OPEN-SOURCE SCRIPT

업데이트됨 Refracted EMA

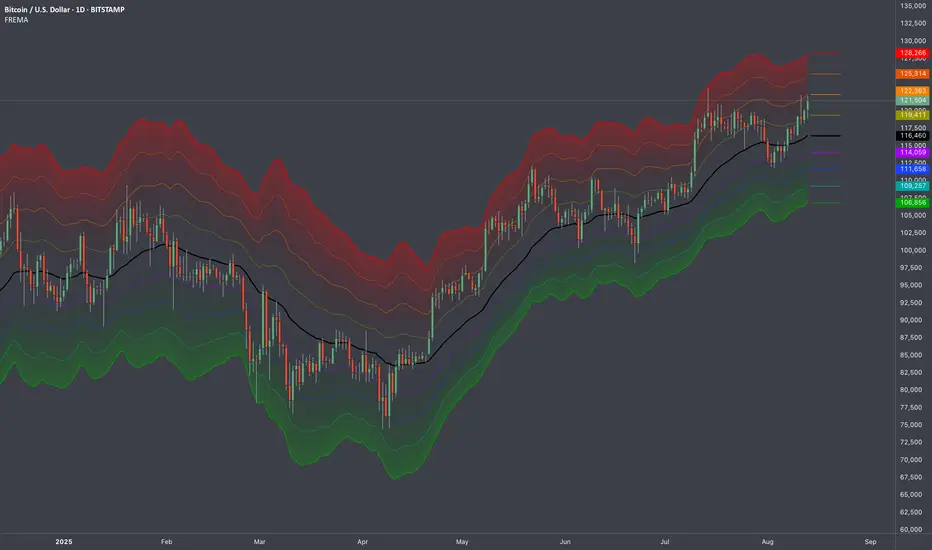

Refracted EMA is a price based indicator with bands that is built on moving average.

The price range between the bands directly depends on relationship of Average True Range to Moving Average. This gives us very valuable variable constant that changes with the market moves.

So the bands expand and contract due to changes in volatility of the market, which makes this tool very flexible exposing psychological levels.

The price range between the bands directly depends on relationship of Average True Range to Moving Average. This gives us very valuable variable constant that changes with the market moves.

So the bands expand and contract due to changes in volatility of the market, which makes this tool very flexible exposing psychological levels.

릴리즈 노트

Small change in formula to increase graphic representation of Volatility릴리즈 노트

Added more bands릴리즈 노트

High Low levelsTF based Support and Resistance

릴리즈 노트

Removed unnecessary lines릴리즈 노트

Increased responsiveness of bands릴리즈 노트

UPD:⚠️ Now the indicator is based exceptionally on Buying & Selling Pressure instead of ATR.

This means that when price goes up the buying pressure determines the width of the upper "hot color" channels, whereas selling pressure set the width of lower "cold color" channels on decline.[/b

Added bool. Color of Original EMA also depends on Buying and Selling Pressure and price change.

릴리즈 노트

Fixed default settings upon update.릴리즈 노트

Added VWAP based bar colors which plays a role of another layer of visualized confirmation.릴리즈 노트

UPDATE: Eliminated VWAP and changed design.릴리즈 노트

Redesign of BG Trending colors. Fast MA carries a signal that colors bars. It should be at least twice less than inputs of Base EMA. I usually use same values of BSP and Base EMA.If you want to use higher values, say 360 for BASE EMA and BSP, then you must increase proportionally the input of Fast EMA and and set Factor accordingly.

If you have no idea what's BSP, please go to my scrips and find "Buying & Selling Pressure" or just add it to the chart.

릴리즈 노트

Had to remove Bar Coloring. It's a crime against trading.Added extended lines of the bands and highlights of Buying and Selling Pressure relationship. They can also create intersections which determine levels of market conditions.

Added historic Traces within our system.

릴리즈 노트

Highlights Color grouped.릴리즈 노트

Altered conditions of firing the highlights릴리즈 노트

LT version update:Fixed once for all background highlight signals by incorporating NET BSP.

Now we have signals based on change of NET BSP and EMA. 2 confirming trend different instruments.

