OPEN-SOURCE SCRIPT

Cumulative Volume Delta (CVD)

█ OVERVIEW

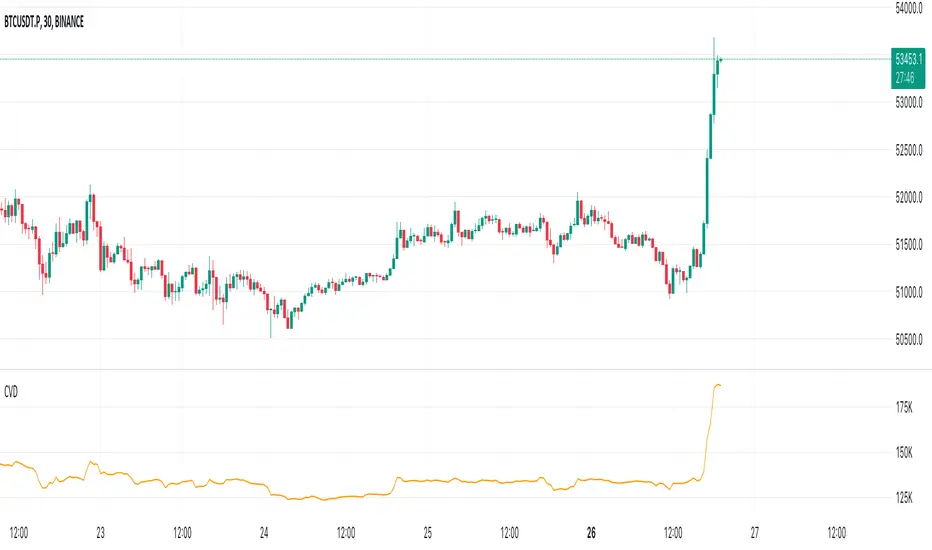

Cumulative Volume Delta (CVD) is a volume-based trading indicator that provides a visual representation of market buying and selling pressure by calculating the difference in traded volumes between the two sides. It uses intrabar information to obtain more precise volume delta information than methods using only the chart's timeframe.

Volume delta is the net difference between Buy Volume and Sell Volume. Positive volume delta indicates that buy volume is more than sell volume, and opposite. So Cumulative Volume Delta (CVD) is a running total/cumulation of volume delta values, where positive VD gets added to the sum and negative VD gets subtracted from the sum.

I found simple and fast solution how to calculate CVD, so made plain and concise code, here is CVD function :

Pine Script®

where _c, _o, _v are close, open and volume of intrabar much lower timeframe.

Indicator uses intrabar information to obtain more precise volume delta information than methods using only the chart's timeframe.

Intrabar precision calculation depends on the chart's timeframe:

CVD is good to use together with open interest, volume and price change.

For example if CVD is rising and price makes good move up in short period and volume is rising and open interest makes good move up in short period and before was flat market it is show big chance to pump.

Cumulative Volume Delta (CVD) is a volume-based trading indicator that provides a visual representation of market buying and selling pressure by calculating the difference in traded volumes between the two sides. It uses intrabar information to obtain more precise volume delta information than methods using only the chart's timeframe.

Volume delta is the net difference between Buy Volume and Sell Volume. Positive volume delta indicates that buy volume is more than sell volume, and opposite. So Cumulative Volume Delta (CVD) is a running total/cumulation of volume delta values, where positive VD gets added to the sum and negative VD gets subtracted from the sum.

I found simple and fast solution how to calculate CVD, so made plain and concise code, here is CVD function :

cvd(_c, _o, _v) =>

var tcvd = 0.0, delta = 0.0

posV = 0.0, negV = 0.0

totUV = 0.0, totDV = 0.0

switch

_c > _o => posV += _v

_c < _o => negV -= _v

_c > nz(_c[1]) => posV += _v

_c < nz(_c[1]) => negV -= _v

nz(posV[1]) > 0 => posV += _v

nz(negV[1]) < 0 => negV -= _v

totUV += posV

totDV += negV

delta := totUV + totDV

cvd = tcvd + delta

tcvd += delta

cvd

where _c, _o, _v are close, open and volume of intrabar much lower timeframe.

Indicator uses intrabar information to obtain more precise volume delta information than methods using only the chart's timeframe.

Intrabar precision calculation depends on the chart's timeframe:

CVD is good to use together with open interest, volume and price change.

For example if CVD is rising and price makes good move up in short period and volume is rising and open interest makes good move up in short period and before was flat market it is show big chance to pump.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.