OPEN-SOURCE SCRIPT

업데이트됨 Buying Opportunity Score V2.1

Overview

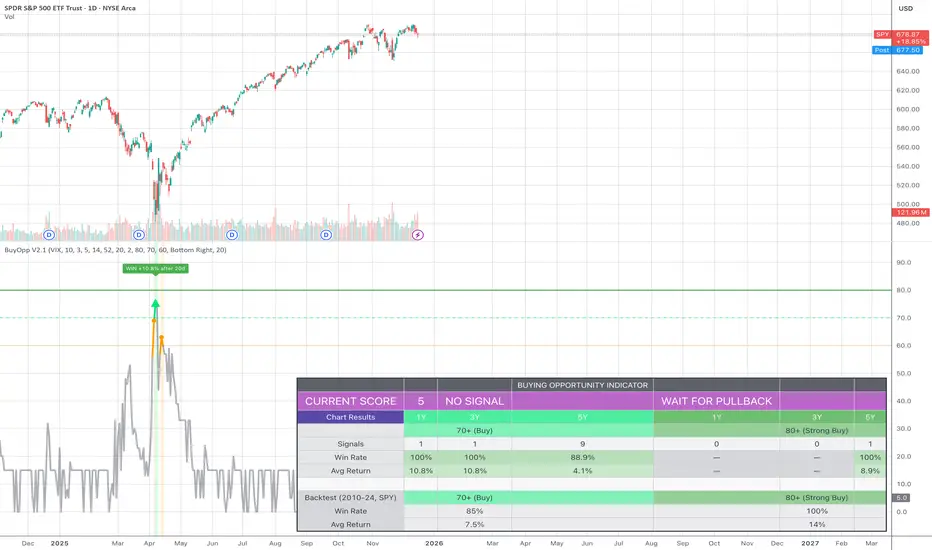

A composite scoring system (0-100) that identifies high-probability buying opportunities during market pullbacks. Validated through backtesting on SPY from 2010-2024.

How It Works

The indicator combines multiple fear and oversold signals into a single actionable score. When fear is elevated and the market is oversold, the score rises. Higher scores historically correlate with better forward returns.

Scoring Components

VIX Level (30 pts) - Market fear gauge

Drawdown (30 pts) - Distance from 52-week high

RSI 14 (12 pts) - Oversold confirmation

Bollinger Band (13 pts) - Statistical extreme

VIX Timing (15 pts) - Bonus when VIX declining from peak

Signal Levels

80+ = STRONG BUY (high conviction)

70-79 = BUY (consider entry)

60-69 = WATCH (monitor closely)

Below 60 = No signal

Backtest Results (SPY, 2010-2024)

70+ Signals: 85% win rate, 7.5% average 20-day return

80+ Signals: 100% win rate, 14% average 20-day return

Features

Statistics table showing 1Y, 3Y, 5Y rolling performance

Signal markers (green triangles) on buy signals

Outcome labels showing WIN/LOSS after measurement period

Multiple alert options

Works on SPY, QQQ, IWM (use VIX for all)

How To Use

Add to SPY, QQQ, or IWM (daily timeframe)

Wait for score to reach 70+ or 80+

Green triangle marks signal day

Check statistics table for recent performance

Set alerts for notifications

Alerts Available

STRONG BUY Signal (80+)

BUY Signal (70+)

Moderate Signal (60+)

Score Crossed 80/70

Score Dropped Below 70

Important Notes

Designed for daily timeframe on broad market ETFs

Signals confirm at end of day (bar close)

Statistics table shows rolling windows based on loaded data

Past performance does not guarantee future results

A composite scoring system (0-100) that identifies high-probability buying opportunities during market pullbacks. Validated through backtesting on SPY from 2010-2024.

How It Works

The indicator combines multiple fear and oversold signals into a single actionable score. When fear is elevated and the market is oversold, the score rises. Higher scores historically correlate with better forward returns.

Scoring Components

VIX Level (30 pts) - Market fear gauge

Drawdown (30 pts) - Distance from 52-week high

RSI 14 (12 pts) - Oversold confirmation

Bollinger Band (13 pts) - Statistical extreme

VIX Timing (15 pts) - Bonus when VIX declining from peak

Signal Levels

80+ = STRONG BUY (high conviction)

70-79 = BUY (consider entry)

60-69 = WATCH (monitor closely)

Below 60 = No signal

Backtest Results (SPY, 2010-2024)

70+ Signals: 85% win rate, 7.5% average 20-day return

80+ Signals: 100% win rate, 14% average 20-day return

Features

Statistics table showing 1Y, 3Y, 5Y rolling performance

Signal markers (green triangles) on buy signals

Outcome labels showing WIN/LOSS after measurement period

Multiple alert options

Works on SPY, QQQ, IWM (use VIX for all)

