INVITE-ONLY SCRIPT

OrderVibe HF

OrderVibe HF (High Frequency) Indicator

Overview

OrderVibe HF is a closed-source analytical framework designed to visualize short-term market direction, momentum shifts, and adaptive volatility conditions.

It does not generate trade calls or execute orders. Its purpose is to provide a fast, structured intraday context for traders observing short-term rotations and reversals.

How it works

-Dynamic Baseline & Flow Score - calculates an adaptive directional baseline that tracks short-term price flow and evaluates its strength through a scoring process. Long/short candidates appear when price movement exceeds a volatility-based threshold and directional pressure passes defined limits.

-Volatility Gate - two selectable modes (ATR + Percentile or Highest ATR legacy) adapt sensitivity to recent volatility and candle-body variation.

-Higher-Timeframe Confirmation (optional) — aligns short-term direction with a higher-timeframe bias for additional confluence.

-Quality Filter - validates candles by body-to-ATR ratio to reduce noise and avoid extreme bars; optional session-time constraint available.

-Cooldown - time- or bar-based delay preventing repetitive triggers.

-Delayed Confirmation - optional waiting stage to ensure conditions persist before confirming a setup; opposite signals cancel pending ones.

-Reverse on Adverse Move — flips directional state after a counter-move exceeding defined thresholds (points, ticks, or ATR×).

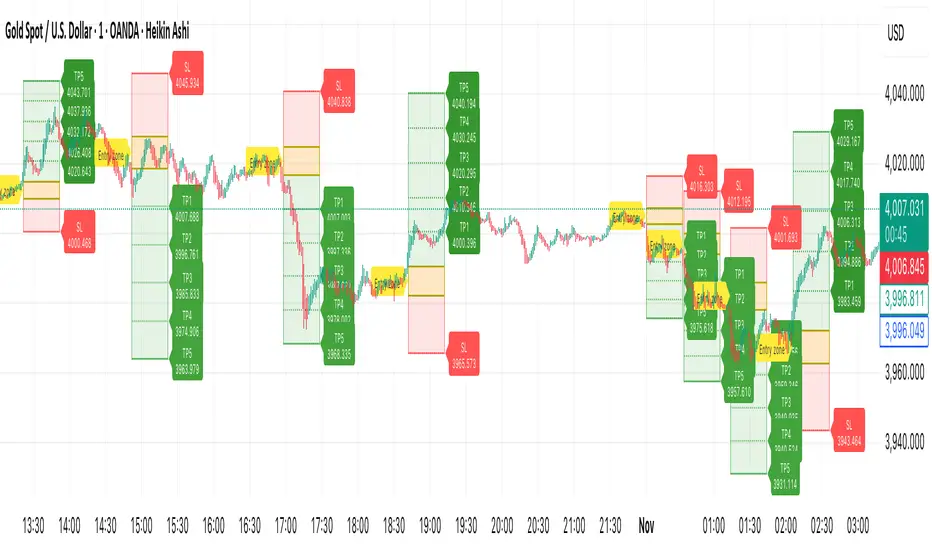

-ATR Setups (TP/SL) — on each signal bar, plots a protective SL and TP1–TP5 from volatility multiples, plus a highlighted Entry Zone visualizing the active risk area.

Alerts

Setup Long / Setup Short — one-shot alerts triggered on the bar where a setup appears (close-only or real-time).

Why it’s different and not a simple mashup

OrderVibe HF prioritizes reaction speed, volatility awareness, and clarity of short-term context rather than pattern recognition.

It merges flow-based directional scoring, adaptive volatility control, confirmation/cooldown management, and ATR-mapped setups into a coherent analytical process.

Usage

Optimized for XAUUSD, M1 timeframe, and Heiken Ashi candles.

Can operate on any symbol or timeframe; adjust sensitivity, ATR length, and thresholds to match your market.

Intended for contextual analysis and journaling, not automated execution.

Always test before live use.

How OrderVibe HF differs from “OrderVibe Indicator”

HF does not use order-block or support/resistance clustering.

It focuses on flow-score direction analysis, adaptive volatility gates, confirmation and reversal mechanics, and ATR-based multi-target setups.

The original Indicator emphasizes broader structural mapping and slower swing analysis.

Disclaimer

Analytical visualization tool only.

