OPEN-SOURCE SCRIPT

Yale Confidence Index [nb]

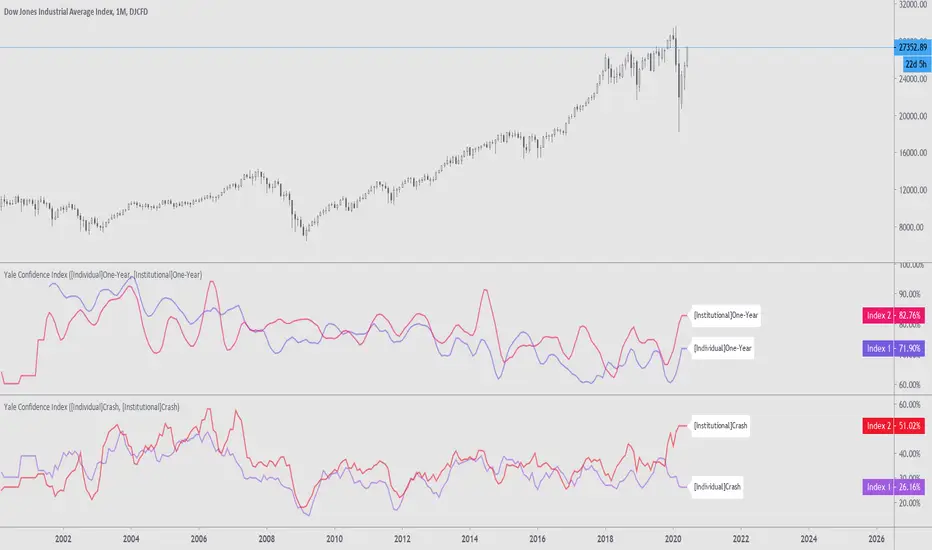

These are the Yale confidence indexes that show individual and institutional sentiment.

Options include:

U.S. One-Year Confidence Index

The percent of the population expecting an increase in the Dow in the coming year.

The One-Year Confidence Index is the percentage of respondents giving a number strictly greater than zero for "in 1 year." Note that the question is worded to mention the possibility that the respondent could predict a downturn, and so this question will obtain more such responses than more optimistically worded questions used by some other surveys. However, the issue is how the answers change through time, and the wording of the question has not been changed through time (except to add the 1-month and the ten-year categories, which were not on the earliest questionnaires).

U.S. Buy-on-Dips Confidence Index

The percent of the population expecting a rebound the next day should the market ever drop 3% in one day.

The Buy-On-Dips Confidence Index is the number of respondents who choose 1 (increase) as a percent of those who chose 1, 2 or 3. This question was never changed.

U.S. Crash Confidence Index

The percent of the population who attach little probability to a stock market crash in the next six months.

The Crash Confidence Index is the percentage of respondents who think that the probability is strictly less than 10%. There were slight wording changes in this question, but inessential.

U.S. Valuation Confidence Index

The percent of the population who think that the market is not too high.

The Valuation Confidence Index is the number of respondents who choose 1 (Too Low) or 3 (About right) as a percentage of those who choose 1, 2, or 3. The wording of this question was never changed, and it was always the first question on the questionnaire.

Source:

som.yale.edu/faculty-research-centers/centers-initiatives/international-center-for-finance/data/stock-market-confidence-indices/united-states-stock-market-confidence-indices

Includes methodology and questions used.

Japanese indexes aren't updated so I did not include them.

Options include:

- showing two different indexes at once

- labels for them

- to filter through a moving average

- highlighting when the first chosen index is greater than the second

- shifting the series 6 months ahead

- showing an average of both indexes

U.S. One-Year Confidence Index

The percent of the population expecting an increase in the Dow in the coming year.

The One-Year Confidence Index is the percentage of respondents giving a number strictly greater than zero for "in 1 year." Note that the question is worded to mention the possibility that the respondent could predict a downturn, and so this question will obtain more such responses than more optimistically worded questions used by some other surveys. However, the issue is how the answers change through time, and the wording of the question has not been changed through time (except to add the 1-month and the ten-year categories, which were not on the earliest questionnaires).

U.S. Buy-on-Dips Confidence Index

The percent of the population expecting a rebound the next day should the market ever drop 3% in one day.

The Buy-On-Dips Confidence Index is the number of respondents who choose 1 (increase) as a percent of those who chose 1, 2 or 3. This question was never changed.

U.S. Crash Confidence Index

The percent of the population who attach little probability to a stock market crash in the next six months.

The Crash Confidence Index is the percentage of respondents who think that the probability is strictly less than 10%. There were slight wording changes in this question, but inessential.

U.S. Valuation Confidence Index

The percent of the population who think that the market is not too high.

The Valuation Confidence Index is the number of respondents who choose 1 (Too Low) or 3 (About right) as a percentage of those who choose 1, 2, or 3. The wording of this question was never changed, and it was always the first question on the questionnaire.

Source:

som.yale.edu/faculty-research-centers/centers-initiatives/international-center-for-finance/data/stock-market-confidence-indices/united-states-stock-market-confidence-indices

Includes methodology and questions used.

Japanese indexes aren't updated so I did not include them.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

My published indicators: tradingview.com/u/NeoButane/

Sorry if I haven't replied to your message yet, I'm a bit backlogged :)

Sorry if I haven't replied to your message yet, I'm a bit backlogged :)

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

My published indicators: tradingview.com/u/NeoButane/

Sorry if I haven't replied to your message yet, I'm a bit backlogged :)

Sorry if I haven't replied to your message yet, I'm a bit backlogged :)

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.