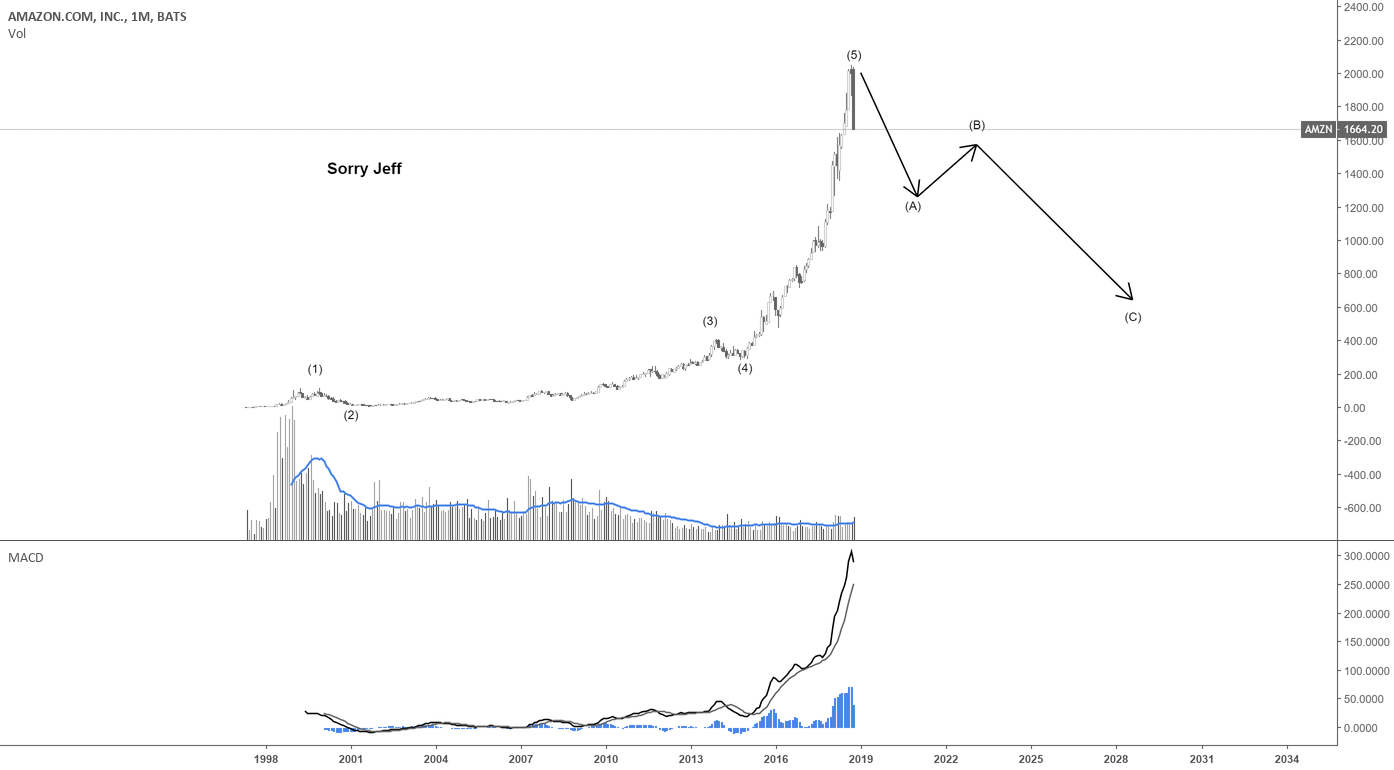

2018 is the new 2008... Trend line failure on spx is a early indicator of a ABC correction ... overvalued tech stocks right and left due to silicon valley hype bubble ...

I don't make these calls lightly... and I totally understand the implications ... but as a analyst I have to call it as I see it

If crypto holds strong than I will be viewing is has a safe haven for lots of this money ...

also I could always be wrong! infact I hope I am because many people would be negativity effected by a crash like this ... but shit... this doesn't look like a healthy drop in any way and market structure is very bearish

Start saving and investing 50% of your income ... and invest into stable low risk assets and do some higher risk investing into stuff like crypto .. then when we are nearing the bottom of stocks again at the 50% retracement (some tech stocks may retrace 80% depending how bubbley they are) but most should do a test of the .618 level and .50 level ... but if you save some of your income you will have cash on the sidelines to buy the dip! because big picture stock market is very bullish.. its just that over valued tech stocks created a bubble ... SPX will not! do a 80% retrace though to be clear a 30 - 40% drop is the WORST I am expecting for the major indices.

anyways stay safe and stay profitable out there

I don't make these calls lightly... and I totally understand the implications ... but as a analyst I have to call it as I see it

If crypto holds strong than I will be viewing is has a safe haven for lots of this money ...

also I could always be wrong! infact I hope I am because many people would be negativity effected by a crash like this ... but shit... this doesn't look like a healthy drop in any way and market structure is very bearish

Start saving and investing 50% of your income ... and invest into stable low risk assets and do some higher risk investing into stuff like crypto .. then when we are nearing the bottom of stocks again at the 50% retracement (some tech stocks may retrace 80% depending how bubbley they are) but most should do a test of the .618 level and .50 level ... but if you save some of your income you will have cash on the sidelines to buy the dip! because big picture stock market is very bullish.. its just that over valued tech stocks created a bubble ... SPX will not! do a 80% retrace though to be clear a 30 - 40% drop is the WORST I am expecting for the major indices.

anyways stay safe and stay profitable out there

코멘트:

This is my big picture view I made FEB 5 (click and read about my thoughts)