

When the dynamic pivot level option is selected, the script now compares probabilities and expected values to determine the best entry setups aligned with the HTF bias and the chosen RR within the settings.

Improvements:

Enhanced Expected Value Analysis:

The new mechanism allows for a more comprehensive evaluation of expected values.

Optimized Stop Loss Sizes:

By automatically detecting setups with the highest expected values, users can benefit from reduced stop loss sizes, enhancing potential returns over the long run.

릴리즈 노트

Improved the multi-timeframe bias detection mechanism for better accuracy in identifying the overall market bias.릴리즈 노트

Improvements- Enhanced HTF Bias Table Color Detection for improved visual clarity and accuracy.

Bug Fixes

- Resolved an issue with the hourly timeframes table size, ensuring proper display and functionality.

릴리즈 노트

- Fixed a bug related to status label on hourly timeframes.릴리즈 노트

Enhanced Probability Calculation- Introduced a condition to focus on the first tap of the Pivot Level (PVT) when calculating probabilities. This change aims to provide more accurate entry probabilities.

First Tap Focus

If the price is already within a range, the indicator will:

- Calculate probabilities and expected values based only on the first tap of the PVT.

This ensures that entries are based on initial market interactions.

Label Status Management

If the price has interacted with either side of the PVT and remains in the same range:

- The label status will change to IDLE | ●

In this state, new probability calculations will not start until price create a new range.

릴리즈 노트

Improved Data Accuracy:Adjusted the request security function to ensure more reliable data retrieval from higher time frames (HTF).

Label and Tooltip Synchronization:

Adjusted labels and tooltips to be synchronized with each other, enhancing user interface consistency and clarity.

릴리즈 노트

Added Real-Time Optimal Risk Calculation:Implemented the Kelly Criterion formula to calculate optimal risk per trade based on the user-defined maximum drawdown. This feature allows traders to risk more on high-probability setups and less on lower-probability setups, maximizing growth while minimizing drawdowns.

Real-Time Profit Factor Calculation:

Introduced real-time profit factor calculation alongside recommended risk-reward (RR) ratios for each setup. Aiming for a profit factor of 1.5 and above ensures that trading fees and commissions do not exceed profits, maintaining strategy profitability. This is particularly beneficial for users targeting a fixed RR per trade.

Improved Confidence Level Calculation:

Enhanced the confidence level calculation, incorporating principles from the Law of Large Numbers for more accurate assessments.

HTF Setup Rating Feature:

Added the ability to rate the overall higher time frame (HTF) setup by hovering the mouse over the respective areas, providing quick insights into setup quality.

Enhanced Probabilistic Table:

Improved the probabilistic table to include idle setups, allowing for better tracking and decision-making.

릴리즈 노트

- The indicator now incorporates machine learning techniques (RL/BO) to study historical data and adapt to new trends in real time, automatically identifying optimal pivot levels for entries.Optimizing for highest Expected Value (EV), price tap frequency, and cumulative profit based on the Kelly Criterion, along with essential metrics like setup confidence level and standard deviation.

릴리즈 노트

- Improved adaptive pivot level calculation technique.릴리즈 노트

- Fixed an error that caused the script to reference too many bars back in the historical data.릴리즈 노트

Excluded interbar conditions from probability calculations to improve accuracy. This change focuses on direct price actions instead of fluctuations between tight ranges.

릴리즈 노트

- Implemented ADLQ to dynamically calculate the optimal take profit level based on ML analysis of historical data.ADLQ automatically factors in expected value E(X), confidence level C(%), and the frequency at which price levels are tapped, providing the most reliable liquidity level for a fixed profit-taking.

릴리즈 노트

- Improved table functionality, allowing users to focus on valid hourly timeframes.릴리즈 노트

- Enhanced probability logic calculations to increase accuracy in predictive modeling.릴리즈 노트

- Converted to Pine Script v6, updating syntax, optimizing performance, and enhancing features for improved functionality.릴리즈 노트

- Simplified underlying logic, significantly reducing probability calculation time.- 75% improvement in loading speed.

