OPEN-SOURCE SCRIPT

업데이트됨 Price Delta Heatmap

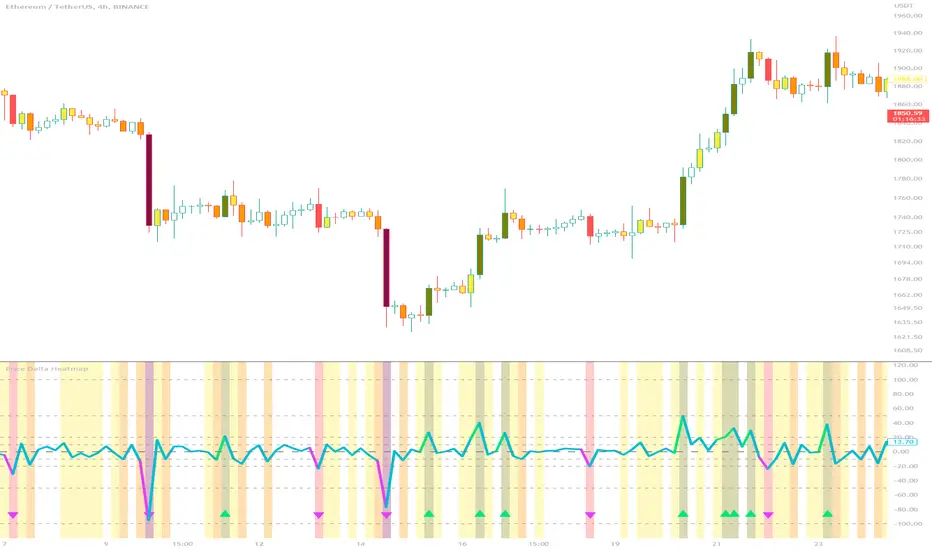

The Price Delta Heatmap is an indicator designed to visualize the price changes of an asset over time. It helps traders identify and analyze significant price movements and potential volatility. The indicator calculates the price delta, which is the difference between the current close price and the previous close price. It then categorizes the price deltas into different color ranges to create a heatmap-like display on the chart.

The indicator uses user-defined thresholds to determine the color ranges. These thresholds represent the minimum price change required for a specific color to be assigned. The thresholds are adjustable to accommodate different asset classes and trading strategies. Positive price deltas are associated with bullish movements, while negative price deltas represent bearish movements.

The indicator plots bars color-coded according to the price delta range it falls into. The color ranges can be customized to match personal preferences or specific trading strategies. Additionally, the indicator includes signal shapes below the bars to highlight significant positive or negative price deltas. Traders can adjust the threshold values based on their preferred sensitivity to price changes. Higher threshold values may filter out minor price movements and focus on more significant shifts, while lower threshold values will capture even minor fluctuations.

****The default settings have the thresholds set to levels of 100, 50, 20, 10, 0, -10, -20, -50, and -100. These numbers are well-suited for assets such as Ethereum or Bitcoin which are larger in price than an asset that has a price of $1.50, for example. To compensate, adjust the thresholds in the settings to reflect the price delta on the desired asset. All coloration and horizontal line plots will adjust to reflect these changes.****

Traders can interpret the Price Delta Heatmap as follows:

-- Bright green bars indicate the highest positive price deltas, suggesting strong bullish price movements.

-- Green bars represent positive price deltas above the third threshold, indicating significant bullish price changes.

-- Olive bars indicate positive price deltas above the second threshold, suggesting moderate bullish price movements.

-- Yellow bars represent positive price deltas above the lowest threshold, indicating minor bullish price changes. This color is reflected on the negative side as well. Yellow bars below zero indicate negative price deltas below the lowest threshold, suggesting minor bearish price changes.

-- White bars represent zero price deltas, indicating no significant price movement.

-- Orange bars represent negative price deltas below the second threshold, indicating moderate bearish price movements.

-- Red bars indicate negative price deltas below the third threshold, suggesting significant bearish price changes.

-- Maroon bars represent the lowest negative price deltas, indicating strong bearish price movements.

The coloration of the Price Delta line itself is determined by the line's relation to the second positive and second negative thresholds (default +/- 20) - if the line is above the second positive threshold, the line is colored lime (and is reflected in a lime arrow at the bottom of the indicator); if the line is below the second negative threshold, the line is colored fuchsia (also reflected as an arrow); if the line is between thresholds, it is colored aqua.

The Price Delta Heatmap can be used in various trading strategies and applications. Some potential use cases include:

-- Trend identification: The indicator helps traders identify periods of high volatility and potential trend reversals.