How To Use

Add to SPY, QQQ, or IWM (daily timeframe)

Wait for score to reach 70+ or 80+

Green triangle marks signal day

Check statistics table for recent performance

Set alerts for notifications

Alerts Available

STRONG BUY Signal (80+)

BUY Signal (70+)

Moderate Signal (60+)

Score Crossed 80/70

Score Dropped Below 70

Important Notes

Designed for daily timeframe on broad market ETFs

Signals confirm at end of day (bar close)

Statistics table shows rolling windows based on loaded data

Past performance does not guarantee future results

릴리즈 노트

Overview:A composite scoring system (0-100) that identifies high-probability buying opportunities during market pullbacks. Validated through backtesting on SPY from 2010-2024.

How It Works

The indicator combines multiple fear and oversold signals into a single actionable score. When fear is elevated and the market is oversold, the score rises. Higher scores historically correlate with better forward returns.

Scoring Components

VIX Level (30 pts) - Market fear gauge

Drawdown (30 pts) - Distance from 52-week high

RSI 14 (12 pts) - Oversold confirmation

Bollinger Band (13 pts) - Statistical extreme

VIX Timing (15 pts) - Bonus when VIX declining from peak

Signal Levels

80+ = STRONG BUY (high conviction)

70-79 = BUY (consider entry)

60-69 = WATCH (monitor closely)

Below 60 = No signal

Backtest Results (SPY, 2010-2024)

70+ Signals: 85% win rate, 7.5% average 20-day return

80+ Signals: 100% win rate, 14% average 20-day return

Features

Statistics table showing 1Y, 3Y, 5Y rolling performance

Signal markers (green triangles) on buy signals

Outcome labels showing WIN/LOSS after measurement period

Multiple alert options

Works on SPY, QQQ, IWM (use VIX for all)

How To Use

Add to SPY, QQQ, or IWM (daily timeframe)

Wait for score to reach 70+ or 80+

Green triangle marks signal day

Check statistics table for recent performance

Set alerts for notifications

Alerts Available

STRONG BUY Signal (80+)

BUY Signal (70+)

Moderate Signal (60+)

Score Crossed 80/70

Score Dropped Below 70

Important Notes

Designed for daily timeframe on broad market ETFs

Signals confirm at end of day (bar close)

Statistics table shows rolling windows based on loaded data

Past performance does not guarantee future results

릴리즈 노트

OverviewA composite scoring system (0-100) that identifies high-probability buying opportunities during market pullbacks. Validated through backtesting on SPY from 2010-2024.

How It Works

The indicator combines multiple fear and oversold signals into a single actionable score. When fear is elevated and the market is oversold, the score rises. Higher scores historically correlate with better forward returns.

Scoring Components

VIX Level (30 pts) - Market fear gauge

Drawdown (30 pts) - Distance from 52-week high

RSI 14 (12 pts) - Oversold confirmation

Bollinger Band (13 pts) - Statistical extreme

VIX Timing (15 pts) - Bonus when VIX declining from peak

Current Score

The table displays your live score (0-100) with context:

0-29 = WAIT FOR PULLBACK - Market calm, no opportunity

30-49 = NOT ACTIONABLE - Mild stress

50-59 = MONITOR - Fear rising

60-69 = WATCH - Potential entry soon

70-79 = BUY - Consider entering

80+ = STRONG BUY - High conviction entry

Signal Levels

80+ = STRONG BUY (high conviction)

70-79 = BUY (consider entry)

60-69 = WATCH (monitor closely)

Below 60 = No signal

Backtest Results (SPY, 2010-2024)

70+ Signals: 85% win rate, 7.5% average 20-day return

80+ Signals: 100% win rate, 14% average 20-day return

Features

Statistics table showing 1Y, 3Y, 5Y rolling performance

Signal markers (green triangles) on buy signals

Outcome labels showing WIN/LOSS result after 20 days

Multiple alert options

Works on SPY, QQQ, IWM (use VIX for all)

How To Use

Add to SPY, QQQ, or IWM (daily timeframe)

Check the CURRENT SCORE row for today's reading

Wait for score to reach 70+ or 80+

Green triangle marks signal day

Set alerts for notifications

Alerts Available

STRONG BUY Signal (80+)

BUY Signal (70+)

Moderate Signal (60+)

Score Crossed 80/70

Score Dropped Below 70

Important Notes

Designed for daily timeframe on broad market ETFs

Signals confirm at end of day (bar close)

Chart Results show rolling 1Y/3Y/5Y performance from loaded data

Backtest row shows validated 2010-2024 SPY results

Past performance does not guarantee future results

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.