OPEN-SOURCE SCRIPT

Robot eVe Colorbox

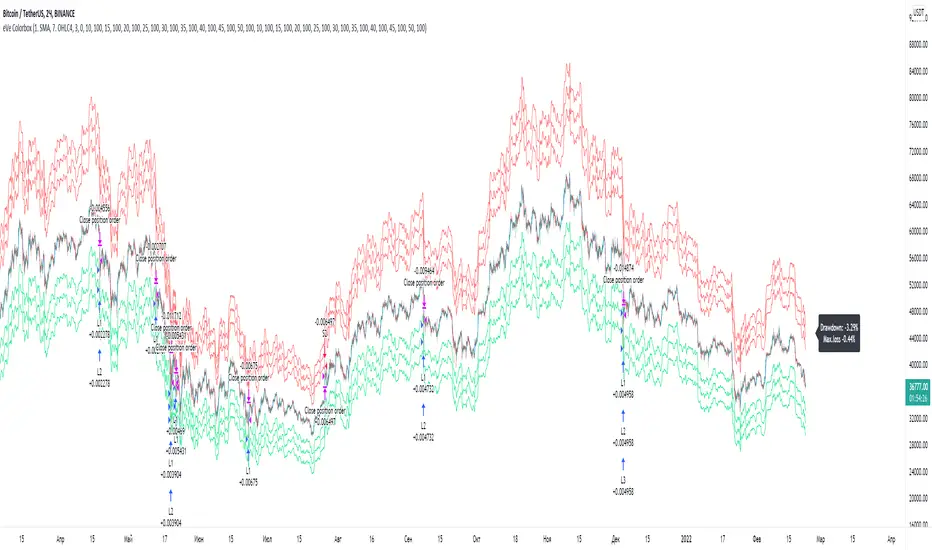

A script to test the Colorbox strategy of the trading robot eVe.

Lines

The blue line is the moving average and the reference point for the other lines.

Lime lines - a shifted moving average for opening a long position using a limit order.

Red lines - a shifted moving average for opening a short position using a limit order.

Strategy

Long positions are opened by a limit order at the price of the lime line.

Short positions shall be opened by a limit order at the price of the red line.

Any positions shall be closed by a market order.

If a long position is open, the position shall be exited upon the occurrence of any rising bar (green bar).

If a position is short, the position is exited on any falling bar (red bar).

This is a counter-trend strategy.

Exchange fees

A maker is used to enter.

A taker is used to exit.

The amounts for a maker and a taker are always equal.

For the backtest, the average commission = (maker_fee + taker_fee) / 2

Symbols

This is a very versatile strategy. It can be profitable on any trading pairs, on any asset class, and on any timeframe. But it requires the right parameters to perform well (see recommendations below).

Recommendations

The more volatile the asset, the better the strategy will work.

The more volatility , the more you need to set a slider for your orders.

The larger the time frame, the greater the number of slots required for orders.

Short positions are less profitable and more risky.

Short positions can be disabled altogether, it can be useful.

The strategy works very well for Crypto/Crypto trading pairs (e.g. ETH/BTC , DOGE/ETH, etc)

Lines

The blue line is the moving average and the reference point for the other lines.

Lime lines - a shifted moving average for opening a long position using a limit order.

Red lines - a shifted moving average for opening a short position using a limit order.

Strategy

Long positions are opened by a limit order at the price of the lime line.

Short positions shall be opened by a limit order at the price of the red line.

Any positions shall be closed by a market order.

If a long position is open, the position shall be exited upon the occurrence of any rising bar (green bar).

If a position is short, the position is exited on any falling bar (red bar).

This is a counter-trend strategy.

Exchange fees

A maker is used to enter.

A taker is used to exit.

The amounts for a maker and a taker are always equal.

For the backtest, the average commission = (maker_fee + taker_fee) / 2

Symbols

This is a very versatile strategy. It can be profitable on any trading pairs, on any asset class, and on any timeframe. But it requires the right parameters to perform well (see recommendations below).

Recommendations

The more volatile the asset, the better the strategy will work.

The more volatility , the more you need to set a slider for your orders.

The larger the time frame, the greater the number of slots required for orders.

Short positions are less profitable and more risky.

Short positions can be disabled altogether, it can be useful.

The strategy works very well for Crypto/Crypto trading pairs (e.g. ETH/BTC , DOGE/ETH, etc)

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.