-- Volatility analysis: By observing the color changes in the heatmap, traders can gauge the volatility of an asset and adjust their risk management strategies accordingly.

-- Confirmation tool: The indicator can be used as a confirmation tool alongside other technical indicators, such as trend-following indicators or oscillators.

-- Breakout trading: Traders can look for price delta bars of a specific color range to identify potential breakout opportunities.

However, it's important to note that the Price Delta Heatmap has certain limitations. These include:

-- Lagging nature: The indicator relies on historical price data, which means it may not provide real-time insights into price movements.

-- Sensitivity to thresholds: The choice of threshold values affects the indicator's sensitivity and may vary depending on the asset being traded. It requires experimentation and adjustment to find optimal values.

-- Market conditions: The indicator's effectiveness may vary depending on market conditions, such as low liquidity or sudden news events.

Traders should consider using the Price Delta Heatmap in conjunction with other technical analysis tools and incorporate risk management strategies to enhance their trading decisions.

The indicator uses user-defined thresholds to determine the color ranges. These thresholds represent the minimum price change required for a specific color to be assigned. The thresholds are adjustable to accommodate different asset classes and trading strategies. Positive price deltas are associated with bullish movements, while negative price deltas represent bearish movements.

The indicator plots bars color-coded according to the price delta range it falls into. The color ranges can be customized to match personal preferences or specific trading strategies. Additionally, the indicator includes signal shapes below the bars to highlight significant positive or negative price deltas. Traders can adjust the threshold values based on their preferred sensitivity to price changes. Higher threshold values may filter out minor price movements and focus on more significant shifts, while lower threshold values will capture even minor fluctuations.

****The default settings have the thresholds set to levels of 100, 50, 20, 10, 0, -10, -20, -50, and -100. These numbers are well-suited for assets such as Ethereum or Bitcoin which are larger in price than an asset that has a price of $1.50, for example. To compensate, adjust the thresholds in the settings to reflect the price delta on the desired asset. All coloration and horizontal line plots will adjust to reflect these changes.****

Traders can interpret the Price Delta Heatmap as follows:

-- Bright green bars indicate the highest positive price deltas, suggesting strong bullish price movements.

-- Green bars represent positive price deltas above the third threshold, indicating significant bullish price changes.

-- Olive bars indicate positive price deltas above the second threshold, suggesting moderate bullish price movements.

-- Yellow bars represent positive price deltas above the lowest threshold, indicating minor bullish price changes. This color is reflected on the negative side as well. Yellow bars below zero indicate negative price deltas below the lowest threshold, suggesting minor bearish price changes.

-- White bars represent zero price deltas, indicating no significant price movement.

-- Orange bars represent negative price deltas below the second threshold, indicating moderate bearish price movements.

-- Red bars indicate negative price deltas below the third threshold, suggesting significant bearish price changes.

-- Maroon bars represent the lowest negative price deltas, indicating strong bearish price movements.

The coloration of the Price Delta line itself is determined by the line's relation to the second positive and second negative thresholds (default +/- 20) - if the line is above the second positive threshold, the line is colored lime (and is reflected in a lime arrow at the bottom of the indicator); if the line is below the second negative threshold, the line is colored fuchsia (also reflected as an arrow); if the line is between thresholds, it is colored aqua.

The Price Delta Heatmap can be used in various trading strategies and applications. Some potential use cases include:

-- Trend identification: The indicator helps traders identify periods of high volatility and potential trend reversals.

-- Volatility analysis: By observing the color changes in the heatmap, traders can gauge the volatility of an asset and adjust their risk management strategies accordingly.

-- Confirmation tool: The indicator can be used as a confirmation tool alongside other technical indicators, such as trend-following indicators or oscillators.

-- Breakout trading: Traders can look for price delta bars of a specific color range to identify potential breakout opportunities.

However, it's important to note that the Price Delta Heatmap has certain limitations. These include:

-- Lagging nature: The indicator relies on historical price data, which means it may not provide real-time insights into price movements.

-- Sensitivity to thresholds: The choice of threshold values affects the indicator's sensitivity and may vary depending on the asset being traded. It requires experimentation and adjustment to find optimal values.

-- Market conditions: The indicator's effectiveness may vary depending on market conditions, such as low liquidity or sudden news events.

Traders should consider using the Price Delta Heatmap in conjunction with other technical analysis tools and incorporate risk management strategies to enhance their trading decisions.

릴리즈 노트

Changed the inputs from integers to floats to allow decimal points to be used in the threshold for low priced assets.오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.