STRONG BULLISH | Ticker: AVGO (Broadcom Inc.) | Timeframe: Daily/Weekly

AVGO is demonstrating a powerful and sustained uptrend, and the recent Q3 FY25 earnings report provides fundamental confirmation that this momentum is well-supported.

AVGO is demonstrating a powerful and sustained uptrend, and the recent Q3 FY25 earnings report provides fundamental confirmation that this momentum is well-supported.

📈 Technical Perspective:

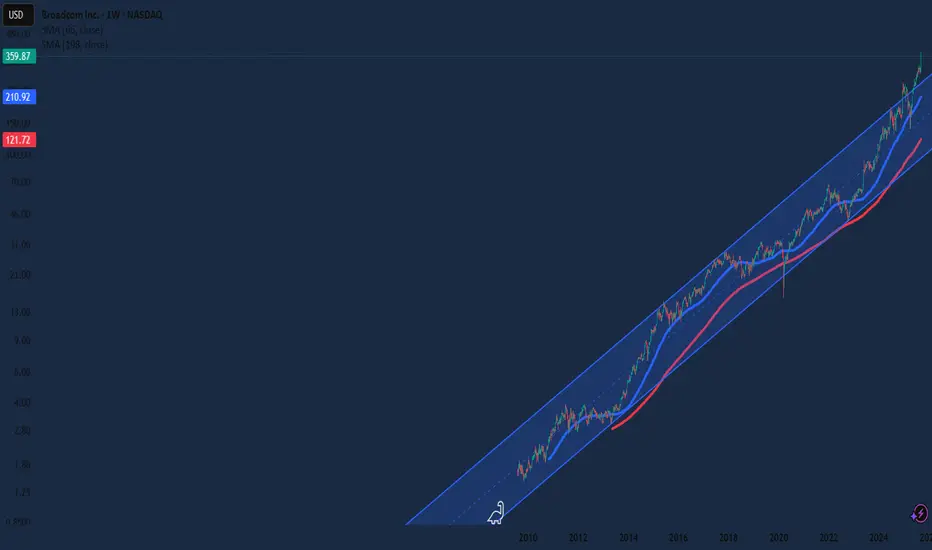

The stock is in a clear ascending channel, consistently making higher highs and higher lows.

It is trading decisively above key moving averages (e.g., 66-day and 198-day EMA), indicating strong bullish sentiment.

Each pullback has been bought aggressively, showing strong institutional support.

✅ Fundamental Catalyst (Q3 FY25 Earnings):

The latest earnings report acts as a powerful catalyst confirming the strength of this trend:

Explosive Revenue Growth: Posted revenue of $15.95B, a massive 22% YoY increase. This isn't just growth; it's accelerating growth.

Exceptional Profitability: Operating income surged 55% YoY to $5.89B, highlighting incredible operational leverage and margin expansion.

AI is the Driver: The Semiconductor Solutions segment ($9.17B) is fueled by insatiable demand for custom AI accelerators and networking chips. This is a long-term, structural growth story, not a short-term hype cycle.

Software Transformation: The Infrastructure Software segment ($6.79B) is successfully transitioning to a high-margin subscription model, creating a predictable and recurring revenue stream.

Shareholder-Friendly: The company returned $2.8B in dividends and is actively buying back stock ($2.45B this quarter), showcasing a strong commitment to capital return.

🎯 Conclusion:

The technical breakout is being validated by exceptional underlying fundamentals. The combination of leadership in AI semiconductors, a sticky software business, and superior capital allocation makes AVGO a premium asset. The trend is your friend, and the fundamental story confirms this friend has a very strong foundation.

📈 Technical Perspective:

The stock is in a clear ascending channel, consistently making higher highs and higher lows.

It is trading decisively above key moving averages (e.g., 66-day and 198-day EMA), indicating strong bullish sentiment.

Each pullback has been bought aggressively, showing strong institutional support.

✅ Fundamental Catalyst (Q3 FY25 Earnings):

The latest earnings report acts as a powerful catalyst confirming the strength of this trend:

Explosive Revenue Growth: Posted revenue of $15.95B, a massive 22% YoY increase. This isn't just growth; it's accelerating growth.

Exceptional Profitability: Operating income surged 55% YoY to $5.89B, highlighting incredible operational leverage and margin expansion.

AI is the Driver: The Semiconductor Solutions segment ($9.17B) is fueled by insatiable demand for custom AI accelerators and networking chips. This is a long-term, structural growth story, not a short-term hype cycle.

Software Transformation: The Infrastructure Software segment ($6.79B) is successfully transitioning to a high-margin subscription model, creating a predictable and recurring revenue stream.

Shareholder-Friendly: The company returned $2.8B in dividends and is actively buying back stock ($2.45B this quarter), showcasing a strong commitment to capital return.

🎯 Conclusion:

The technical breakout is being validated by exceptional underlying fundamentals. The combination of leadership in AI semiconductors, a sticky software business, and superior capital allocation makes AVGO a premium asset. The trend is your friend, and the fundamental story confirms this friend has a very strong foundation.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.