The recent shutdown of the U.S. government has triggered a domino effect on the release of key macroeconomic indicators. Due to the temporary closure of several federal agencies — notably the Bureau of Labor Statistics (BLS) and the Bureau of Economic Analysis (BEA) — a series of crucial statistics have been delayed, making it more difficult to assess the real-time economic situation of the United States.

A Severely Disrupted Economic Calendar

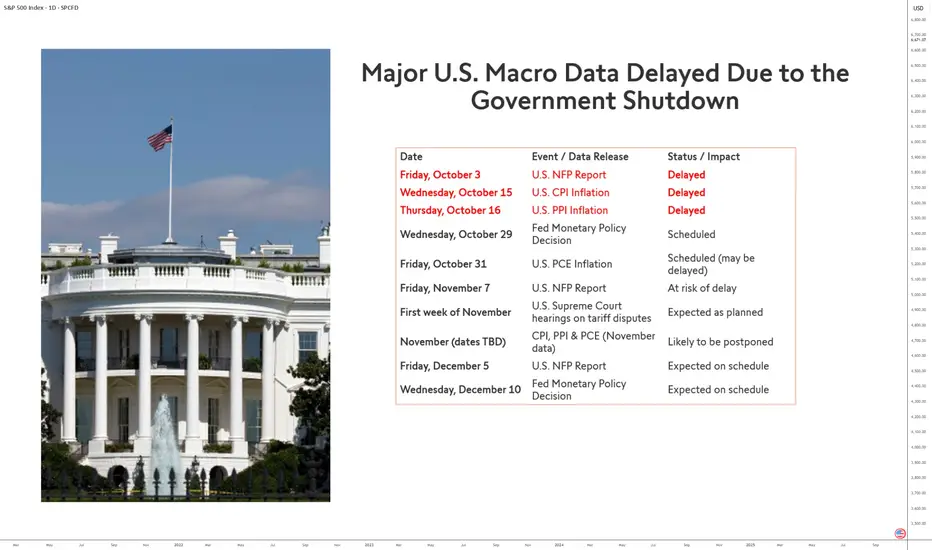

From early October, several major releases were postponed. The Non-Farm Payrolls (NFP) report scheduled for October 3 was the first casualty and the CPI and PPI inflation indicators on October 15 and 16.

These consecutive delays have disoriented financial markets, depriving them of the statistical benchmarks essential to anticipate the Federal Reserve’s decisions. As a result, visibility on inflation, employment, and consumption trends has been significantly reduced, fueling volatility in U.S. equity markets.

The Fed in the Dark

This disrupted schedule complicates the Fed’s task ahead of its October 29 monetary policy decision, followed by the PCE inflation release on October 31.

Without fresh data, FOMC members will have to rely on partial or outdated information to decide on the path of interest rates. This lack of reliable data could lead the institution to adopt a more cautious stance, postponing any major adjustment to its monetary policy.

Cascading Effects in the Coming Months — Unless the Shutdown Ends in October

The November 7 NFP report and Supreme Court hearings on tariff policies, scheduled for the same week, may also be affected if the shutdown continues. Similarly, November inflation data (CPI, PPI, and PCE) could face further delays, undermining the accuracy of economic forecasts for year-end.

Finally, the December releases — notably the December 5 NFP report and the December 10 Fed meeting — could mark a return to calendar normality, provided the affected agencies manage to catch up on lost time.

In short, the sooner this shutdown episode ends, the faster the overall publication of macroeconomic figures will return to normal.

DISCLAIMER:

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only. The presented idea (including market commentary, market data and observations) is not a work product of any research department of Swissquote or its affiliates. This material is intended to highlight market action and does not constitute investment, legal or tax advice. If you are a retail investor or lack experience in trading complex financial products, it is advisable to seek professional advice from licensed advisor before making any financial decisions.

This content is not intended to manipulate the market or encourage any specific financial behavior.

Swissquote makes no representation or warranty as to the quality, completeness, accuracy, comprehensiveness or non-infringement of such content. The views expressed are those of the consultant and are provided for educational purposes only. Any information provided relating to a product or market should not be construed as recommending an investment strategy or transaction. Past performance is not a guarantee of future results.

Swissquote and its employees and representatives shall in no event be held liable for any damages or losses arising directly or indirectly from decisions made on the basis of this content.

The use of any third-party brands or trademarks is for information only and does not imply endorsement by Swissquote, or that the trademark owner has authorised Swissquote to promote its products or services.

Swissquote is the marketing brand for the activities of Swissquote Bank Ltd (Switzerland) regulated by FINMA, Swissquote Capital Markets Limited regulated by CySEC (Cyprus), Swissquote Bank Europe SA (Luxembourg) regulated by the CSSF, Swissquote Ltd (UK) regulated by the FCA, Swissquote Financial Services (Malta) Ltd regulated by the Malta Financial Services Authority, Swissquote MEA Ltd. (UAE) regulated by the Dubai Financial Services Authority, Swissquote Pte Ltd (Singapore) regulated by the Monetary Authority of Singapore, Swissquote Asia Limited (Hong Kong) licensed by the Hong Kong Securities and Futures Commission (SFC) and Swissquote South Africa (Pty) Ltd supervised by the FSCA.

Products and services of Swissquote are only intended for those permitted to receive them under local law.

