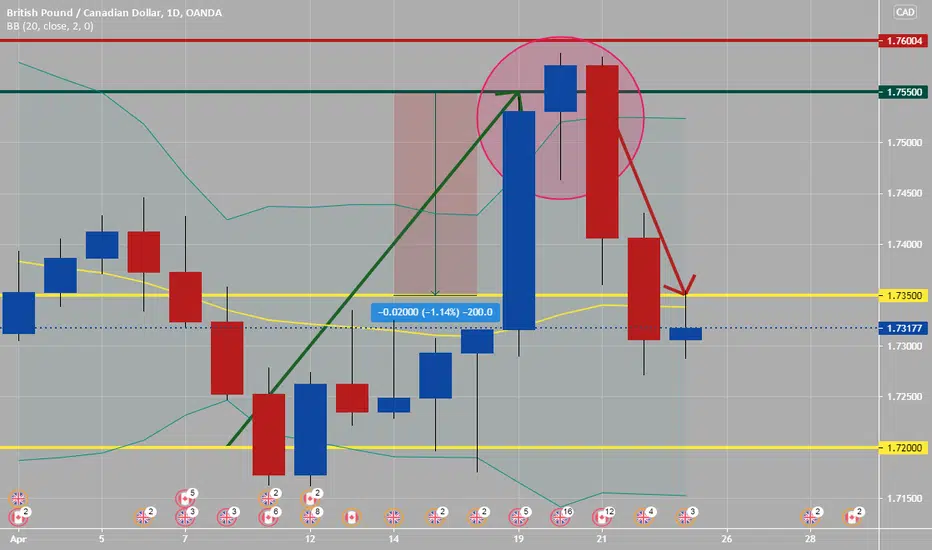

The hangman candle, so named because it looks like a person who has been executed with legs swinging beneath, always occurs after an extended uptrend. The hangman occurs because traders, seeing a sell-off in the shares, rush in to grab the stock a bargain price.

In order for the Hanging Man signal to be valid, the following conditions must exist:

• The Forex pair must have been in a definite uptrend before this signal occurs. This can be visually seen on the chart.

• The lower shadow must be at least twice the size of the body.

• The day after the Hanging Man is formed, one should witness continued selling.

• There should be no upper shadow or a very small upper shadow. The color of the body does not matter, but a red body would be more positive than a blue or green body.

In order for the Hanging Man signal to be valid, the following conditions must exist:

• The Forex pair must have been in a definite uptrend before this signal occurs. This can be visually seen on the chart.

• The lower shadow must be at least twice the size of the body.

• The day after the Hanging Man is formed, one should witness continued selling.

• There should be no upper shadow or a very small upper shadow. The color of the body does not matter, but a red body would be more positive than a blue or green body.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.