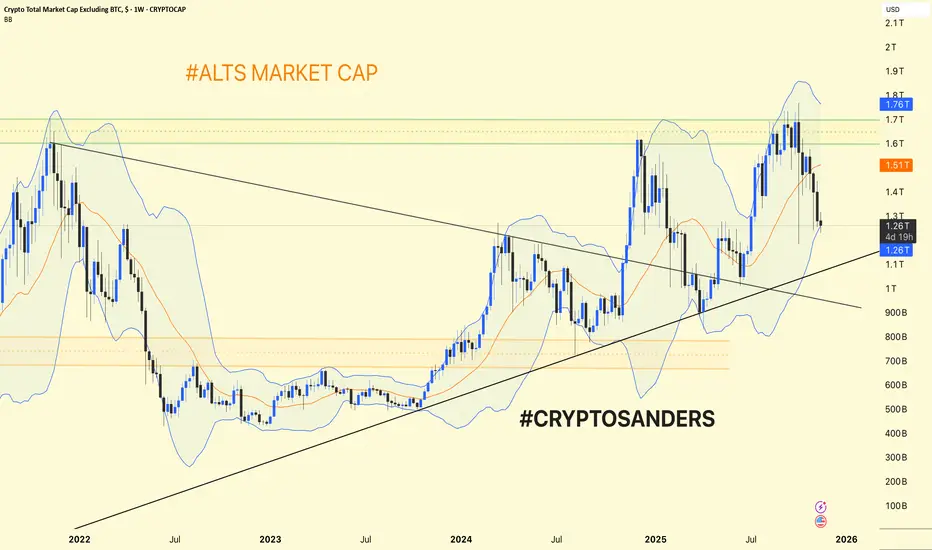

Alts Market Cap (#ALTS) Weekly Chart Update & Analysis

Trend Structure: The altcoin market cap (total crypto market cap excluding BTC) is trading within a broad uptrend channel after a major breakout in early 2024.

Support is currently found near $1.25T (recent swing low and channel support).

Resistance remains around $1.51T (orange line) and $1.76T (major horizontal/upper Bollinger Band zone).

Bollinger Bands: The chart uses weekly Bollinger Bands—price has pulled back from the upper band ($1.76T) and is now holding the midline ($1.26T) as short-term support.

A successful hold above $1.25T keeps the uptrend intact and sets the stage for a move back to $1.51–$1.76T.

A breakdown could lead to a deeper dip toward the long-term rising trendline (currently around $1T).

Alts are consolidating at higher lows inside an uptrend. Holding above the $1.25T area signals strength; a break above $1.51T confirms fresh upside momentum, while losing $1.25T would signal caution for further corrections.

DYOR | NFA

Trend Structure: The altcoin market cap (total crypto market cap excluding BTC) is trading within a broad uptrend channel after a major breakout in early 2024.

Support is currently found near $1.25T (recent swing low and channel support).

Resistance remains around $1.51T (orange line) and $1.76T (major horizontal/upper Bollinger Band zone).

Bollinger Bands: The chart uses weekly Bollinger Bands—price has pulled back from the upper band ($1.76T) and is now holding the midline ($1.26T) as short-term support.

A successful hold above $1.25T keeps the uptrend intact and sets the stage for a move back to $1.51–$1.76T.

A breakdown could lead to a deeper dip toward the long-term rising trendline (currently around $1T).

Alts are consolidating at higher lows inside an uptrend. Holding above the $1.25T area signals strength; a break above $1.51T confirms fresh upside momentum, while losing $1.25T would signal caution for further corrections.

DYOR | NFA

관련 발행물

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

관련 발행물

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.