릴리즈 노트

- Fixing my silly mistake on wicks. (facepalm)

- incorporated ST based on BSP.

릴리즈 노트

Added no wick mode. Where certain wicks depending on whether we're dealing with Buying or Selling Pressure. In this mode bands shrink and expand faster in correlation to trend condition.

When we're at uptrend cold color zones shrink faster while hot color zones expand according to candle metrics.

릴리즈 노트

- Changed default formula of bands

- Rearranged user inputs

릴리즈 노트

Update:- Ability to alter the averaging of buying/selling pressure and their factors separately

- Assigning custom ranges enables targeting certain trend conditions

Default for both:

Averaging: 10

Factor: 3

I do not suggest changing the average BP & SP. Let them be 10.

However, by setting the factor of BP lower than of SP will force the trade to close at higher levels. It is suitable when strategy is Open Long/Close Long oriented.

릴리즈 노트

Added:Bool "Invert BSP"

Assigns inverted Buying and Selling Pressure for SuperTrend bands. When enabled it closes positions faster.

Bool "Dynamic Factor"

Example: For non-inverted BSP, the bullish band of SuperTrend will have values of (BPMA X BPMA / SPMA). When inverted - SPMA*SPMA/BPMA.

Extra multiplication with that ratio gives the supertrend band an adjustment to the existing proportion of Buying and Selling Pressure of the market.

Use Dynamic Factor with default inputs of (10; 3) for each 1 raws.

When both "Invert BSP" and "Dynamic factor" are enabled:

Position Entry and Position Close are timed with the proportions of Candle Metrics.

Both are off in default mode

릴리즈 노트

Minor but important updates in FR dispay릴리즈 노트

- Added ability to choose the type of MA of the Base

릴리즈 노트

Introducing new changes:- Deleted Geometric FREMA bands. There is no need amplifying the volatility bands with candle ratios.

- Added output of SuperTrend Bands

- FR and SuperTrend are inversely tied together. ST downtrend activates bullish FR entries and vice versa. FR signals play role of close ST short/long.

- Ability to swap volatility sources of each band separately by checking ⇅ (Invert). Default (when unchecked): Uptrend band powered by Buying Pressure ; Downtrend band - with Selling Pressure. Example of use: Say we want to make uptrend band more sensitive so it can close faster. Other than reducing averaging or factor, we can check ⇅ so uptrend band will be spaced with Selling Pressure. As trend grows the SP reduces accordingly making the space shrink right on time to close the longs higher.

- ATR^2 / Selling Pressure (when Invert checked / Buying Pressure) ATR^2 / Buying Pressure (when Invert checked / Selling Pressure). Example: Filters out big drops when enabled on downtrend band.

- FR is just like SuperTrend - runs on volatility and triggers signals but has only one band to reflect uptrend and downtrend condition of the market. Apart from squaring and swapping, the only numerical user input to alter FR sensitivity is Averaging. Whereas ST bands can be adjusted also by factor. Multiple FR signals of same direction can be used for dollar cost averaging to divide the risk.

릴리즈 노트

Cleaned up the code for a better performance and design:- Replaced individual FREMA range coloring with a gradient.

- Colors of FR signals are assigned by FREMA band color.

- Added ability to boost the FR sensitivity to ultimate.

- Changed squaring method for SuperTrend bands.

Uptrend Band (green): Buying Pressure squared divided by Higher Wicks

Downtrend Band (red): Selling Pressure squared divided by Lower Wicks

It's more efficient than using ATR in previous version. It uses less lines of code yet gives bigger gaps in the beginning of trends which doesn't allow the market noise to violate with false signals.

While on uptrend we want the big distance of band gap to still respond to a rise in counter force - higher wicks (part of selling pressure). As a result that distance will shrink. And vice versa for downtrend.

릴리즈 노트

Simplified overall user experience by correcting some formulas and reducing number of user inputs- Smoothed FREMA Bands with Gaussian Filter

- Linked up ST trend change with FR

- SuperTrend no longer has multiplier as it is replaced with dynamic one. (Determined by relationship of ATR to certain bar fragments)

릴리즈 노트

After thoroughly reviewing the code, I’ve removed useless components which slowed down the indicator’s primary function. It was designed to be a strong alternative to most volatility channels out there. Now the code reflects its original purpose. I will avoid doing such unnecessary buildups in the future. Apologies for any confusion!릴리즈 노트

- Eliminated unnecessary components slowing down the system.

