INVITE-ONLY SCRIPT

Altcoin Breadth | QuantumResearch

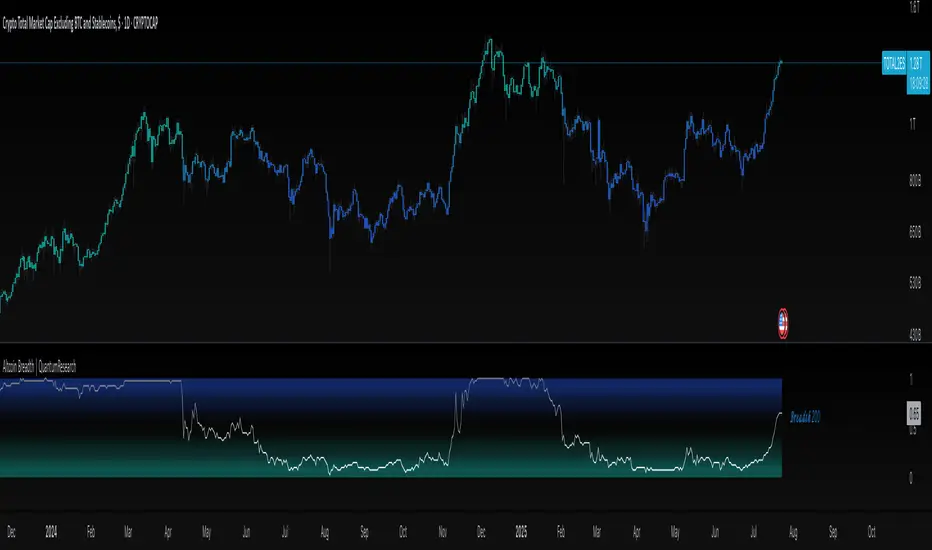

🔹 Altcoin Breadth | QuantumResearch

Purpose:

Altcoin Breadth measures the strength of the altcoin market by tracking how many assets trade above key moving averages (50-day and 200-day). It offers a normalized view of trend participation across 40 major crypto assets.

How It Works:

For each of the 40 altcoins:

The script checks whether the asset's current price is above its 50-day and/or 200-day simple moving average.

Each condition counts as a binary "1" (trend up) or "0" (trend down).

The total values are averaged, yielding two normalized values between 0 and 1:

Breadth 50: % of assets above their 50 SMA

Breadth 200: % of assets above their 200 SMA

Visual Display:

Plots Breadth 50 and Breadth 200 separately as two gradient-colored lines.

Dynamic labels at the latest bar indicate current breadth values.

Optional bar coloring to reflect underlying breadth momentum.

Key Features:

Evaluates short-term and long-term trend strength across the altcoin sector.

Dynamic visualization of market participation breadth.

Clear trend shifts and sector-wide bullish/bearish transitions.

Separate toggles to show either Breadth 50, Breadth 200, or both.

Trading Application:

Identify broad altcoin uptrends or breakdowns.

Use Breadth 200 for macro confirmation; Breadth 50 for tactical shifts.

Align altcoin exposure with healthy trend participation levels.

⚠️ Breadth tools offer market-wide context, not individual entry signals. Use in combination with trend or momentum indicators.

Disclaimer: Past performance does not guarantee future results. This tool is intended for informational and educational use only. Cryptocurrency markets are volatile and involve high risk.

Purpose:

Altcoin Breadth measures the strength of the altcoin market by tracking how many assets trade above key moving averages (50-day and 200-day). It offers a normalized view of trend participation across 40 major crypto assets.

How It Works:

For each of the 40 altcoins:

The script checks whether the asset's current price is above its 50-day and/or 200-day simple moving average.

Each condition counts as a binary "1" (trend up) or "0" (trend down).

The total values are averaged, yielding two normalized values between 0 and 1:

Breadth 50: % of assets above their 50 SMA

Breadth 200: % of assets above their 200 SMA

Visual Display:

Plots Breadth 50 and Breadth 200 separately as two gradient-colored lines.

Dynamic labels at the latest bar indicate current breadth values.

Optional bar coloring to reflect underlying breadth momentum.

Key Features:

Evaluates short-term and long-term trend strength across the altcoin sector.

Dynamic visualization of market participation breadth.

Clear trend shifts and sector-wide bullish/bearish transitions.

Separate toggles to show either Breadth 50, Breadth 200, or both.

Trading Application:

Identify broad altcoin uptrends or breakdowns.

Use Breadth 200 for macro confirmation; Breadth 50 for tactical shifts.

Align altcoin exposure with healthy trend participation levels.

⚠️ Breadth tools offer market-wide context, not individual entry signals. Use in combination with trend or momentum indicators.

Disclaimer: Past performance does not guarantee future results. This tool is intended for informational and educational use only. Cryptocurrency markets are volatile and involve high risk.

초대 전용 스크립트

이 스크립트는 작성자가 승인한 사용자만 접근할 수 있습니다. 사용하려면 요청 후 승인을 받아야 하며, 일반적으로 결제 후에 허가가 부여됩니다. 자세한 내용은 아래 작성자의 안내를 따르거나 QuantumResearch에게 직접 문의하세요.

트레이딩뷰는 스크립트의 작동 방식을 충분히 이해하고 작성자를 완전히 신뢰하지 않는 이상, 해당 스크립트에 비용을 지불하거나 사용하는 것을 권장하지 않습니다. 커뮤니티 스크립트에서 무료 오픈소스 대안을 찾아보실 수도 있습니다.

작성자 지시 사항

Get access to this indicator here : https://whop.com/quantum-whop

🌐 Gain access to our cutting-edge tools:

whop.com/quantum-whop/

⚒️ Get access to our toolbox here for free:

quantumresearchportfolio.carrd.co

All tools and content provided are for informational and educational purposes only.

whop.com/quantum-whop/

⚒️ Get access to our toolbox here for free:

quantumresearchportfolio.carrd.co

All tools and content provided are for informational and educational purposes only.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

초대 전용 스크립트

이 스크립트는 작성자가 승인한 사용자만 접근할 수 있습니다. 사용하려면 요청 후 승인을 받아야 하며, 일반적으로 결제 후에 허가가 부여됩니다. 자세한 내용은 아래 작성자의 안내를 따르거나 QuantumResearch에게 직접 문의하세요.

트레이딩뷰는 스크립트의 작동 방식을 충분히 이해하고 작성자를 완전히 신뢰하지 않는 이상, 해당 스크립트에 비용을 지불하거나 사용하는 것을 권장하지 않습니다. 커뮤니티 스크립트에서 무료 오픈소스 대안을 찾아보실 수도 있습니다.

작성자 지시 사항

Get access to this indicator here : https://whop.com/quantum-whop

🌐 Gain access to our cutting-edge tools:

whop.com/quantum-whop/

⚒️ Get access to our toolbox here for free:

quantumresearchportfolio.carrd.co

All tools and content provided are for informational and educational purposes only.

whop.com/quantum-whop/

⚒️ Get access to our toolbox here for free:

quantumresearchportfolio.carrd.co

All tools and content provided are for informational and educational purposes only.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.