INVITE-ONLY SCRIPT

업데이트됨 SPX ORB 60m → 0DTE Credit Spreads (Signals & Webhooks)

SPX ORB 60m → 0DTE Credit Spreads (Signals & Webhooks)

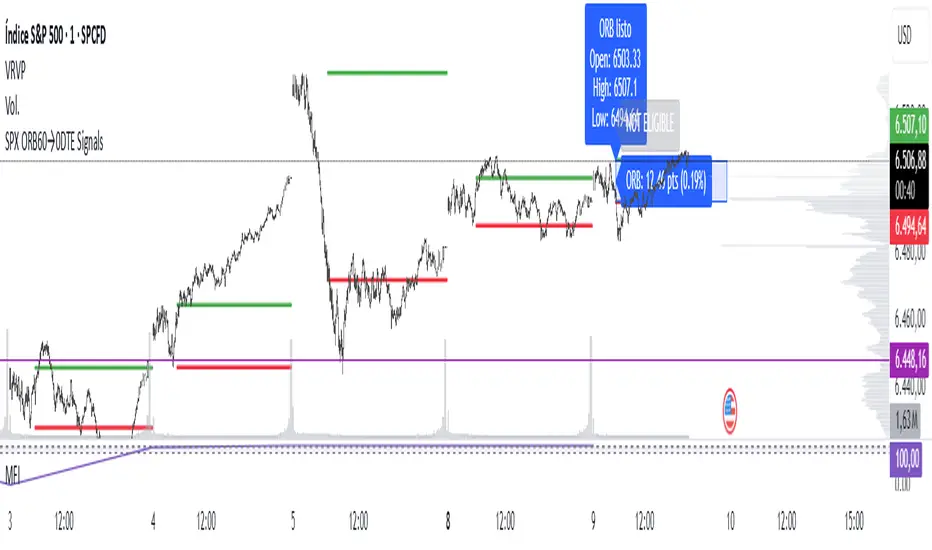

This indicator implements a 60-minute Opening Range Breakout (ORB) workflow for SPX and maps the first breakout during a monitoring window to a same-day options credit-spread idea. It’s signal-only (no backtesting) and includes both visual planning tools and automation hooks (webhooks/alerts).

How it works

ORB window: 09:30–10:30 New York. The script builds ORB High/Low and fixes them at 10:30.

Monitoring window: 10:31–12:00 New York.

The first wick break picks direction:

Break above ORB High → bullish bias → PUT credit spread idea (short strike below ORB Low − offset).

Break below ORB Low → bearish bias → CALL credit spread idea (short strike above ORB High + offset).

One signal per day. The bar is tagged “Fired PUT/CALL”.

Key inputs

Spread width ($), strike step ($), and independent short-strike offsets for PUT/CALL.

Eligibility thresholds by % of 09:30 open or points (separate minima for PUT vs CALL), plus an “ignore thresholds” test mode.

Day-of-week filters per side.

Preview before fire: show gray dotted “hypothetical” strikes only when eligible (or always), or hide until the actual trigger.

If the chosen side is blocked by weekday filter, you can still display it disabled (gray).

Visuals

ORB Rectangle: from 10:30 to 16:00 NY spanning ORB High/Low; updates intraday and then stays fixed. Optional label shows the range in pts and %.

Executed lines & labels: customizable style and width; colorized after the first trigger.

“NOT ELIGIBLE” gray label (optional) when thresholds/day filters are not met.

Outcome tag at session close (informational): WIN/LOSE relative to the short strike.

ORB High/Low plotted with plot.style_linebr for clean session edges.

Probability box (informational)

Optional box displayed at the breakout with a 0–100% composite score from:

ORB/ATR size (capped),

ADX (Wilder calculation inside the script),

ATR regime vs a long SMA baseline.

All lengths, caps, weights, colors and opacity are configurable, including a time offset to place the box.

Automation

Two backends supported: DigitalOcean server.js or SignalStack (Tastytrade).

Optional limit_price per leg and time_in_force (day/gtc) for SignalStack.

Alertconditions provided for PUT / CALL signals so you can create alerts from the TradingView dialog.

Additionally, the script can emit alert() payloads on trigger (enable in settings) to drive your webhook.

Notes

Designed for intraday NY session; 1–15m charts are typical.

Signals are for automation/planning, not recommendations. Validate risk, fills, and routing.

