INVITE-ONLY SCRIPT

업데이트됨 Universal Trend Following Valuation | viResearch

Universal Trend Following Valuation | viResearch

Conceptual Foundation and Innovation

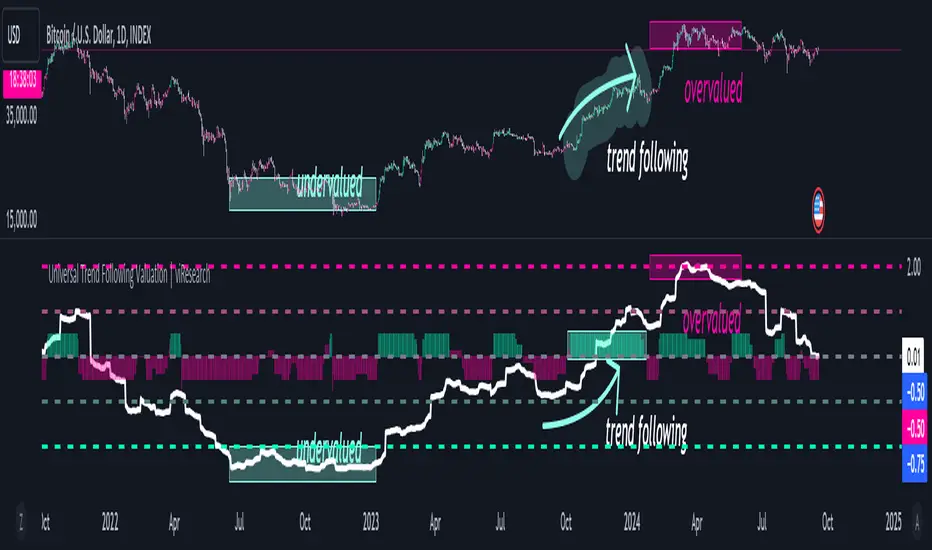

The "Universal Trend Following Valuation" script represents a comprehensive approach to trend-following systems. It combines multiple technical indicators and methods to assess market trends, integrating Sharpe, Sortino, and Omega ratios with various moving averages and Z-score calculations. By utilizing advanced statistical tools, the script provides traders with a well-rounded evaluation of trend strength, direction, and potential reversals. The inclusion of Z-scores and custom ratios allows for a more in-depth and accurate market analysis, making it a valuable tool for trend valuation.

Technical Composition and Calculation

This script is built on various performance metrics and trend-following methods. It features ratio calculations, such as Sharpe, Sortino, and Omega, which provide insight into the risk-adjusted performance of assets, helping traders gauge the strength of market trends. Weekly RSI values are smoothed using dema, ema, and median methods to offer a clearer view of trend momentum. Additionally, Z-scores are applied to these ratios and the weekly RSI, offering a standardized assessment of trend deviations from historical performance. A custom scoring system is used to generate a cumulative trend score, highlighting potential market reversals or confirmations.

Key Indicators and Features

The script uses weekly RSI and EMA/Dema smoothing to reduce market noise and produce clearer trend signals. The Sharpe, Sortino, and Omega ratio calculations help assess market performance and volatility, with Z-scores adding another analytical layer. Different moving averages (HMA, DEMA, SMMA) are incorporated to evaluate both short-term and long-term trends, making the script adaptable to various market conditions. Furthermore, the script provides trend confirmation through multiple layers by using indicators like the Supertrend and the Average True Range (ATR) factor to cross-check trends for increased reliability.

Practical Applications

This script is ideal for traders looking to systematically evaluate market trends and effectively position themselves. The combination of advanced statistical tools and customizable moving averages and ratios ensures that the script remains both flexible and powerful. It is particularly useful for confirming trends and highlighting potential reversals, giving traders a reliable signal for either trend continuation or reversals. The inclusion of Sharpe and Sortino ratios allows traders to focus on trends that offer a favorable risk-reward profile.

Advantages and Strategic Value

The "Universal Trend Following Valuation" script offers a detailed, multifaceted approach to trend analysis. Its use of advanced statistical tools provides a more precise evaluation of market trends, making it valuable for both novice and experienced traders. The script reduces noise while ensuring that the core trend signals remain accurate, helping traders make more informed decisions in volatile market conditions.

Summary and Usage Tips

Incorporating the "Universal Trend Following Valuation" into your trading system can significantly enhance your ability to follow and confirm trends. With its customizable parameters and alerts, this script offers a powerful and reliable tool for navigating market volatility and optimizing trade entries and exits. By combining trend-following signals with performance metrics, traders can refine their strategies with increased confidence.

