OPEN-SOURCE SCRIPT

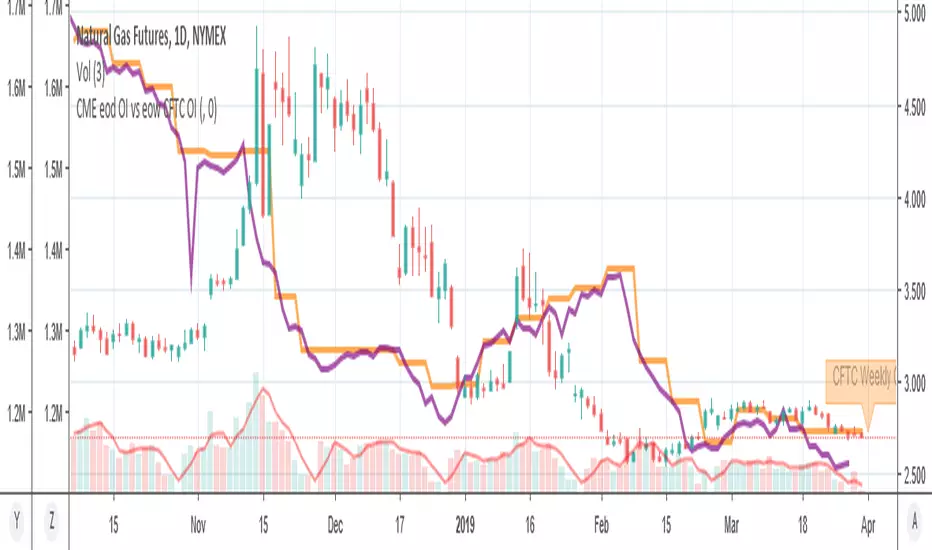

업데이트됨 MY_CME eod OI vs CFTC eow OI

Daily e-o-d Open Interest as published by CME.

As CFTC COT Open Interest relates to last Tuesday, here you can have an idea how things evolved day-by-day since then.

As CME total OI is not accessibl as data, here I sum OI of the next 9 outstanding contracts, which gives a fair idea of the trend in OI

As CFTC COT Open Interest relates to last Tuesday, here you can have an idea how things evolved day-by-day since then.

As CME total OI is not accessibl as data, here I sum OI of the next 9 outstanding contracts, which gives a fair idea of the trend in OI

릴리즈 노트

One can input a "preliminary" e-o-d Open Interest if published hereon CME sitecmegroup.com/market-data/volume-open-interest/metals-volume.html as the "final" data becomes available on tv quite late

릴리즈 노트

fixed colors릴리즈 노트

fixed offset of CME "final" OI, -1 on weekends,-2 weektime, as OI should be public within the next day, and relates to the previous day. But noton weekends...anyway you get the meaning릴리즈 노트

offset fix릴리즈 노트

Cleaned code, now sums OI of the next 20 contracts. Good for gold and E-mini. WTI is not too suitable, as it has dozens of conracts active for the next 3/4 years .

릴리즈 노트

Added new input "number of contracts"This script uses the QUANDL:CHRIS datasets, that records CME e-o-d data by quandl, and is exported daily to tradinview

The number of outstanding contracts CME differs from product to product

eg Gold has 16 oustanding contracts, E-mini has 4, NatGas has 43!

The scripts has max 20. You can add as many as you like in the source code,but toomuch typing for me

// NUMBER OF CONTRACTS

// eg:

// CME Vol and Open Interesst page eg. for GOLD:

// cmegroup.com/trading/metals/precious/gold_quotes_volume_voi.html?optid=7489&optionProductId=7488

// Totals Volume & OI (last line of table) are not exported by CME to quaandl

// CME data is recorded&exported daily by quandl.com to tradingview

// via the che CHRIS/CME datasets

// quandl.com/data/CHRIS

// Eg. Nat GAs cntract n. 20, field n. 7(OI)

// quandl.com/data/CHRIS/CME_NG20 (@quandl.com)

// this data is (should be) exported daily to tradinview

// tradingview.com/e/?symbol=QUANDL:CHRIS/CME_NG20|7 (TradingView)

// This script tries to sum all the fut cntrcts' Vol&OI to obtain a fair total

//

// Number of outstanding cntrcts per commodity differ.

// eg E-mini (ES) has 4 contracts, Gold(GC) 16 cntrcts, NatGas(NG) has 43, WTI(CL) has 38 etc

// see doc by quandl:

// s3.amazonaws.com/quandl-production-static/Ticker+CSV's/Futures/continuous.csv

릴리즈 노트

This latest version sets automatically the number of outstanding contracts' OI to sum upbasen on the ticker future code

data is taken from QUNDL:CHRIS/CME_ dataset

// Number of outstanding cntrcts per commodity CME differ.

// eg E-mini (ES) has 4 contracts, Gold(GC) 16 cntrcts, NatGas(NG) has 43, WTI(CL) has 38 etc

// this script now gets the n.of outstandig cntrcts' OI to sum from the following table:

// s3.amazonaws.com/quandl-production-static/Ticker+CSV's/Futures/continuous.csv

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.