OPEN-SOURCE SCRIPT

Ehlers Two-Pole Stochastic

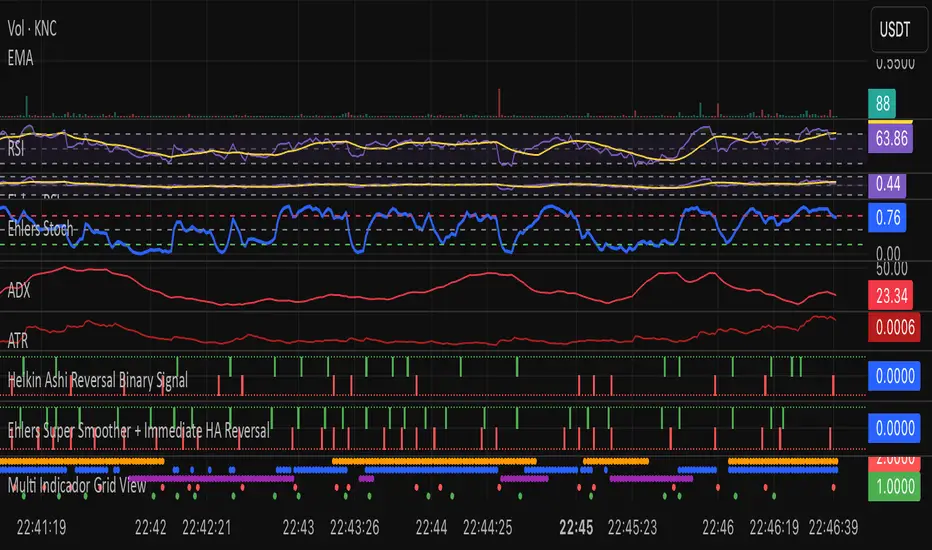

This indicator implements John Ehlers' Two-Pole Stochastic Filter, a smoother alternative to the traditional stochastic oscillator. Instead of relying on raw %K values, it applies a second-order IIR filter (recursive smoothing) to reduce noise and improve trend clarity.

It outputs a single line oscillating between 0 and 1, with less lag and false signals compared to standard stochastic implementations.

Key Features:

Uses a two-pole filter to smooth the normalized stochastic (%K).

Ideal for detecting clean reversals and trend continuations.

Designed for minimal visual noise and greater signal confidence.

Interpretation:

Values near 1.0 may suggest overbought conditions.

Values near 0.0 may suggest oversold conditions.

Crosses above 0.5 can signal bullish shifts, and below 0.5 bearish shifts.

Recommended Settings:

Default smoothing factor (alpha) is 0.7 — higher values make the output more responsive, while lower values smooth further.

Inspired by concepts from Cybernetic Analysis for Stocks and Futures by John F. Ehlers.

It outputs a single line oscillating between 0 and 1, with less lag and false signals compared to standard stochastic implementations.

Key Features:

Uses a two-pole filter to smooth the normalized stochastic (%K).

Ideal for detecting clean reversals and trend continuations.

Designed for minimal visual noise and greater signal confidence.

Interpretation:

Values near 1.0 may suggest overbought conditions.

Values near 0.0 may suggest oversold conditions.

Crosses above 0.5 can signal bullish shifts, and below 0.5 bearish shifts.

Recommended Settings:

Default smoothing factor (alpha) is 0.7 — higher values make the output more responsive, while lower values smooth further.

Inspired by concepts from Cybernetic Analysis for Stocks and Futures by John F. Ehlers.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.