OPEN-SOURCE SCRIPT

업데이트됨 [SGM VaR Stats VS Empirical]

Main Functions

Logarithmic Returns & Historical Data

Calculates logarithmic returns from closing prices.

Stores these returns in a dynamic array with a configurable maximum size.

Approximation of the Inverse Error Function

Uses an approximation of the erfinv function to calculate z-scores for given confidence levels.

Basic Statistics

Mean: Calculates the average of the data in the array.

Standard Deviation: Measures the dispersion of returns.

Median: Provides a more robust measure of central tendency for skewed distributions.

Z-Score: Converts a confidence level into a standard deviation multiplier.

Empirical vs. Statistical Projection

Empirical Projection

Based on the median of cumulative returns for each projected period.

Applies an adjustable confidence filter to exclude extreme values.

Statistical Projection

Relies on the mean and standard deviation of historical returns.

Incorporates a standard deviation multiplier for confidence-adjusted projections.

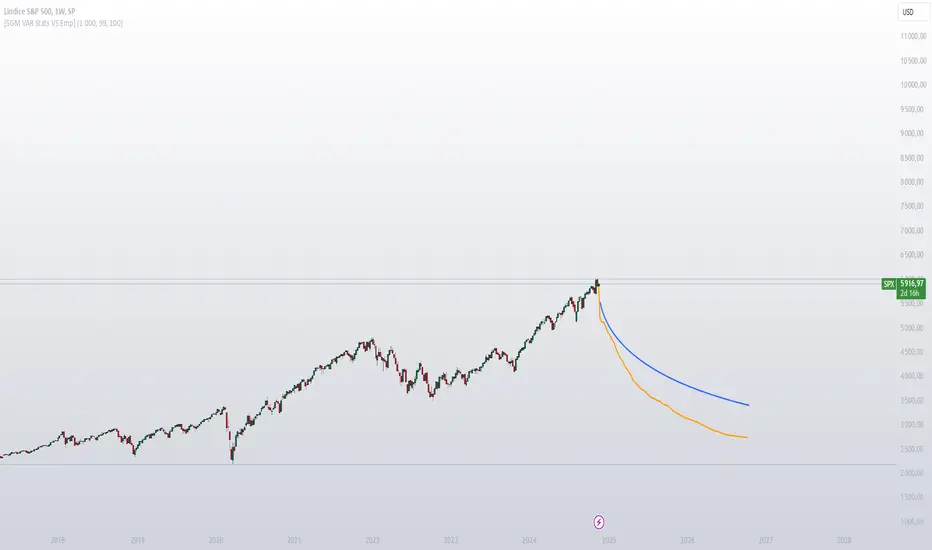

PolyLines (Graphs)

Generates projections visually through polylines:

Statistical Polyline (Blue): Based on traditional statistical methods.

Empirical Polyline (Orange): Derived from empirical data analysis.

Projection Customization

Maximum Data Size: Configurable limit for the historical data array (max_array_size).

Confidence Level: Adjustable by the user (conf_lvl), affects the width of the confidence bands.

Projection Length: Configurable number of projected periods (length_projection).

Key Steps

Capture logarithmic returns and update the historical data array.

Calculate basic statistics (mean, median, standard deviation).

Perform projections:

Empirical: Based on the median of cumulative returns.

Statistical: Based on the mean and standard deviation.

Visualization:

Compare statistical and empirical projections using polylines.

Utility

This script allows users to compare:

Traditional Statistical Projections: Based on mathematical properties of historical returns.

Empirical Projections: Relying on direct historical observations.

Divergence or convergence of these lines also highlights the presence of skewness or kurtosis in the return distribution.

Ideal for traders and financial analysts looking to assess an asset’s potential future performance using combined statistical and empirical approaches.

Logarithmic Returns & Historical Data

Calculates logarithmic returns from closing prices.

Stores these returns in a dynamic array with a configurable maximum size.

Approximation of the Inverse Error Function

Uses an approximation of the erfinv function to calculate z-scores for given confidence levels.

Basic Statistics

Mean: Calculates the average of the data in the array.

Standard Deviation: Measures the dispersion of returns.

Median: Provides a more robust measure of central tendency for skewed distributions.

Z-Score: Converts a confidence level into a standard deviation multiplier.

Empirical vs. Statistical Projection

Empirical Projection

Based on the median of cumulative returns for each projected period.

Applies an adjustable confidence filter to exclude extreme values.

Statistical Projection

Relies on the mean and standard deviation of historical returns.

Incorporates a standard deviation multiplier for confidence-adjusted projections.

PolyLines (Graphs)

Generates projections visually through polylines:

Statistical Polyline (Blue): Based on traditional statistical methods.

Empirical Polyline (Orange): Derived from empirical data analysis.

Projection Customization

Maximum Data Size: Configurable limit for the historical data array (max_array_size).

Confidence Level: Adjustable by the user (conf_lvl), affects the width of the confidence bands.

Projection Length: Configurable number of projected periods (length_projection).

Key Steps

Capture logarithmic returns and update the historical data array.

Calculate basic statistics (mean, median, standard deviation).

Perform projections:

Empirical: Based on the median of cumulative returns.

Statistical: Based on the mean and standard deviation.

Visualization:

Compare statistical and empirical projections using polylines.

Utility

This script allows users to compare:

Traditional Statistical Projections: Based on mathematical properties of historical returns.

Empirical Projections: Relying on direct historical observations.

Divergence or convergence of these lines also highlights the presence of skewness or kurtosis in the return distribution.

Ideal for traders and financial analysts looking to assess an asset’s potential future performance using combined statistical and empirical approaches.

릴리즈 노트

changing initial settings릴리즈 노트

-오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

Sigaud | Junior Quantitative Trader & Developer

Combining technical expertise with analytical precision.

Gaining experience and growing in the field.

📧 Contact: from the website

Combining technical expertise with analytical precision.

Gaining experience and growing in the field.

📧 Contact: from the website

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

Sigaud | Junior Quantitative Trader & Developer

Combining technical expertise with analytical precision.

Gaining experience and growing in the field.

📧 Contact: from the website

Combining technical expertise with analytical precision.

Gaining experience and growing in the field.

📧 Contact: from the website

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.