- Adapted design for a better experience handling the mean reversion.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

Unlock exclusive tools: fractlab.com

ᴀʟʟ ᴄᴏɴᴛᴇɴᴛ ᴘʀᴏᴠɪᴅᴇᴅ ʙʏ ꜰʀᴀᴄᴛʟᴀʙ ɪꜱ ɪɴᴛᴇɴᴅᴇᴅ ꜰᴏʀ ɪɴꜰᴏʀᴍᴀᴛɪᴏɴᴀʟ ᴀɴᴅ ᴇᴅᴜᴄᴀᴛɪᴏɴᴀʟ ᴘᴜʀᴘᴏꜱᴇꜱ ᴏɴʟʏ.

ᴘᴀꜱᴛ ᴘᴇʀꜰᴏʀᴍᴀɴᴄᴇ ɪꜱ ɴᴏᴛ ɪɴᴅɪᴄᴀᴛɪᴠᴇ ᴏꜰ ꜰᴜᴛᴜʀᴇ ʀᴇꜱᴜʟᴛꜱ.

ᴀʟʟ ᴄᴏɴᴛᴇɴᴛ ᴘʀᴏᴠɪᴅᴇᴅ ʙʏ ꜰʀᴀᴄᴛʟᴀʙ ɪꜱ ɪɴᴛᴇɴᴅᴇᴅ ꜰᴏʀ ɪɴꜰᴏʀᴍᴀᴛɪᴏɴᴀʟ ᴀɴᴅ ᴇᴅᴜᴄᴀᴛɪᴏɴᴀʟ ᴘᴜʀᴘᴏꜱᴇꜱ ᴏɴʟʏ.

ᴘᴀꜱᴛ ᴘᴇʀꜰᴏʀᴍᴀɴᴄᴇ ɪꜱ ɴᴏᴛ ɪɴᴅɪᴄᴀᴛɪᴠᴇ ᴏꜰ ꜰᴜᴛᴜʀᴇ ʀᴇꜱᴜʟᴛꜱ.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

Unlock exclusive tools: fractlab.com

ᴀʟʟ ᴄᴏɴᴛᴇɴᴛ ᴘʀᴏᴠɪᴅᴇᴅ ʙʏ ꜰʀᴀᴄᴛʟᴀʙ ɪꜱ ɪɴᴛᴇɴᴅᴇᴅ ꜰᴏʀ ɪɴꜰᴏʀᴍᴀᴛɪᴏɴᴀʟ ᴀɴᴅ ᴇᴅᴜᴄᴀᴛɪᴏɴᴀʟ ᴘᴜʀᴘᴏꜱᴇꜱ ᴏɴʟʏ.

ᴘᴀꜱᴛ ᴘᴇʀꜰᴏʀᴍᴀɴᴄᴇ ɪꜱ ɴᴏᴛ ɪɴᴅɪᴄᴀᴛɪᴠᴇ ᴏꜰ ꜰᴜᴛᴜʀᴇ ʀᴇꜱᴜʟᴛꜱ.

ᴀʟʟ ᴄᴏɴᴛᴇɴᴛ ᴘʀᴏᴠɪᴅᴇᴅ ʙʏ ꜰʀᴀᴄᴛʟᴀʙ ɪꜱ ɪɴᴛᴇɴᴅᴇᴅ ꜰᴏʀ ɪɴꜰᴏʀᴍᴀᴛɪᴏɴᴀʟ ᴀɴᴅ ᴇᴅᴜᴄᴀᴛɪᴏɴᴀʟ ᴘᴜʀᴘᴏꜱᴇꜱ ᴏɴʟʏ.

ᴘᴀꜱᴛ ᴘᴇʀꜰᴏʀᴍᴀɴᴄᴇ ɪꜱ ɴᴏᴛ ɪɴᴅɪᴄᴀᴛɪᴠᴇ ᴏꜰ ꜰᴜᴛᴜʀᴇ ʀᴇꜱᴜʟᴛꜱ.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.