OPEN-SOURCE SCRIPT

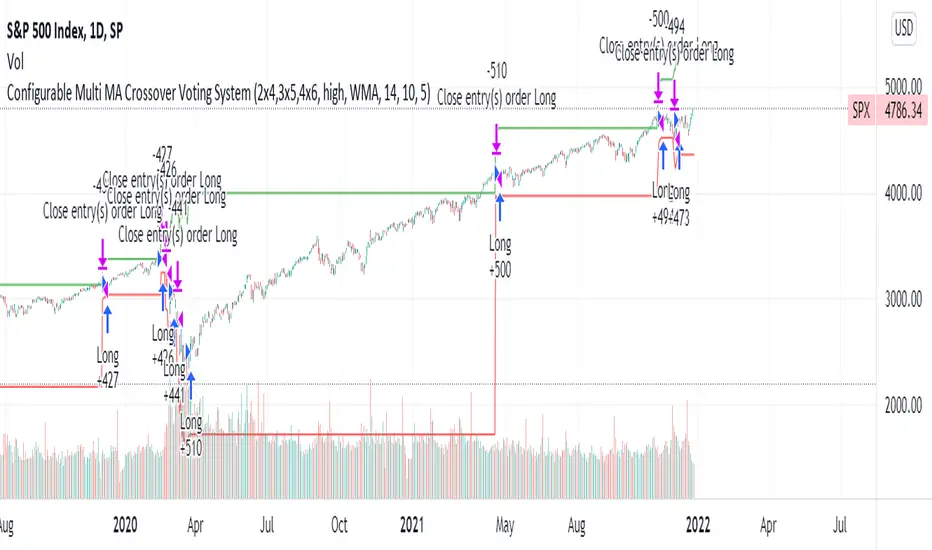

Configurable Multi MA Crossover Voting System

This strategy goes long when all fast moving averages that you have defined are above their counterpart slow moving averages.

Long position is closed when profit or loss target is hit and at least one of the fast moving averages is below its counterpart slow moving average.

The format of the config is simple. The format is : FASTxSLOW,FASTxSLOW,...

Example : If you want 2 moving averages fast=9,slow=14 and fast=20,slow=50 you define it like this : 9x14,20x50

Another example : 5x10,10x15,15x20 => means 3 moving average setups : first wih fast=5/slow=10, second with fast=10/slow=15, last with fast=15/slow=20

You can chose the type of moving average : SMA, WMA, VWMA (i got issues with EMA/RMA so i removed them)

You can chose the source of the moving average : high, close, hl2 etc.

You can chose the period on which ATR is calculated and ATR profit/loss factors.

Profit is calculated like : buy_price + atr_factor*atr

Loss is calculated like : buy_price - atr_factor*atr

Performance in backtest is variable depending on the timeframe, the options and the market.

Performance in backtest suggests it works better for higher timeframes like 1d, 4h etc.

Disclaimer

Please remember that past performance may not be indicative of future results.

Due to various factors, including changing market conditions, the strategy may no longer perform as well as in historical backtesting.

This post and the script don’t provide any financial advice.

Long position is closed when profit or loss target is hit and at least one of the fast moving averages is below its counterpart slow moving average.

The format of the config is simple. The format is : FASTxSLOW,FASTxSLOW,...

Example : If you want 2 moving averages fast=9,slow=14 and fast=20,slow=50 you define it like this : 9x14,20x50

Another example : 5x10,10x15,15x20 => means 3 moving average setups : first wih fast=5/slow=10, second with fast=10/slow=15, last with fast=15/slow=20

You can chose the type of moving average : SMA, WMA, VWMA (i got issues with EMA/RMA so i removed them)

You can chose the source of the moving average : high, close, hl2 etc.

You can chose the period on which ATR is calculated and ATR profit/loss factors.

Profit is calculated like : buy_price + atr_factor*atr

Loss is calculated like : buy_price - atr_factor*atr

Performance in backtest is variable depending on the timeframe, the options and the market.

Performance in backtest suggests it works better for higher timeframes like 1d, 4h etc.

Disclaimer

Please remember that past performance may not be indicative of future results.

Due to various factors, including changing market conditions, the strategy may no longer perform as well as in historical backtesting.

This post and the script don’t provide any financial advice.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.