🌟 MSFT HEIST ALERT! 🌟 Steal from the Cops, Not from the Citizens! 🚔➡️🤑

Dear Ladies & Gentleman of the Thief Trading Guild, 🎩👒

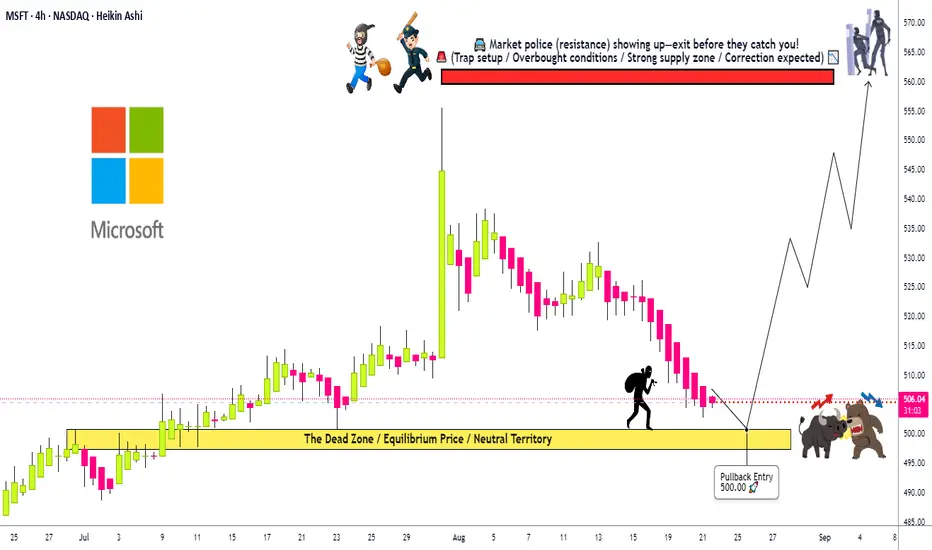

Based on the 🔥Thief Trading Style Analysis🔥, here is our master plan to heist the Microsoft Corporation (MSFT) fortress. Our intel confirms a BULLISH ambush is setting up! It's time to loot! 💰💸✈️

🦹♂️ THE HEIST PLAN (SWING TRADE) 🦹♂️

Entry Point: The Perfect Pullback Loot Zone! 🎯

We're waiting for the asset to pull back to our LAYERED LIMIT ORDER TRAP! 🪤 Thief OG's use multiple entries to maximize the steal!

LAYER 1: 510.00 (First dibs!)

LAYER 2: 505.00 (Loading the bag!)

LAYER 3: 500.00 (MAIN HEIST - Perfect Pullback!)

LAYER 4: 498.00 (Bonus loot! Add more layers based on your own risk, thieves!)

Stop Loss: The Getaway Car Location! 🛑🏎️

This is Thief SL @ 485.00. This is where the trade idea is invalidated. Dear Thieves, adjust your final SL based on your own risk, strategy, and how many layers you used. Don't get caught! 👮♂️🚔

Target: The Police Barricade! 🚧🚨

Intel shows a major resistance wall (Police Barricade) at 565.00. Our mission is to escape with the stolen money BEFORE we get there! Escape Target: 560.00! Count your profits and live to trade another day! 💵🎉🤝

📢 THIEF'S BROADCAST 📢

Yo! Listen up, crew! 🗣️ If you're placing limit orders on this pullback, your stop loss should be set ONLY AFTER your order is filled! You feel me? Now, if you're smart, you'll place that stop loss where I told you 📍, but if you're a rebel, you can put it wherever you like 🤪 - just remember, you're playing with fire 🔥, and it's your risk, not mine! 👊

⚠️ TRADING ALERT : EARNINGS & NEWS ⚠️

MSFT is a big cap stock, and news/earnings can cause extreme volatility! To protect your stolen loot:

Avoid entering new layers before major news.

Consider taking some profit before earnings.

Use trailing stop-loss orders to protect running positions!

💖 Supporting our robbery plan = 💥Hitting the Boost Button💥 It fuels our getaway car and helps us find the next big heist! Let's make stealing money look easy! 🏆💪❤️🎉

I'll see you at the next heist, so stay tuned! 🤑🐱👤🤗🤩

Dear Ladies & Gentleman of the Thief Trading Guild, 🎩👒

Based on the 🔥Thief Trading Style Analysis🔥, here is our master plan to heist the Microsoft Corporation (MSFT) fortress. Our intel confirms a BULLISH ambush is setting up! It's time to loot! 💰💸✈️

🦹♂️ THE HEIST PLAN (SWING TRADE) 🦹♂️

Entry Point: The Perfect Pullback Loot Zone! 🎯

We're waiting for the asset to pull back to our LAYERED LIMIT ORDER TRAP! 🪤 Thief OG's use multiple entries to maximize the steal!

LAYER 1: 510.00 (First dibs!)