This is not financial advice and does not guarantee performance outcomes.

Use independent judgment and sound risk management.

Overview

OrderVibe HF is a closed-source analytical framework designed to visualize short-term market direction, momentum shifts, and adaptive volatility conditions.

It does not generate trade calls or execute orders. Its purpose is to provide a fast, structured intraday context for traders observing short-term rotations and reversals.

How it works

-Dynamic Baseline & Flow Score - calculates an adaptive directional baseline that tracks short-term price flow and evaluates its strength through a scoring process. Long/short candidates appear when price movement exceeds a volatility-based threshold and directional pressure passes defined limits.

-Volatility Gate - two selectable modes (ATR + Percentile or Highest ATR legacy) adapt sensitivity to recent volatility and candle-body variation.

-Higher-Timeframe Confirmation (optional) — aligns short-term direction with a higher-timeframe bias for additional confluence.

-Quality Filter - validates candles by body-to-ATR ratio to reduce noise and avoid extreme bars; optional session-time constraint available.

-Cooldown - time- or bar-based delay preventing repetitive triggers.

-Delayed Confirmation - optional waiting stage to ensure conditions persist before confirming a setup; opposite signals cancel pending ones.

-Reverse on Adverse Move — flips directional state after a counter-move exceeding defined thresholds (points, ticks, or ATR×).

-ATR Setups (TP/SL) — on each signal bar, plots a protective SL and TP1–TP5 from volatility multiples, plus a highlighted Entry Zone visualizing the active risk area.

Alerts

Setup Long / Setup Short — one-shot alerts triggered on the bar where a setup appears (close-only or real-time).

Why it’s different and not a simple mashup

OrderVibe HF prioritizes reaction speed, volatility awareness, and clarity of short-term context rather than pattern recognition.

It merges flow-based directional scoring, adaptive volatility control, confirmation/cooldown management, and ATR-mapped setups into a coherent analytical process.

Usage

Optimized for XAUUSD, M1 timeframe, and Heiken Ashi candles.

Can operate on any symbol or timeframe; adjust sensitivity, ATR length, and thresholds to match your market.

Intended for contextual analysis and journaling, not automated execution.

Always test before live use.

How OrderVibe HF differs from “OrderVibe Indicator”

HF does not use order-block or support/resistance clustering.

It focuses on flow-score direction analysis, adaptive volatility gates, confirmation and reversal mechanics, and ATR-based multi-target setups.

The original Indicator emphasizes broader structural mapping and slower swing analysis.

Disclaimer

Analytical visualization tool only.

This is not financial advice and does not guarantee performance outcomes.

Use independent judgment and sound risk management.

초대 전용 스크립트

이 스크립트는 작성자가 승인한 사용자만 접근할 수 있습니다. 사용하려면 요청 후 승인을 받아야 하며, 일반적으로 결제 후에 허가가 부여됩니다. 자세한 내용은 아래 작성자의 안내를 따르거나 ordervibe에게 직접 문의하세요.

트레이딩뷰는 스크립트의 작동 방식을 충분히 이해하고 작성자를 완전히 신뢰하지 않는 이상, 해당 스크립트에 비용을 지불하거나 사용하는 것을 권장하지 않습니다. 커뮤니티 스크립트에서 무료 오픈소스 대안을 찾아보실 수도 있습니다.

작성자 지시 사항

Access is invite-only and granted manually on TradingView. For contact details, see my Signature.

Contact: ordervibeofficial@gmail.com

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

초대 전용 스크립트

이 스크립트는 작성자가 승인한 사용자만 접근할 수 있습니다. 사용하려면 요청 후 승인을 받아야 하며, 일반적으로 결제 후에 허가가 부여됩니다. 자세한 내용은 아래 작성자의 안내를 따르거나 ordervibe에게 직접 문의하세요.

트레이딩뷰는 스크립트의 작동 방식을 충분히 이해하고 작성자를 완전히 신뢰하지 않는 이상, 해당 스크립트에 비용을 지불하거나 사용하는 것을 권장하지 않습니다. 커뮤니티 스크립트에서 무료 오픈소스 대안을 찾아보실 수도 있습니다.

작성자 지시 사항

Access is invite-only and granted manually on TradingView. For contact details, see my Signature.

Contact: ordervibeofficial@gmail.com

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.