INVITE-ONLY SCRIPT

업데이트됨 TradeSpec-Designed for Crypto, Stocks, Currencies and Futures

TradeSpec- Overview

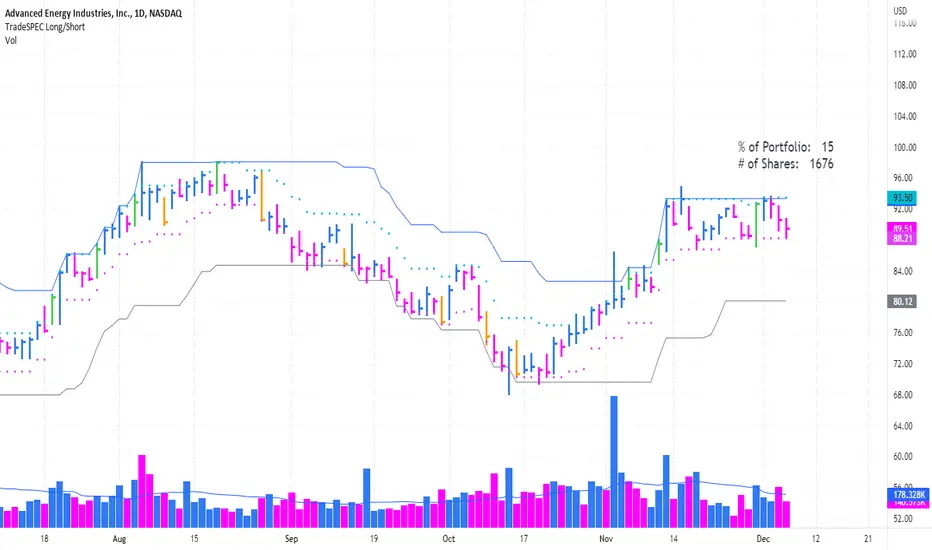

1. Main Trend (gray line) lets you see your trailing stop as the the trend progresses and provide a definitive point to know where to execute your sell and lock in your profits. Also, you have the ability to adjust the indicator value based on your trading time frame and objective.

2. Initial stop value (pink dotted line) can be used to determine position size.

3. Specific price bars ( yellow or green) are highlighted to show potential starting points for new or continued trends.

4. Price Alerts Indicator (orange or green crosses above price) looks to highlight areas of importance during a trend. Become aware when the trend could be ready to plateau for a while or when a top could be forming. The alert markers can be used to tighten your trailing stop, remove a portion of the trade, or be used as an indication to remove the position entirely.

1. Main Trend (gray line) lets you see your trailing stop as the the trend progresses and provide a definitive point to know where to execute your sell and lock in your profits. Also, you have the ability to adjust the indicator value based on your trading time frame and objective.

2. Initial stop value (pink dotted line) can be used to determine position size.

3. Specific price bars ( yellow or green) are highlighted to show potential starting points for new or continued trends.

4. Price Alerts Indicator (orange or green crosses above price) looks to highlight areas of importance during a trend. Become aware when the trend could be ready to plateau for a while or when a top could be forming. The alert markers can be used to tighten your trailing stop, remove a portion of the trade, or be used as an indication to remove the position entirely.

릴리즈 노트

Term Clarification릴리즈 노트

Main trendline makes small adjustments based on ROC. 릴리즈 노트

Small adjustment to the initial stop indicator릴리즈 노트

A quick update to the trend change color.릴리즈 노트

I've updated the script to version 4 and have now included the position sizer with it.TradeSpec will now automatically calculate the number of shares you can buy and the percentage of your capital to use. It will then display the values as a label above the last bar.

Position sizing is based on the initial stop indicator (pink dotted) line and the amount of risk you want to take per trade. You can use this value or use a custom stop value to determine your position size.

To determine the correct number of shares to purchase, you can adjust the portfolio value.

By combining all the indicators into one, you now have the ability to use other indicators in the lower panes.

릴리즈 노트

This is an update to the position sizing label.It now appears with black text to make it easier to see.

릴리즈 노트

A minor change to the pivot point calculation for shorter term setups릴리즈 노트

Refreshed titles to match for less confusion regarding the Main Trailing Stop Value.릴리즈 노트

The latest version has the ability to step values for the "Main Trailing Stop Value" and the "Initial Stop Value" by .5 versus 1.릴리즈 노트

Updated to Version 5TradeSpec now allows you the option to calculate a short position automatically by using the Initial Stop Multiple( Short) value.

You can also display the Initial Stop Multiple (Short) and the Trailing Stop Multiple (Short) on the chart for visual reference.

TradeSpec lets you change the text color of the portfolio calculations. This allows you use any color theme and still be able to see % of account used and # of shares to buy or sell short.

릴리즈 노트

A quick update that allows you to color the portfolio calculation text based on going long or short. It's a quick visual cue to make sure you are displaying the correct calculation.릴리즈 노트

The latest update allows you to display long, short and custom portfolio allocations in a table at once. This allows for a quick reference before making a decision.릴리즈 노트

Minor display fix for table view릴리즈 노트

Updated the Main Short Indicator and removed the table display from the bottom.릴리즈 노트

Minor adjustments to the display settingsYou now have the ability to turn the portfolio calculation display on or off while using the indicators.

초대 전용 스크립트

이 스크립트는 작성자가 승인한 사용자만 접근할 수 있습니다. 사용하려면 요청 후 승인을 받아야 하며, 일반적으로 결제 후에 허가가 부여됩니다. 자세한 내용은 아래 작성자의 안내를 따르거나 TradeAnatomy에게 직접 문의하세요.

트레이딩뷰는 스크립트의 작동 방식을 충분히 이해하고 작성자를 완전히 신뢰하지 않는 이상, 해당 스크립트에 비용을 지불하거나 사용하는 것을 권장하지 않습니다. 커뮤니티 스크립트에서 무료 오픈소스 대안을 찾아보실 수도 있습니다.

작성자 지시 사항

Please visit https://tradeanatomy.com/

to register for free use. Thanks

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

초대 전용 스크립트

이 스크립트는 작성자가 승인한 사용자만 접근할 수 있습니다. 사용하려면 요청 후 승인을 받아야 하며, 일반적으로 결제 후에 허가가 부여됩니다. 자세한 내용은 아래 작성자의 안내를 따르거나 TradeAnatomy에게 직접 문의하세요.

트레이딩뷰는 스크립트의 작동 방식을 충분히 이해하고 작성자를 완전히 신뢰하지 않는 이상, 해당 스크립트에 비용을 지불하거나 사용하는 것을 권장하지 않습니다. 커뮤니티 스크립트에서 무료 오픈소스 대안을 찾아보실 수도 있습니다.

작성자 지시 사항

Please visit https://tradeanatomy.com/

to register for free use. Thanks

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.