Crypto isn’t new anymore. We’re past the toddler years. Total crypto market cap has surged past $3 trillion again, and maturity is following price. Each cycle brings innovation. The next one will be about infrastructure, scalability, compliance, privacy.

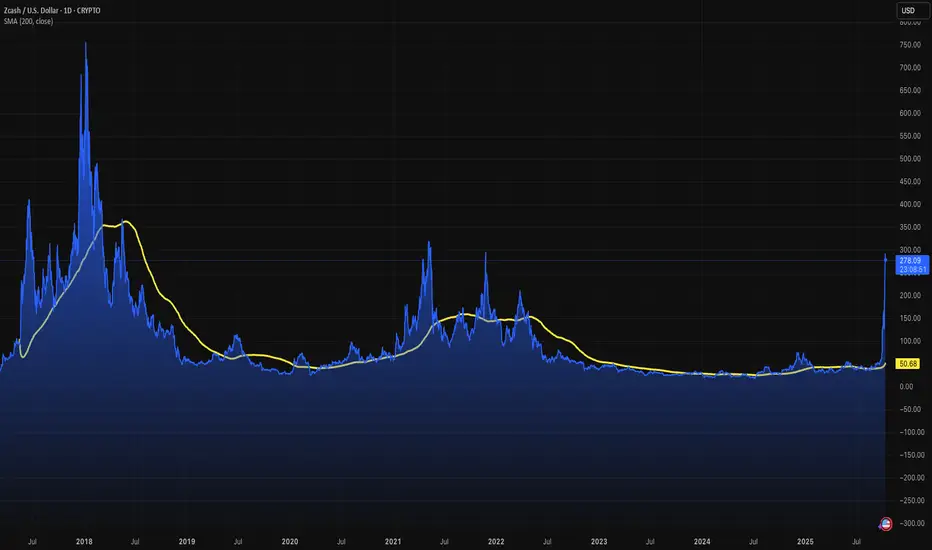

Zcash fits that last bucket. We must saw from the outset that crypto is different to other asset classes in that it is very much sentiment driven. The network grows and becomes self-fulfilling.

It's a sentiment asset class, based on utility, confidence, and durability. Liquidity drives interest, interest builds trust, trust scales networks.

Zero-knowledge proofs aren’t theory, they’re live. Zcash lets you send fully encrypted transactions. No blockchain breadcrumb trail. That’s a big deal in a world that’s getting more watched.

Regulators are moving. The EU’s MiCA framework is here. The US Treasury wants more visibility over crypto flows. Even stablecoins are facing surveillance. But there’s a line, privacy isn’t crime. Legitimate financial privacy will be demanded by users who value security, not secrecy.

Zcash is one of the few projects positioned for this. Its tech is peer-reviewed, its encryption is compelling. As crypto grows, so will scrutiny. And with that, demand for tools that offer privacy without leaving the system.

With a market cap of $3.8 billion, Zcash is a fraction of Bitcoin’s $1.2 trillion or Ethereum’s $450 billion (as of October 2025). Yet, it outshines competitors like Monero, whose $3.2 billion market cap lags despite similar privacy goals, thanks to Zcash’s superior zero-knowledge tech and transparent framework that regulators can trust.

While privacy coins face scrutiny, Monero was delisted from major exchanges like Binance in 2024, Zcash’s design mitigates these risks, balancing user privacy with regulatory accountability.

Add to your watch list and accept this will have a lot of volatility in the coming months.

The forecasts provided herein are intended for informational purposes only and should not be construed as guarantees of future performance. This is an example only to enhance a consumer's understanding of the strategy being described above and is not to be taken as Blueberry Markets providing personal advice.

Zcash fits that last bucket. We must saw from the outset that crypto is different to other asset classes in that it is very much sentiment driven. The network grows and becomes self-fulfilling.

It's a sentiment asset class, based on utility, confidence, and durability. Liquidity drives interest, interest builds trust, trust scales networks.

Zero-knowledge proofs aren’t theory, they’re live. Zcash lets you send fully encrypted transactions. No blockchain breadcrumb trail. That’s a big deal in a world that’s getting more watched.

Regulators are moving. The EU’s MiCA framework is here. The US Treasury wants more visibility over crypto flows. Even stablecoins are facing surveillance. But there’s a line, privacy isn’t crime. Legitimate financial privacy will be demanded by users who value security, not secrecy.

Zcash is one of the few projects positioned for this. Its tech is peer-reviewed, its encryption is compelling. As crypto grows, so will scrutiny. And with that, demand for tools that offer privacy without leaving the system.

With a market cap of $3.8 billion, Zcash is a fraction of Bitcoin’s $1.2 trillion or Ethereum’s $450 billion (as of October 2025). Yet, it outshines competitors like Monero, whose $3.2 billion market cap lags despite similar privacy goals, thanks to Zcash’s superior zero-knowledge tech and transparent framework that regulators can trust.

While privacy coins face scrutiny, Monero was delisted from major exchanges like Binance in 2024, Zcash’s design mitigates these risks, balancing user privacy with regulatory accountability.

Add to your watch list and accept this will have a lot of volatility in the coming months.

The forecasts provided herein are intended for informational purposes only and should not be construed as guarantees of future performance. This is an example only to enhance a consumer's understanding of the strategy being described above and is not to be taken as Blueberry Markets providing personal advice.

The Blueberry Team

관련 발행물

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.

The Blueberry Team

관련 발행물

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.