릴리즈 노트

- Minor tweaks focused on enhancing efficiency.릴리즈 노트

- Minor improvements and bug fixes.릴리즈 노트

- Improved adaptive calculation logic, leading to more accurate detection of PVT levels.- Minor UI refinements.

릴리즈 노트

- Added range highlight feature to visualize the current price’s distance from liquidity levels (BSLQ/SSLQ) in percentage.릴리즈 노트

- Minor box-color bugfix.릴리즈 노트

- Minor improvement to multi-timeframe bias detection.릴리즈 노트

- Added 2.0 block detection for HTF.- Enables more accurate trend and structural analysis using higher timeframe contextual bias.

릴리즈 노트

- Minor logical improvements.릴리즈 노트

- Added ADLQ (Adjusted Liquidity Level) to dynamically calculate extended liquidity levels based on average liquidity grab extensions for improved risk management.릴리즈 노트

- Enhanced ADLQ functionality with price extension levels to improve trade management and decision-making.릴리즈 노트

- Improved predictive modeling accuracy by refining bias detection criteria, resulting in more reliable and consistent predictions.릴리즈 노트

1. Built-In Trailing Stoploss:• Added a dynamic trailing stoploss feature based on market structure.

• Automatically adjusts positions as new breaks of structure (BOS) occur, ensuring better risk management while capturing extended trends.

2. Multi-Timeframe Analysis:

• Custom timeframe selection for entries.

• Users can now analyze up to 8 timeframes to identify high-probability opportunities according to the HTF bias.

릴리즈 노트

- Implemented dynamic request logic to reduce unnecessary script calculations, enhancing efficiency.릴리즈 노트

- Minor improvements and bug fixes.릴리즈 노트

- Added bias source detection릴리즈 노트

- Simplified script calculation logic and bias detection릴리즈 노트

- Removed hourly lines and labels for maximum compatibility with Quantify [Trading Model]릴리즈 노트

- Improved Top-down and Continuation Model logic초대 전용 스크립트

이 스크립트는 작성자가 승인한 사용자만 접근할 수 있습니다. 사용하려면 요청 후 승인을 받아야 하며, 일반적으로 결제 후에 허가가 부여됩니다. 자세한 내용은 아래 작성자의 안내를 따르거나 Fractalyst에게 직접 문의하세요.

트레이딩뷰는 스크립트의 작동 방식을 충분히 이해하고 작성자를 완전히 신뢰하지 않는 이상, 해당 스크립트에 비용을 지불하거나 사용하는 것을 권장하지 않습니다. 커뮤니티 스크립트에서 무료 오픈소스 대안을 찾아보실 수도 있습니다.

작성자 지시 사항

📈 | Track record:

darwinexzero.com/darwin/XRPV/performance

🎯 | Entry Model:

whop.com/fractalyst

📥 | Work with Me:

fractalyst.net

darwinexzero.com/darwin/XRPV/performance

🎯 | Entry Model:

whop.com/fractalyst

📥 | Work with Me:

fractalyst.net

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

초대 전용 스크립트

이 스크립트는 작성자가 승인한 사용자만 접근할 수 있습니다. 사용하려면 요청 후 승인을 받아야 하며, 일반적으로 결제 후에 허가가 부여됩니다. 자세한 내용은 아래 작성자의 안내를 따르거나 Fractalyst에게 직접 문의하세요.

트레이딩뷰는 스크립트의 작동 방식을 충분히 이해하고 작성자를 완전히 신뢰하지 않는 이상, 해당 스크립트에 비용을 지불하거나 사용하는 것을 권장하지 않습니다. 커뮤니티 스크립트에서 무료 오픈소스 대안을 찾아보실 수도 있습니다.

작성자 지시 사항

📈 | Track record:

darwinexzero.com/darwin/XRPV/performance

🎯 | Entry Model:

whop.com/fractalyst

📥 | Work with Me:

fractalyst.net

darwinexzero.com/darwin/XRPV/performance

🎯 | Entry Model:

whop.com/fractalyst

📥 | Work with Me:

fractalyst.net

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.