OPEN-SOURCE SCRIPT

Mean Reversion Trading V1

Overview

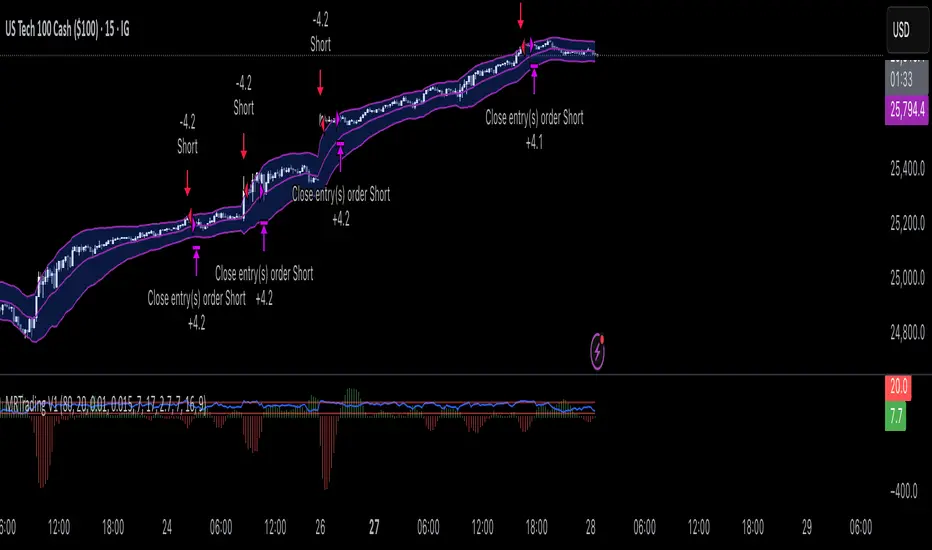

This is a simple mean reversion strategy that combines RSI, Keltner Channels, and MACD Histograms to predict reversals. Current parameters were optimized for NASDAQ 15M and performance varies depending on asset. The strategy can be optimized for specific asset and timeframe.

How it works

Long Entry (All must be true):

1. RSI < Lower Threshold

2. Close < Lower KC Band

3. MACD Histogram > 0 and rising

4. No open trades

Short Entry (All must be true):

1. RSI > Upper Threshold

2. Close > Upper KC Band

3. MACD Histogram < 0 and falling

4. No open trades

Long Exit:

1. Stop Loss: Average position size x ( 1 - SL percent)

2. Take Profit: Average position size x ( 1 + TP percent)

3. MACD Histogram crosses below zero

Short Exit:

1. Stop Loss: Average position size x ( 1 + SL percent)

2. Take Profit: Average position size x ( 1 - TP percent)

3. MACD Histogram crosses above zero

Settings and parameters are explained in the tooltips.

Important

Initial capital is set as 100,000 by default and 100 percent equity is used for trades

This is a simple mean reversion strategy that combines RSI, Keltner Channels, and MACD Histograms to predict reversals. Current parameters were optimized for NASDAQ 15M and performance varies depending on asset. The strategy can be optimized for specific asset and timeframe.

How it works

Long Entry (All must be true):

1. RSI < Lower Threshold

2. Close < Lower KC Band

3. MACD Histogram > 0 and rising

4. No open trades

Short Entry (All must be true):

1. RSI > Upper Threshold

2. Close > Upper KC Band

3. MACD Histogram < 0 and falling

4. No open trades

Long Exit:

1. Stop Loss: Average position size x ( 1 - SL percent)

2. Take Profit: Average position size x ( 1 + TP percent)

3. MACD Histogram crosses below zero

Short Exit:

1. Stop Loss: Average position size x ( 1 + SL percent)

2. Take Profit: Average position size x ( 1 - TP percent)

3. MACD Histogram crosses above zero

Settings and parameters are explained in the tooltips.

Important

Initial capital is set as 100,000 by default and 100 percent equity is used for trades

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.