PROTECTED SOURCE SCRIPT

업데이트됨 Fractal Waves

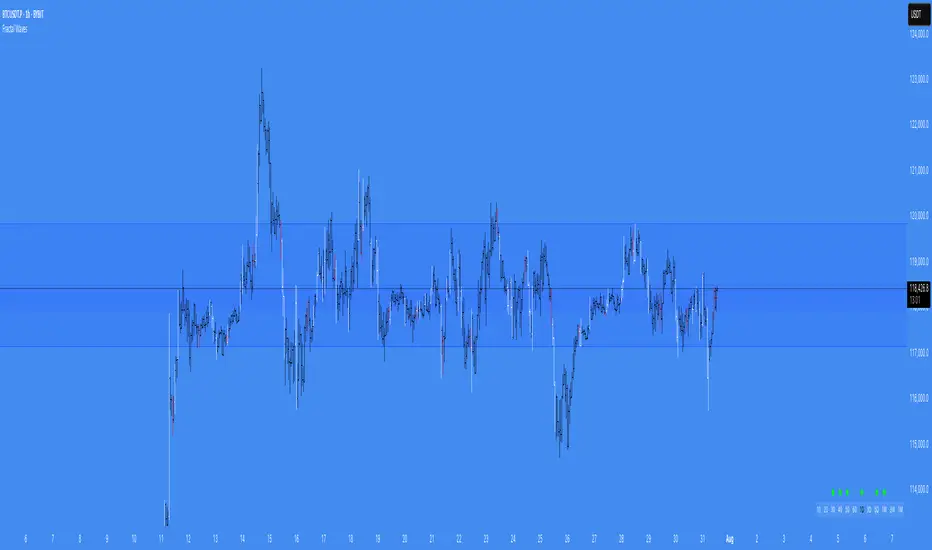

Summary of the "Fractal Waves" Indicator

The "Fractal Waves" indicator is a multifaceted trading tool designed for TradingView that combines various technical analysis methods to help traders identify potential market trends and trading opportunities. It overlays multiple analyses directly onto price charts, providing a comprehensive visual representation of market dynamics.

Key Features:

Usage Notes:

Conclusion:

The "Fractal Waves" indicator serves as an advanced analytical tool that synthesizes various technical indicators to support traders in market analysis. By overlaying fractal patterns, moving averages from multiple timeframes, volume analysis, and bar patterns onto price charts, it aids in identifying potential trading opportunities and understanding market dynamics across different timeframes. The combination of visual cues and alert notifications makes it a valuable asset for traders seeking deeper insight into market behavior.

The "Fractal Waves" indicator is a multifaceted trading tool designed for TradingView that combines various technical analysis methods to help traders identify potential market trends and trading opportunities. It overlays multiple analyses directly onto price charts, providing a comprehensive visual representation of market dynamics.

Key Features:

- Fractal Wave Detection and Visualization:Purpose: Identifies fractal highs and lows to signal potential trend reversals or continuations.

Functionality:[]Calculates fractal highs, lows, and midpoints on both the current and an additional user-selected timeframe. []Plots lines at these fractal points with color coding to distinguish between bullish and bearish trends. []Fills areas between fractal highs and lows with background colors to enhance visual cues. []Updates fractal lines dynamically as new fractals are identified. - Multiple Time Frame Moving Averages (MTF MA):Purpose: Provides insight into trend directions across different timeframes.

Functionality:[]Allows plotting of up to three customizable moving averages from different timeframes on the current chart. []Users can select the type of MA (SMA, EMA, DEMA, VWMA, RMA, WMA), length, resolution, and color. []Optionally displays labels showing MA details like type, length, and resolution for clarity. []Bar Pattern Identification (Inside and Outside Bars):Purpose: Highlights specific bar patterns that may indicate market indecision or breakout potential.

Functionality:[]Detects inside bars (where the current bar's range is within the previous bar) and outside bars (where the current bar's range exceeds the previous bar). []Colors bars based on whether they are bullish or bearish inside/outside bars using user-defined colors. []Utilizes "The Strat" methodology to assign numbers (1 for inside bars, 2 for directional bars, 3 for outside bars) and plots them above the bars. []Wicked Wicks Visualization:Purpose: Highlights significant wicks that may indicate rejection at certain price levels.

Functionality:[]Identifies long upper wicks (top wicks) and lower wicks (bottom wicks) relative to previous bars. []Plots custom candles to emphasize these wicks with specific background and border colors. []Aids in recognizing potential reversals or strong buying/selling pressure. []Volume Weighted Average Price (VWAP):Purpose: Helps identify the average trading price weighted by volume, acting as dynamic support or resistance.

