PROTECTED SOURCE SCRIPT

UCS_Price Action Normalized Volatility

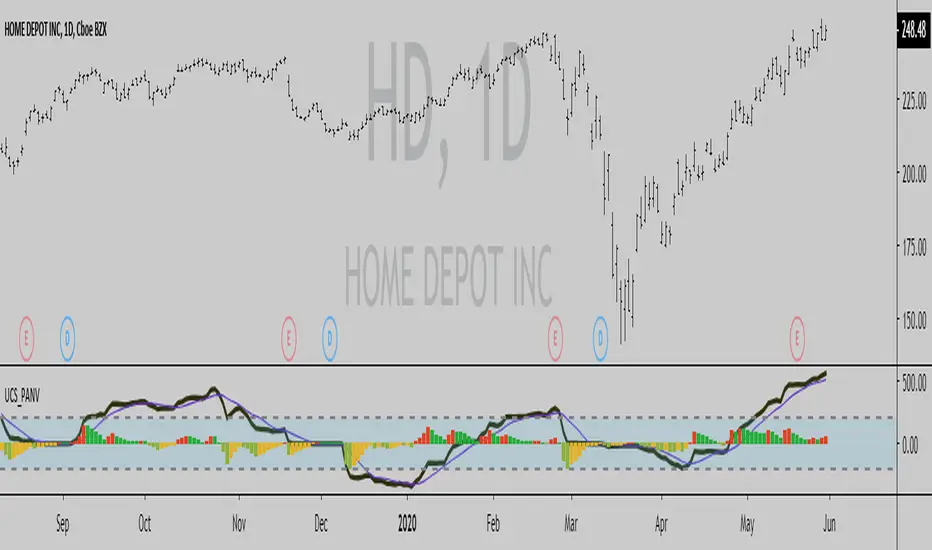

For Stock, Futures and Forex traders this may not be a replacement for MACD . But for an Option Trader, this would make sense 1000 times.

So, What is this?

This is the MACD for OPTIONS traders, remove the smoothness and adjust for volatility . Thats all it is.

Why is it important?

No one, ABSOLUTELY no one should be buying options in high volatility period for a long haul. So, this indicator takes that out of your guess work and only spits out price movement with relation to volatility .

You can use this exactly like a MACD for any options ( aka , volatility driven market).

Few things I have added, since I created and used it privately.

1. Chop Zone - Trade the Extremes of any Product

2. Buyers Zone - Shorts reconsider

3. Sellers Zone - Longs reconsider

Why did I create this?

Volatility dictates the market movement. That is an indepth conversation. If you are curious you can research on how shorts are squeezed, what are market makers obligations, how they maintain profitability. How NITE got burned, are some starting point for your own research.

So, if you are an options trader, I highly recommend to use this/test it and share your thoughts and how you use it.

- Good Luck Everyone.

So, What is this?

This is the MACD for OPTIONS traders, remove the smoothness and adjust for volatility . Thats all it is.

Why is it important?

No one, ABSOLUTELY no one should be buying options in high volatility period for a long haul. So, this indicator takes that out of your guess work and only spits out price movement with relation to volatility .

You can use this exactly like a MACD for any options ( aka , volatility driven market).

Few things I have added, since I created and used it privately.

1. Chop Zone - Trade the Extremes of any Product

2. Buyers Zone - Shorts reconsider

3. Sellers Zone - Longs reconsider

Why did I create this?

Volatility dictates the market movement. That is an indepth conversation. If you are curious you can research on how shorts are squeezed, what are market makers obligations, how they maintain profitability. How NITE got burned, are some starting point for your own research.

So, if you are an options trader, I highly recommend to use this/test it and share your thoughts and how you use it.

- Good Luck Everyone.

보호된 스크립트입니다

이 스크립트는 비공개 소스로 게시됩니다. 하지만 이를 자유롭게 제한 없이 사용할 수 있습니다 – 자세한 내용은 여기에서 확인하세요.

Uday C Santhakumar

udaycs.substack.com/

udaycs.substack.com/

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

보호된 스크립트입니다

이 스크립트는 비공개 소스로 게시됩니다. 하지만 이를 자유롭게 제한 없이 사용할 수 있습니다 – 자세한 내용은 여기에서 확인하세요.

Uday C Santhakumar

udaycs.substack.com/

udaycs.substack.com/

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.