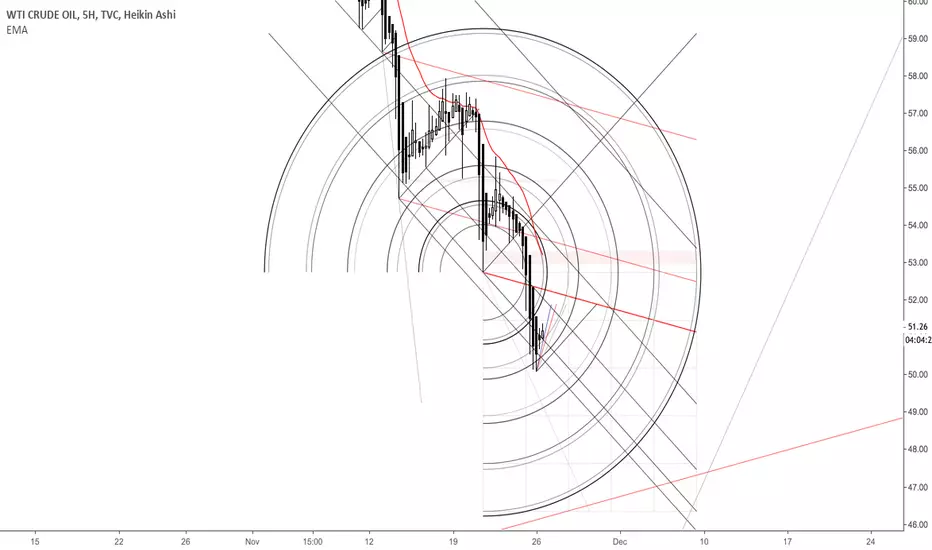

USOIL is likely to pullback to around 5220 where continuation sellers are expected to enter the market. As for now, buying any minor pullback to 5085 towards the 5220 area and flipping short around there seems reasonable. Shorter timeframe for trade entries and thorough risk management is of utmost importance. It is better to get out of the market with minimal loss than hold the bag for weeks. This is overly a bearish market and the previous times sellers were too eager to sell and didn't wait for any significant pullback. There's a sense of urgency in the market and people are selling any pullbacks so being careful with longs is a must.

액티브 트레이드

In long @ 5084 stop 5049 & 1R-3R targets거래청산: 타겟 닿음

1/2 position closed @ 1R, remaining half open with the same stop. A risk free trade.거래청산: 타겟 닿음

3R target on the remaining 1/2 position. 2R on the full position.노트

Limit sell order @ 5195, stop @ 5230액티브 트레이드

거래청산: 타겟 닿음

Booked 1/2 position @ 1.1R, the remaining half working with same stop. A risk free trade.거래청산: 타겟 닿음

Booked the remaining 1/2 with 3R. 2R on the full position.면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.