Fundamental

Price: ~IDR 4,140 per share.

Earnings: EPS ~376, showing good profit generation.

Dividend Yield: ~8.4%, quite attractive.

Assets & Equity: Growing steadily, though debt is also increasing.

Strength: Strong in micro/SME lending, wide customer base.

Risk: Economic slowdown, rising interest rates, and loan defaults (NPL).

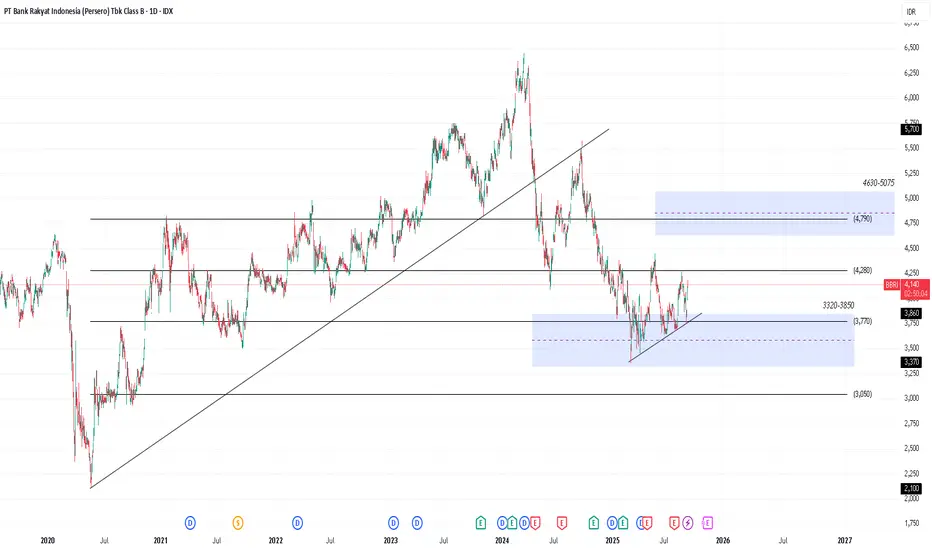

Technical

Support: IDR 3,740–3,900

Resistance: IDR 4,290–4,380

Trend: Short-term downtrend, but near oversold → possible rebound.

Current Action: Price is consolidating (sideways).

Outlook

For long-term investors: Good for dividend and growth exposure.

For short-term traders: Buy near support, sell near resistance.

Risks: Economy, regulation, and loan quality.

Price: ~IDR 4,140 per share.

Earnings: EPS ~376, showing good profit generation.

Dividend Yield: ~8.4%, quite attractive.

Assets & Equity: Growing steadily, though debt is also increasing.

Strength: Strong in micro/SME lending, wide customer base.

Risk: Economic slowdown, rising interest rates, and loan defaults (NPL).

Technical

Support: IDR 3,740–3,900

Resistance: IDR 4,290–4,380

Trend: Short-term downtrend, but near oversold → possible rebound.

Current Action: Price is consolidating (sideways).

Outlook

For long-term investors: Good for dividend and growth exposure.

For short-term traders: Buy near support, sell near resistance.

Risks: Economy, regulation, and loan quality.

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.