LAYER 2: 505.00 (Loading the bag!)

LAYER 3: 500.00 (MAIN HEIST - Perfect Pullback!)

LAYER 4: 498.00 (Bonus loot! Add more layers based on your own risk, thieves!)

Stop Loss: The Getaway Car Location! 🛑🏎️

This is Thief SL @ 485.00. This is where the trade idea is invalidated. Dear Thieves, adjust your final SL based on your own risk, strategy, and how many layers you used. Don't get caught! 👮♂️🚔

Target: The Police Barricade! 🚧🚨

Intel shows a major resistance wall (Police Barricade) at 565.00. Our mission is to escape with the stolen money BEFORE we get there! Escape Target: 560.00! Count your profits and live to trade another day! 💵🎉🤝

📢 THIEF'S BROADCAST 📢

Yo! Listen up, crew! 🗣️ If you're placing limit orders on this pullback, your stop loss should be set ONLY AFTER your order is filled! You feel me? Now, if you're smart, you'll place that stop loss where I told you 📍, but if you're a rebel, you can put it wherever you like 🤪 - just remember, you're playing with fire 🔥, and it's your risk, not mine! 👊

⚠️ TRADING ALERT : EARNINGS & NEWS ⚠️

MSFT is a big cap stock, and news/earnings can cause extreme volatility! To protect your stolen loot:

Avoid entering new layers before major news.

Consider taking some profit before earnings.

Use trailing stop-loss orders to protect running positions!

💖 Supporting our robbery plan = 💥Hitting the Boost Button💥 It fuels our getaway car and helps us find the next big heist! Let's make stealing money look easy! 🏆💪❤️🎉

I'll see you at the next heist, so stay tuned! 🤑🐱👤🤗🤩

노트

📊 Microsoft (MSFT) Stock Report – 01 Sept 2025 📈💰 Price Snapshot

💵 Current Price: $506.69

🏁 Open: $508.66

🔼 High: $509.60

🔽 Low: $504.49

📉 Prev. Close: $509.64

🏦 Market Cap: $3.77T

📊 52W High: $555.45

📊 52W Low: $344.79

😊 Investor Sentiment

👨💻 Retail Traders: 51.75% Bullish 🟢

🏛️ Institutional Traders: 59.70% Bullish 🟢

🌡️ Mood: Moderately Positive ✨

😨 Fear & Greed Index

📉 Score: 39 → Fear 😟

🧭 Signal: Cautious investors, potential undervaluation ⚡

📈 Fundamental Strength

⭐ Score: 7.85 / 10

🔑 Highlights:

Strong financial health

Azure & Office growth on track

14.18% YoY cash flow growth 💵

🌍 Macro Environment

🌐 Score: 6.5 / 10

⚖️ Factors:

Stable economic data 📑

Tariff risks 🚧

Fed rate policy: 4.25% – 4.50% 💸

🐂 Market Outlook

⏳ Short-Term: Neutral ⚖️

📆 Long-Term: Bullish 🟢

💡 Key Insight: Short-term consolidation, but fundamentals + institutional support point to sustained growth 🚀

🚀 Final Take

Microsoft stands strong with bullish long-term potential.

Institutions are backing growth 🏦

Retail traders show cautious optimism 👥

Fear-driven caution may hint at undervaluation 💎

Macro risks exist, but fundamentals keep MSFT positioned as a long-term winner 🏆

액티브 트레이드

📊 Microsoft (MSFT) Stock Analysis💰 Real-Time Stock Price

Current Price: 💵 $517.93 USD

Daily Metrics (September 19, 2025):

Open: 🚀 $510.56

High: 📈 $519.30

Low: 📉 $510.31

Previous Day Close: 🏁 $508.45

Market Cap: 💸 $3,849,859,862,675.47

52-Week Range: 🔍 $344.79 (Low) – $555.45 (High)

P/E Ratio: ❓ Not available

Dividend Yield: 💸 0.7% (based on $0.91 quarterly dividend announced September 15, 2025)

🔍 Fundamental Analysis: Company Health & Value

🌟 Financial Health:

Revenue Growth: 💵 Q4 FY2025 revenue of $76.4 billion, beating estimates of $73.8 billion. Intelligent Cloud unit soared 26% to $29.9 billion, with Azure and cloud services up 39% year-over-year, fueled by AI demand. 🚀

Profitability: 💪 Strong margins driven by cloud and AI growth. Adjusted earnings for peers (e.g., Alibaba) suggest Microsoft’s cost discipline remains solid.

Market Position: 🏆 Microsoft leads in cloud computing (Azure), AI, and software, with a $3.7 trillion market cap, second only to Nvidia.

Dividend: 📈 Quarterly dividend raised 9.6% to $0.91 per share, signaling strong cash flow confidence.

