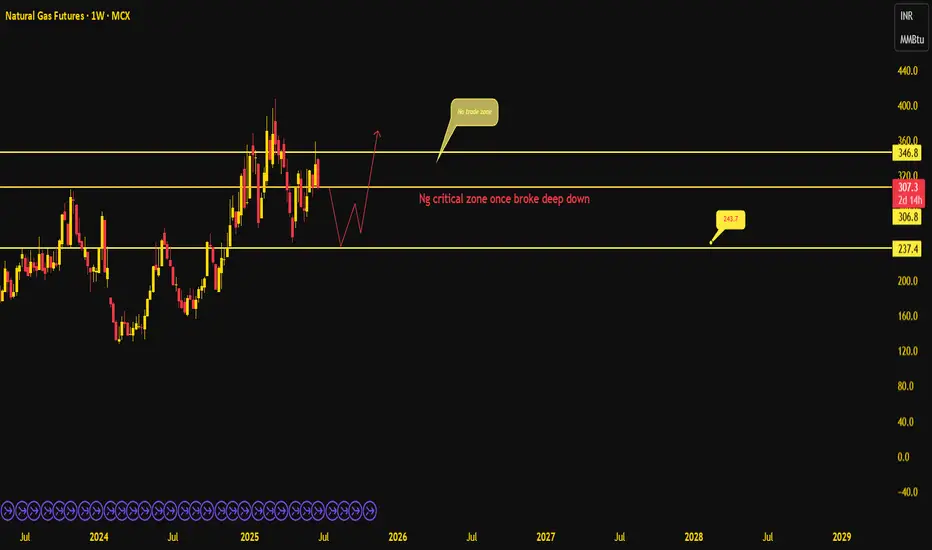

Natural Gas is currently trading at a crucial juncture around ₹307, having posted a sharp -7.81% weekly decline. The zone between ₹306.8 and ₹320 has proven to be a critical structure area, acting as a decision point for market . Historically, this range has triggered strong directional moves once broken, making it a no-trade zone for fresh entries until price action confirms a bias.

If Natural Gas closes below this critical zone, deeper downside is very much on the table. The next major support lies near ₹243.7 and eventually ₹237.4. This level acted as a former accumulation range and could attract demand again. However, the red projection suggests a potential bounce after retesting lower zones, forming a base before any meaningful upside attempt.

Until a strong reclaim of ₹320+ happens with momentum, the short-term outlook remains bearish-to-sideways. ill suggest to wait for a decisive breakdown below ₹306 or a confirmed reclaim of ₹320 to position accordingly. This is a time for patience—price is entering a reactive volatility pocket, where traps are common.

If Natural Gas closes below this critical zone, deeper downside is very much on the table. The next major support lies near ₹243.7 and eventually ₹237.4. This level acted as a former accumulation range and could attract demand again. However, the red projection suggests a potential bounce after retesting lower zones, forming a base before any meaningful upside attempt.

Until a strong reclaim of ₹320+ happens with momentum, the short-term outlook remains bearish-to-sideways. ill suggest to wait for a decisive breakdown below ₹306 or a confirmed reclaim of ₹320 to position accordingly. This is a time for patience—price is entering a reactive volatility pocket, where traps are common.

Stay ahead of the market—Follow my channel for free insights~~ Telegram channel link below !

t.me/+jvSU52DTZAphYTc1

youtube.com/@TeamSpark-08

t.me/+jvSU52DTZAphYTc1

youtube.com/@TeamSpark-08

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

Stay ahead of the market—Follow my channel for free insights~~ Telegram channel link below !

t.me/+jvSU52DTZAphYTc1

youtube.com/@TeamSpark-08

t.me/+jvSU52DTZAphYTc1

youtube.com/@TeamSpark-08

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.