Disclaimer: Backtests are based on past results and are not indicative of future performance.

Conceptual Foundation and Innovation

The "Universal Trend Following Valuation" script represents a comprehensive approach to trend-following systems. It combines multiple technical indicators and methods to assess market trends, integrating Sharpe, Sortino, and Omega ratios with various moving averages and Z-score calculations. By utilizing advanced statistical tools, the script provides traders with a well-rounded evaluation of trend strength, direction, and potential reversals. The inclusion of Z-scores and custom ratios allows for a more in-depth and accurate market analysis, making it a valuable tool for trend valuation.

Technical Composition and Calculation

This script is built on various performance metrics and trend-following methods. It features ratio calculations, such as Sharpe, Sortino, and Omega, which provide insight into the risk-adjusted performance of assets, helping traders gauge the strength of market trends. Weekly RSI values are smoothed using dema, ema, and median methods to offer a clearer view of trend momentum. Additionally, Z-scores are applied to these ratios and the weekly RSI, offering a standardized assessment of trend deviations from historical performance. A custom scoring system is used to generate a cumulative trend score, highlighting potential market reversals or confirmations.

Key Indicators and Features

The script uses weekly RSI and EMA/Dema smoothing to reduce market noise and produce clearer trend signals. The Sharpe, Sortino, and Omega ratio calculations help assess market performance and volatility, with Z-scores adding another analytical layer. Different moving averages (HMA, DEMA, SMMA) are incorporated to evaluate both short-term and long-term trends, making the script adaptable to various market conditions. Furthermore, the script provides trend confirmation through multiple layers by using indicators like the Supertrend and the Average True Range (ATR) factor to cross-check trends for increased reliability.

Practical Applications

This script is ideal for traders looking to systematically evaluate market trends and effectively position themselves. The combination of advanced statistical tools and customizable moving averages and ratios ensures that the script remains both flexible and powerful. It is particularly useful for confirming trends and highlighting potential reversals, giving traders a reliable signal for either trend continuation or reversals. The inclusion of Sharpe and Sortino ratios allows traders to focus on trends that offer a favorable risk-reward profile.

Advantages and Strategic Value

The "Universal Trend Following Valuation" script offers a detailed, multifaceted approach to trend analysis. Its use of advanced statistical tools provides a more precise evaluation of market trends, making it valuable for both novice and experienced traders. The script reduces noise while ensuring that the core trend signals remain accurate, helping traders make more informed decisions in volatile market conditions.

Summary and Usage Tips

Incorporating the "Universal Trend Following Valuation" into your trading system can significantly enhance your ability to follow and confirm trends. With its customizable parameters and alerts, this script offers a powerful and reliable tool for navigating market volatility and optimizing trade entries and exits. By combining trend-following signals with performance metrics, traders can refine their strategies with increased confidence.

Disclaimer: Backtests are based on past results and are not indicative of future performance.

릴리즈 노트

Update| UI초대 전용 스크립트

이 스크립트는 작성자가 승인한 사용자만 접근할 수 있습니다. 사용하려면 요청 후 승인을 받아야 하며, 일반적으로 결제 후에 허가가 부여됩니다. 자세한 내용은 아래 작성자의 안내를 따르거나 viResearch에게 직접 문의하세요.

트레이딩뷰는 스크립트의 작동 방식을 충분히 이해하고 작성자를 완전히 신뢰하지 않는 이상, 해당 스크립트에 비용을 지불하거나 사용하는 것을 권장하지 않습니다. 커뮤니티 스크립트에서 무료 오픈소스 대안을 찾아보실 수도 있습니다.

작성자 지시 사항

DM via X link in Bio

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

초대 전용 스크립트

이 스크립트는 작성자가 승인한 사용자만 접근할 수 있습니다. 사용하려면 요청 후 승인을 받아야 하며, 일반적으로 결제 후에 허가가 부여됩니다. 자세한 내용은 아래 작성자의 안내를 따르거나 viResearch에게 직접 문의하세요.

트레이딩뷰는 스크립트의 작동 방식을 충분히 이해하고 작성자를 완전히 신뢰하지 않는 이상, 해당 스크립트에 비용을 지불하거나 사용하는 것을 권장하지 않습니다. 커뮤니티 스크립트에서 무료 오픈소스 대안을 찾아보실 수도 있습니다.

작성자 지시 사항

DM via X link in Bio

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.