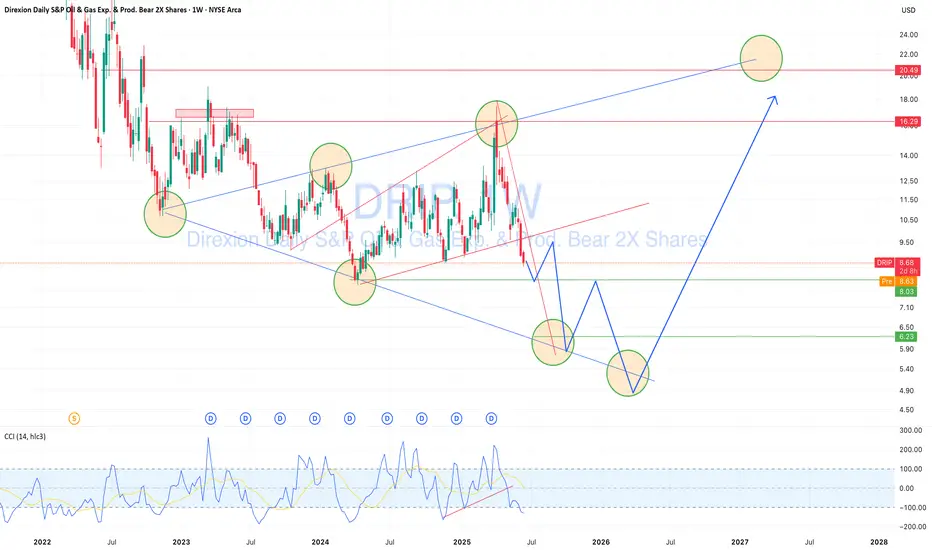

DRIP — Geopolitical Oil Risk Creates a Buying Opportunity

DRIP (inverse 2x ETF on US oil & gas exploration/production) is approaching a key technical support zone.

While oil may continue rising short term due to geopolitical tensions — especially US-Iran risks and Middle East instability — this short-term pressure could push DRIP lower toward the $5.00–6.00 area. That zone aligns with strong historical reversal points and trend support. From there, a rebound toward $12.00–20.00 is technically and fundamentally possible, offering 30–50%+ profit potential. I’m planning staged entries in the marked range, managing risk with awareness of commodity market volatility and global uncertainty.

While oil may continue rising short term due to geopolitical tensions — especially US-Iran risks and Middle East instability — this short-term pressure could push DRIP lower toward the $5.00–6.00 area. That zone aligns with strong historical reversal points and trend support. From there, a rebound toward $12.00–20.00 is technically and fundamentally possible, offering 30–50%+ profit potential. I’m planning staged entries in the marked range, managing risk with awareness of commodity market volatility and global uncertainty.

🔗 Сайт totoshkatrades.com

👨🎓 Наш телеграм t.me/totoshkatrading

🉐 Платформы linktr.ee/totoshka55

💬 Наши контакты @totoshkatips

👨🎓 Наш телеграм t.me/totoshkatrading

🉐 Платформы linktr.ee/totoshka55

💬 Наши контакты @totoshkatips

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.

🔗 Сайт totoshkatrades.com

👨🎓 Наш телеграм t.me/totoshkatrading

🉐 Платформы linktr.ee/totoshka55

💬 Наши контакты @totoshkatips

👨🎓 Наш телеграм t.me/totoshkatrading

🉐 Платформы linktr.ee/totoshka55

💬 Наши контакты @totoshkatips

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.