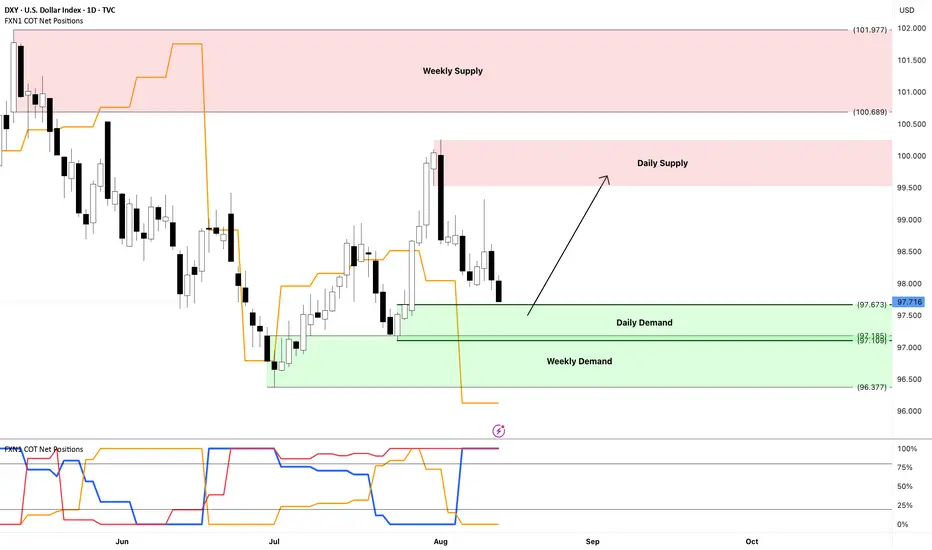

The US Consumer Price Index (CPI) report released yesterday acted as a headwind for the dollar. Although core inflation rose to 3.1% year-over-year and 0.33% month-over-month—figures that are not ideal—they are not severe enough to overshadow the recent weakening in the jobs market. On the USD chart, the price is approaching a significant daily demand zone, which is anchored by a weekly demand area. This confluence could potentially serve as a turning point, offering a possible opportunity for the USD to rebound.

✅ Please share your thoughts about DXY in the comments section below and HIT LIKE if you appreciate my analysis. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

✅ Please share your thoughts about DXY in the comments section below and HIT LIKE if you appreciate my analysis. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

✅ TELEGRAM CHANNEL: t.me/+VECQWxY0YXKRXLod

🔥 USA ZERO SPREAD BROKER: forexn1.com/usa/

🔥 UP to 4000$ BONUS: forexn1.com/broker/

🟪 Instagram: instagram.com/forexn1_com/

🔥 USA ZERO SPREAD BROKER: forexn1.com/usa/

🔥 UP to 4000$ BONUS: forexn1.com/broker/

🟪 Instagram: instagram.com/forexn1_com/

관련 발행물

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

✅ TELEGRAM CHANNEL: t.me/+VECQWxY0YXKRXLod

🔥 USA ZERO SPREAD BROKER: forexn1.com/usa/

🔥 UP to 4000$ BONUS: forexn1.com/broker/

🟪 Instagram: instagram.com/forexn1_com/

🔥 USA ZERO SPREAD BROKER: forexn1.com/usa/

🔥 UP to 4000$ BONUS: forexn1.com/broker/

🟪 Instagram: instagram.com/forexn1_com/

관련 발행물

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.