Functionality:[]Calculates and plots the daily VWAP, updating at the start of each session. []Changes VWAP line color at session start for visual differentiation. []Applicable primarily to intraday charts (60-minute timeframe or lower). []Volume and Extreme Volume Reversal (EVR) Analysis:Purpose: Detects areas of unusually high volume that may precede price reversals.

Functionality:[]Tracks the highest volume bars of the current and previous day. []Plots boxes and lines to highlight extreme volume areas. []Changes candle colors for high-volume bars to draw attention. []Calculates and plots potential reversal levels based on extreme volume. - Rate of Change (ROC) and Average True Range (ATR) Ratio Analysis:Purpose: Assesses price momentum relative to volatility to predict trend changes.

Functionality:[]Calculates the ROC and ATR over specified lengths. []Computes the ratio of ROC to ATR to gauge momentum. []Plots bullish or bearish dots on the chart when ROC-ATR ratio aligns with the fractal trend, indicating potential trend shifts. []Provides alerts when a new bullish or bearish trend is detected. - Average Volume Weighted Average Price (AVWAP) with Dynamic Lookback Periods:Purpose: Identifies key price levels based on volume-weighted averages over specific lookback periods.

Functionality:- []Calculates AVWAPs from the highest and lowest points over dynamic or manual lookback periods. []Adjusts lookback periods automatically based on the current chart timeframe or uses user-defined periods. []Plots AVWAP lines and fills the area between them, highlighting overlaps which may signify significant support/resistance levels.

Functionality:- []Displays a table at the bottom of the chart showing fractal wave values and inside bar statuses for timeframes from 5 minutes to monthly. []Uses color coding to indicate bullish or bearish trends and whether the price is above or below the fractal wave. []Indicates inside bars with symbols and colors to quickly identify consolidation periods.

Functionality:- []Triggers alerts for:

- []Bullish or bearish trend changes when the ROC-ATR ratio aligns with the fractal trend. []Price crossing above a fractal high or below a fractal low. []Formation of new bullish or bearish fractals.

- EVR-based potential long or short opportunities.

Usage Notes:

- []Customization: The indicator offers extensive customization options, allowing users to adjust colors, timeframes, calculation periods, and display preferences to suit their trading style. []Timeframe Considerations: Some features, like EVR analysis and intraday VWAP, are optimized for intraday timeframes (up to 60 minutes). The indicator adjusts calculations and visualizations based on the current chart's timeframe. []Comprehensive Analysis: By combining multiple technical analysis tools—such as fractals, moving averages, volume analysis, and bar patterns—the indicator provides a holistic view of market conditions. []Visual Clarity: The use of color coding, labels, and symbols enhances visual interpretation, making it easier for traders to identify patterns and trends at a glance.

- Alerts and Notifications: Built-in alert conditions help traders stay informed of key market developments, enabling timely decision-making without the need for constant chart monitoring.

Conclusion:

The "Fractal Waves" indicator serves as an advanced analytical tool that synthesizes various technical indicators to support traders in market analysis. By overlaying fractal patterns, moving averages from multiple timeframes, volume analysis, and bar patterns onto price charts, it aids in identifying potential trading opportunities and understanding market dynamics across different timeframes. The combination of visual cues and alert notifications makes it a valuable asset for traders seeking deeper insight into market behavior.

릴리즈 노트

Removed the Expanding Volume Range AND AVWAP from the code and added that as a separate indicator now as it was a bit slow. In addition this updated fractal waves now has more lines shown on the channel and it will auto-hide the additional fractal wave above 1D 릴리즈 노트

Now the additional fractal wave is dynamic, meaning if you set a timeframe value in the input setting, it will hide it once it goes above it. 릴리즈 노트

Small update, I've added the 3 Day to the timeframe selection options to match the table timeframes at the bottom. 릴리즈 노트

Now has a 50% Fractal Line History for the additional Fractal Wave릴리즈 노트

Cleaned up릴리즈 노트

I have added alerts for when it goes above and below the fractal high and low + added some extra time frames in the table (12 total) 릴리즈 노트

I have now merged my "Expanding volume" script into this fractal waves script given it's used for the same trading strategy. 릴리즈 노트

Simplified 릴리즈 노트

The script has had a big update. Now it creates a volume range based on high volume candles and you will see it close once the fractal closes above or below it. 릴리즈 노트

Updated code, so the inside and outside bars only display when above the TF filter in settings. 릴리즈 노트

There was a bug preventing inside and outside bars displaying on timeframes greater than 1 day 릴리즈 노트

Small tweaks 보호된 스크립트입니다

이 스크립트는 비공개 소스로 게시됩니다. 하지만 제한 없이 자유롭게 사용할 수 있습니다 — 여기에서 자세히 알아보기.

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.

보호된 스크립트입니다

이 스크립트는 비공개 소스로 게시됩니다. 하지만 제한 없이 자유롭게 사용할 수 있습니다 — 여기에서 자세히 알아보기.

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.