📊 Valuation:

MSFT stock gained 20.6% year-to-date, outperforming the Zacks Computer–Software industry’s 19.7% growth. 📈

No P/E ratio available, but high market cap and consistent outperformance reflect a premium valuation driven by AI and cloud leadership. 🌟

Summary: ✅ Microsoft’s financials are rock-solid, with robust revenue growth, high profitability, and a dominant position in AI and cloud computing. The dividend hike underscores cash flow strength.

🚨 Catalyst & News-Driven Analysis: Price Movers

🌟 AI Datacenter Investments:

Microsoft committed $7 billion to Wisconsin AI datacenters, including $4 billion for a second facility, set to launch by early 2026, creating jobs and boosting AI infrastructure. 🏗️

A $30 billion investment in UK AI infrastructure (2025–2028) signals global AI expansion, likely increasing Azure revenue. 🌍

Impact: Positive catalyst, boosting long-term growth confidence. 📈

⚖️ OpenAI Partnership:

Microsoft and OpenAI restructured their partnership with a non-binding deal, reducing Microsoft’s revenue share. This may slightly impact AI-related revenue but allows OpenAI to scale with other cloud providers, potentially benefiting Microsoft indirectly. 🤝

Impact: Neutral, with minor revenue trade-offs balanced by strategic flexibility.

⚠️ Windows Update Issue:

September 2025 Windows security updates caused connection issues with SMBv1 shares, affecting Windows 10, 11, and Server platforms. This may create short-term negative sentiment among enterprise clients. 🖥️

Impact: Minor negative, limited to short-term reputation.

Summary: ✅ AI investments are major positive catalysts, outweighing the neutral OpenAI deal and minor Windows issue. The net effect is bullish.

🌍 Market Sentiment & Macro Environment

🌟 Market Sentiment:

MSFT stock rose 1.83% on September 19, 2025, showing strong short-term momentum. 📈

Social media chatter reflects optimism about Microsoft’s AI and cloud growth, with no specific negative sentiment reported for September 20. 😊

🌟 Macro Environment:

Federal Reserve Rate Cut: A 96.1% probability of a 25-basis-point cut to 4%–4.25% supports tech stocks like MSFT by lowering borrowing costs and fueling growth investment. 🏦

Market Trends: The S&P 500 and Nasdaq are buoyed by rate-cut optimism, reducing bearish pressure in September. 📊

AI Demand: Global demand for AI infrastructure, reinforced by Microsoft’s partnerships with Nvidia and others, is a strong tailwind. 🤖

Summary: ✅ Favorable macro conditions (rate cuts, AI demand) and positive market sentiment support MSFT’s growth outlook.

😊 Retail & Institutional Trader Sentiment

🌟 Retail Sentiment:

Social media reflects enthusiasm for Microsoft’s AI and cloud leadership. Retail investors likely view MSFT as a stable, growth-oriented tech stock. 😄

The 20.6% year-to-date gain and dividend increase bolster retail confidence. 📈

🌟 Institutional Sentiment:

Boltwood Capital Management: Increased MSFT holdings by 5.9% (17,986 shares) in Q2 2025, signaling confidence. 💪

Fortis Capital Advisors LLC: Reduced stake by 8.3% (32,565 shares) in Q1 2025, indicating some profit-taking but not widespread selling. ⚖️

Analyst Views: Wall Street analysts, including Jim Cramer, praise Microsoft’s cloud business strength. 🗣️

Summary: ✅ Both retail and institutional sentiment are predominantly positive, with institutions showing net confidence despite minor sell-offs.

😱 Investor Mood: Market Fear & Greed

🌟 Fear & Greed Index:

No specific index value for September 20, 2025, but the market’s positive response to the Fed’s rate cut probability suggests a shift toward greed. 😄

Tech stocks, including MSFT, benefit from optimism around rate cuts and AI growth, indicating a greed-driven mood. 🚀

Summary: ✅ Investor mood leans greedy, driven by favorable monetary policy and AI sector enthusiasm, supporting MSFT’s bullish outlook.

🏆 Overall Score: Bullish or Bearish?

✅ Fundamental Analysis: Strong financials, AI-driven revenue growth, and a dominant market position make Microsoft a powerhouse. 💪

✅ Catalysts: AI datacenter investments ($7B in Wisconsin, $30B in UK) are major positive drivers, outweighing minor negatives like the Windows update issue. 🌟

✅ Market Sentiment & Macro: Rate cuts and AI demand create a supportive environment. 📈

✅ Trader Sentiment: Retail and institutional investors are confident, backed by bullish analyst views. 😊

✅ Investor Mood: Greed-driven market fuels tech stock growth. 🚀

Final Score: Bullish (Long Trend) 🐂Microsoft’s robust fundamentals, AI-driven catalysts, and favorable macro conditions support a strong bullish outlook for MSFT stock as of September 20, 2025. The stock’s 20.6% year-to-date gain and 1.83% daily increase reinforce this trend.

💰 Money-Making Analysis

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

관련 발행물

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

💰 Money-Making Analysis

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

관련 발행물

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.