All investments carry a degree of risk. The risk of loss in trading or holding financial instruments can be substantial. The value of financial instruments, including but not limited to stocks, bonds, cryptocurrencies, and other assets, can fluctuate both upwards and downwards. There is a significant risk of financial loss when buying, selling, holding, staking, or investing in these instruments. SQBE makes no recommendations regarding any specific investment, transaction, or the use of any particular investment strategy.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The vast majority of retail client accounts suffer capital losses when trading in CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Digital Assets are unregulated in most countries and consumer protection rules may not apply. As highly volatile speculative investments, Digital Assets are not suitable for investors without a high-risk tolerance. Make sure you understand each Digital Asset before you trade.

Cryptocurrencies are not considered legal tender in some jurisdictions and are subject to regulatory uncertainties.

The use of Internet-based systems can involve high risks, including, but not limited to, fraud, cyber-attacks, network and communication failures, as well as identity theft and phishing attacks related to crypto-assets.

A Severely Disrupted Economic Calendar

From early October, several major releases were postponed. The Non-Farm Payrolls (NFP) report scheduled for October 3 was the first casualty and the CPI and PPI inflation indicators on October 15 and 16.

These consecutive delays have disoriented financial markets, depriving them of the statistical benchmarks essential to anticipate the Federal Reserve’s decisions. As a result, visibility on inflation, employment, and consumption trends has been significantly reduced, fueling volatility in U.S. equity markets.

The Fed in the Dark

This disrupted schedule complicates the Fed’s task ahead of its October 29 monetary policy decision, followed by the PCE inflation release on October 31.

Without fresh data, FOMC members will have to rely on partial or outdated information to decide on the path of interest rates. This lack of reliable data could lead the institution to adopt a more cautious stance, postponing any major adjustment to its monetary policy.

Cascading Effects in the Coming Months — Unless the Shutdown Ends in October

The November 7 NFP report and Supreme Court hearings on tariff policies, scheduled for the same week, may also be affected if the shutdown continues. Similarly, November inflation data (CPI, PPI, and PCE) could face further delays, undermining the accuracy of economic forecasts for year-end.

Finally, the December releases — notably the December 5 NFP report and the December 10 Fed meeting — could mark a return to calendar normality, provided the affected agencies manage to catch up on lost time.

In short, the sooner this shutdown episode ends, the faster the overall publication of macroeconomic figures will return to normal.

DISCLAIMER:

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only. The presented idea (including market commentary, market data and observations) is not a work product of any research department of Swissquote or its affiliates. This material is intended to highlight market action and does not constitute investment, legal or tax advice. If you are a retail investor or lack experience in trading complex financial products, it is advisable to seek professional advice from licensed advisor before making any financial decisions.

This content is not intended to manipulate the market or encourage any specific financial behavior.

Swissquote makes no representation or warranty as to the quality, completeness, accuracy, comprehensiveness or non-infringement of such content. The views expressed are those of the consultant and are provided for educational purposes only. Any information provided relating to a product or market should not be construed as recommending an investment strategy or transaction. Past performance is not a guarantee of future results.

Swissquote and its employees and representatives shall in no event be held liable for any damages or losses arising directly or indirectly from decisions made on the basis of this content.

The use of any third-party brands or trademarks is for information only and does not imply endorsement by Swissquote, or that the trademark owner has authorised Swissquote to promote its products or services.

Swissquote is the marketing brand for the activities of Swissquote Bank Ltd (Switzerland) regulated by FINMA, Swissquote Capital Markets Limited regulated by CySEC (Cyprus), Swissquote Bank Europe SA (Luxembourg) regulated by the CSSF, Swissquote Ltd (UK) regulated by the FCA, Swissquote Financial Services (Malta) Ltd regulated by the Malta Financial Services Authority, Swissquote MEA Ltd. (UAE) regulated by the Dubai Financial Services Authority, Swissquote Pte Ltd (Singapore) regulated by the Monetary Authority of Singapore, Swissquote Asia Limited (Hong Kong) licensed by the Hong Kong Securities and Futures Commission (SFC) and Swissquote South Africa (Pty) Ltd supervised by the FSCA.

Products and services of Swissquote are only intended for those permitted to receive them under local law.

All investments carry a degree of risk. The risk of loss in trading or holding financial instruments can be substantial. The value of financial instruments, including but not limited to stocks, bonds, cryptocurrencies, and other assets, can fluctuate both upwards and downwards. There is a significant risk of financial loss when buying, selling, holding, staking, or investing in these instruments. SQBE makes no recommendations regarding any specific investment, transaction, or the use of any particular investment strategy.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The vast majority of retail client accounts suffer capital losses when trading in CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Digital Assets are unregulated in most countries and consumer protection rules may not apply. As highly volatile speculative investments, Digital Assets are not suitable for investors without a high-risk tolerance. Make sure you understand each Digital Asset before you trade.

Cryptocurrencies are not considered legal tender in some jurisdictions and are subject to regulatory uncertainties.

The use of Internet-based systems can involve high risks, including, but not limited to, fraud, cyber-attacks, network and communication failures, as well as identity theft and phishing attacks related to crypto-assets.

This content is written by Vincent Ganne for Swissquote.

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only and does not constitute investment, legal or tax advice.

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only and does not constitute investment, legal or tax advice.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

This content is written by Vincent Ganne for Swissquote.

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only and does not constitute investment, legal or tax advice.

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only and does not constitute investment, legal or tax advice.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.