OPEN-SOURCE SCRIPT

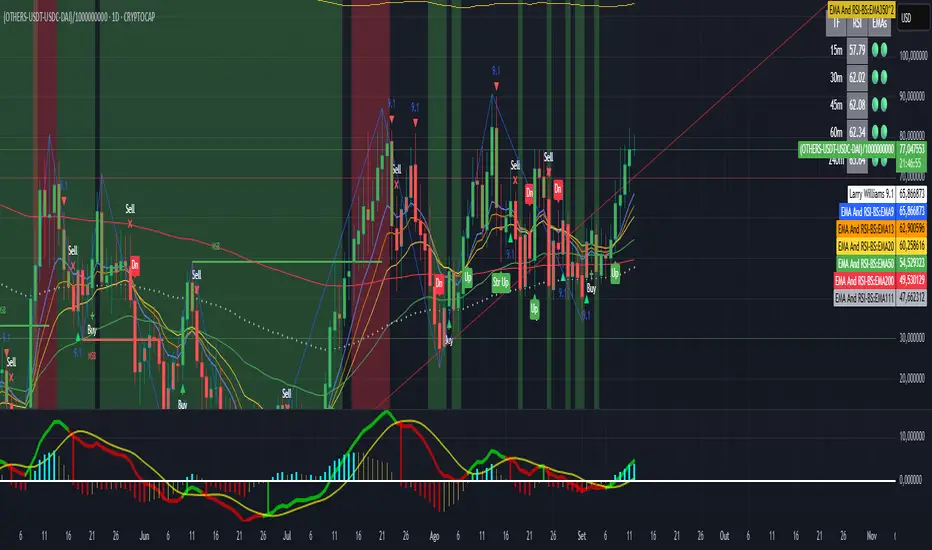

업데이트됨 EMA Oracle and RSI

EMA Oracle

- “See the market’s structure through the eyes of exponential wisdom.”

combines classic EMA stacks with Pi-based logic to reveal high-probability buy/sell zones and trend bias across timeframes

Multi-EMA Trend & Pi Signal Indicator

This advanced indicator combines classic trend analysis with Pi-based signal logic to help traders identify optimal entry and exit zones across multiple timeframes.

Core Features

EMA Trend Structure: Displays EMAs 9, 13, 20, 50, and 200 to visualize short-term and long-term trend orientation. Bullish momentum is indicated when shorter EMAs are stacked above longer ones.

Pi-Based Signal Logic: Inspired by the Pi Indicator, it includes EMA111 and EMA700 (350×2) on the daily chart:

Buy Zone: When price is trading below EMA111, it signals potential accumulation for spot or low-leverage position trades.

Sell Zone: When price is above EMA700, it suggests potential distribution or exit zones.

Trend Cross Alerts: Detects EMA crossovers and crossunders to highlight shifts in market structure and generate buy/sell signals.

Multi-Timeframe Analysis: Evaluates trend direction across selected timeframes (e.g., 15m, 30m, 1h, 4h, 1D), offering a broader market perspective.

RSI Integration: Combines Relative Strength Index (RSI) readings with EMA positioning to assess momentum and overbought/oversold conditions.

Trend Table Display: A dynamic table summarizes the asset’s trend status per timeframe, showing:

RSI values

EMA alignment

Overall trend bias (bullish, bearish, neutral)

- “See the market’s structure through the eyes of exponential wisdom.”

combines classic EMA stacks with Pi-based logic to reveal high-probability buy/sell zones and trend bias across timeframes

Multi-EMA Trend & Pi Signal Indicator

This advanced indicator combines classic trend analysis with Pi-based signal logic to help traders identify optimal entry and exit zones across multiple timeframes.

Core Features

EMA Trend Structure: Displays EMAs 9, 13, 20, 50, and 200 to visualize short-term and long-term trend orientation. Bullish momentum is indicated when shorter EMAs are stacked above longer ones.

Pi-Based Signal Logic: Inspired by the Pi Indicator, it includes EMA111 and EMA700 (350×2) on the daily chart:

Buy Zone: When price is trading below EMA111, it signals potential accumulation for spot or low-leverage position trades.

Sell Zone: When price is above EMA700, it suggests potential distribution or exit zones.

Trend Cross Alerts: Detects EMA crossovers and crossunders to highlight shifts in market structure and generate buy/sell signals.

Multi-Timeframe Analysis: Evaluates trend direction across selected timeframes (e.g., 15m, 30m, 1h, 4h, 1D), offering a broader market perspective.

RSI Integration: Combines Relative Strength Index (RSI) readings with EMA positioning to assess momentum and overbought/oversold conditions.

Trend Table Display: A dynamic table summarizes the asset’s trend status per timeframe, showing:

RSI values

EMA alignment

Overall trend bias (bullish, bearish, neutral)

릴리즈 노트

EMA Oracle*** Did a small change to correct the indicator of tendency on the table that is shown on the up right.

- “See the market’s structure through the eyes of exponential wisdom.”

combines classic EMA stacks with Pi-based logic to reveal high-probability buy/sell zones and trend bias across timeframes

Multi-EMA Trend & Pi Signal Indicator

This advanced indicator combines classic trend analysis with Pi-based signal logic to help traders identify optimal entry and exit zones across multiple timeframes.

Core Features

EMA Trend Structure: Displays EMAs 9, 13, 20, 50, and 200 to visualize short-term and long-term trend orientation. Bullish momentum is indicated when shorter EMAs are stacked above longer ones.

Pi-Based Signal Logic: Inspired by the Pi Indicator, it includes EMA111 and EMA700 (350×2) on the daily chart:

Buy Zone: When price is trading below EMA111, it signals potential accumulation for spot or low-leverage position trades.

Sell Zone: When price is above EMA700, it suggests potential distribution or exit zones.

Trend Cross Alerts: Detects EMA crossovers and crossunders to highlight shifts in market structure and generate buy/sell signals.

Multi-Timeframe Analysis: Evaluates trend direction across selected timeframes (e.g., 15m, 30m, 1h, 4h, 1D), offering a broader market perspective.

RSI Integration: Combines Relative Strength Index (RSI) readings with EMA positioning to assess momentum and overbought/oversold conditions.

Trend Table Display: A dynamic table summarizes the asset’s trend status per timeframe, showing:

RSI values

EMA alignment

Overall trend bias (bullish, bearish, neutral)

릴리즈 노트

Made a few changes for stability and more friendly view. Since Pine Script has some limitations, the table from this indicator is best viewed in 1h TF.릴리즈 노트

Improvements in the visualization, increasing transparency of the colors, you should try longs when green and have caution when red.릴리즈 노트

Corrected a Minor error with RSI오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.