Disclaimer

For educational/informational purposes only. Not financial advice. Options trading involves substantial risk.

This indicator implements a 60-minute Opening Range Breakout (ORB) workflow for SPX and maps the first breakout during a monitoring window to a same-day options credit-spread idea. It’s signal-only (no backtesting) and includes both visual planning tools and automation hooks (webhooks/alerts).

How it works

ORB window: 09:30–10:30 New York. The script builds ORB High/Low and fixes them at 10:30.

Monitoring window: 10:31–12:00 New York.

The first wick break picks direction:

Break above ORB High → bullish bias → PUT credit spread idea (short strike below ORB Low − offset).

Break below ORB Low → bearish bias → CALL credit spread idea (short strike above ORB High + offset).

One signal per day. The bar is tagged “Fired PUT/CALL”.

Key inputs

Spread width ($), strike step ($), and independent short-strike offsets for PUT/CALL.

Eligibility thresholds by % of 09:30 open or points (separate minima for PUT vs CALL), plus an “ignore thresholds” test mode.

Day-of-week filters per side.

Preview before fire: show gray dotted “hypothetical” strikes only when eligible (or always), or hide until the actual trigger.

If the chosen side is blocked by weekday filter, you can still display it disabled (gray).

Visuals

ORB Rectangle: from 10:30 to 16:00 NY spanning ORB High/Low; updates intraday and then stays fixed. Optional label shows the range in pts and %.

Executed lines & labels: customizable style and width; colorized after the first trigger.

“NOT ELIGIBLE” gray label (optional) when thresholds/day filters are not met.

Outcome tag at session close (informational): WIN/LOSE relative to the short strike.

ORB High/Low plotted with plot.style_linebr for clean session edges.

Probability box (informational)

Optional box displayed at the breakout with a 0–100% composite score from:

ORB/ATR size (capped),

ADX (Wilder calculation inside the script),

ATR regime vs a long SMA baseline.

All lengths, caps, weights, colors and opacity are configurable, including a time offset to place the box.

Automation

Two backends supported: DigitalOcean server.js or SignalStack (Tastytrade).

Optional limit_price per leg and time_in_force (day/gtc) for SignalStack.

Alertconditions provided for PUT / CALL signals so you can create alerts from the TradingView dialog.

Additionally, the script can emit alert() payloads on trigger (enable in settings) to drive your webhook.

Notes

Designed for intraday NY session; 1–15m charts are typical.

Signals are for automation/planning, not recommendations. Validate risk, fills, and routing.

Disclaimer

For educational/informational purposes only. Not financial advice. Options trading involves substantial risk.

초대 전용 스크립트

이 스크립트는 작성자가 승인한 사용자만 접근할 수 있습니다. 사용하려면 요청을 보내고 승인을 받아야 합니다. 일반적으로 결제 후에 승인이 이루어집니다. 자세한 내용은 아래 작성자의 지침을 따르거나 mauricio_a_morales에게 직접 문의하세요.

트레이딩뷰는 스크립트 작성자를 완전히 신뢰하고 스크립트 작동 방식을 이해하지 않는 한 스크립트 비용을 지불하거나 사용하지 않는 것을 권장하지 않습니다. 무료 오픈소스 대체 스크립트는 커뮤니티 스크립트에서 찾을 수 있습니다.

작성자 지시 사항

Just DM for access request

경고: 액세스를 요청하기 앞서 초대 전용 스크립트에 대한 가이드를 읽어주세요.

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.

초대 전용 스크립트

이 스크립트는 작성자가 승인한 사용자만 접근할 수 있습니다. 사용하려면 요청을 보내고 승인을 받아야 합니다. 일반적으로 결제 후에 승인이 이루어집니다. 자세한 내용은 아래 작성자의 지침을 따르거나 mauricio_a_morales에게 직접 문의하세요.

트레이딩뷰는 스크립트 작성자를 완전히 신뢰하고 스크립트 작동 방식을 이해하지 않는 한 스크립트 비용을 지불하거나 사용하지 않는 것을 권장하지 않습니다. 무료 오픈소스 대체 스크립트는 커뮤니티 스크립트에서 찾을 수 있습니다.

작성자 지시 사항

Just DM for access request

경고: 액세스를 요청하기 앞서 초대 전용 스크립트에 대한 가이드를 읽어주세요.

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.