INVITE-ONLY SCRIPT

업데이트됨 Orderflow Pro+

Description:

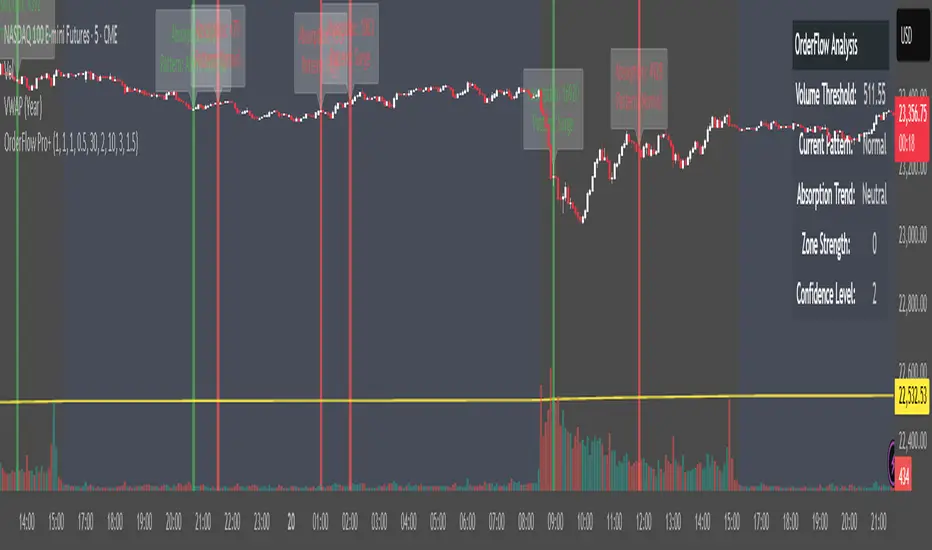

OrderFlow Pro+ is an advanced volume analysis tool designed to detect absorption events in market data. This professional tool identifies when significant trading volume occurs with minimal price movement, indicating potential support or resistance levels. The indicator uses statistical methods to establish dynamic volume thresholds, allowing it to adapt to different market conditions. OrderFlow Pro+ classifies absorption events as either bid or ask absorption, visualizes them with customizable highlighting, and identifies recurring patterns to form absorption zones. The tool includes a trend analysis component that evaluates the balance between bid and ask absorption over a configurable lookback period, providing users with insights into the dominant market force. With adjustable confidence levels, volume divisors, and visualization options, OrderFlow Pro+ delivers actionable order flow intelligence suitable for various purposes and timeframes.

Key Features:

Absorption Detection: Identifies when significant volume is absorbed at specific price levels with minimal price movement

Volume Analysis: Dynamically calculates volume thresholds based on statistical methods to filter meaningful readings.

Absorption Zones: Visualizes areas where multiple absorption events occur, potentially indicating strong support/resistance

Trend Assessment: Provides absorption trend readings to gauge market bias direction

Customizable Sensitivity: Adjust confidence levels for conservative, balanced, or aggressive signal detection

Visual Alerts: Optional alerts for bid/ask absorption events and significant trend changes

Benefits:

Gain deeper insights into market structure through volume behaviour analysis

Identify potential reversal zones where large orders are being absorbed

Understand the strength of buying and selling pressure

Make more informed entries and exits based on orderflow dynamics

Complement your existing technical analysis with volume-price relationship data

Disclaimer: Orderflow Pro+ is developed with a purpose and goal to understand and decode market movements for learning and informative purposes but does not generate any buy/sell/hold signals and it does not provide any target price. It is not shared with an aim to induce or encourage trading/investing but with a goal to enhance a user's understanding of markets. Trading/Investing are risky endeavours with risk of partial or complete erosion of capital. Please consult a registered financial advisor before venturing into trading/investing

OrderFlow Pro+ is an advanced volume analysis tool designed to detect absorption events in market data. This professional tool identifies when significant trading volume occurs with minimal price movement, indicating potential support or resistance levels. The indicator uses statistical methods to establish dynamic volume thresholds, allowing it to adapt to different market conditions. OrderFlow Pro+ classifies absorption events as either bid or ask absorption, visualizes them with customizable highlighting, and identifies recurring patterns to form absorption zones. The tool includes a trend analysis component that evaluates the balance between bid and ask absorption over a configurable lookback period, providing users with insights into the dominant market force. With adjustable confidence levels, volume divisors, and visualization options, OrderFlow Pro+ delivers actionable order flow intelligence suitable for various purposes and timeframes.

Key Features:

Absorption Detection: Identifies when significant volume is absorbed at specific price levels with minimal price movement

Volume Analysis: Dynamically calculates volume thresholds based on statistical methods to filter meaningful readings.

Absorption Zones: Visualizes areas where multiple absorption events occur, potentially indicating strong support/resistance

Trend Assessment: Provides absorption trend readings to gauge market bias direction

Customizable Sensitivity: Adjust confidence levels for conservative, balanced, or aggressive signal detection

Visual Alerts: Optional alerts for bid/ask absorption events and significant trend changes

Benefits:

Gain deeper insights into market structure through volume behaviour analysis

Identify potential reversal zones where large orders are being absorbed

Understand the strength of buying and selling pressure

Make more informed entries and exits based on orderflow dynamics

Complement your existing technical analysis with volume-price relationship data

Disclaimer: Orderflow Pro+ is developed with a purpose and goal to understand and decode market movements for learning and informative purposes but does not generate any buy/sell/hold signals and it does not provide any target price. It is not shared with an aim to induce or encourage trading/investing but with a goal to enhance a user's understanding of markets. Trading/Investing are risky endeavours with risk of partial or complete erosion of capital. Please consult a registered financial advisor before venturing into trading/investing

릴리즈 노트

OrderFlow Pro+ is an advanced volume analysis tool designed to detect absorption events in market data. This tool identifies when significant trading volume occurs with minimal price movement, indicating potential support or resistance levels. The indicator uses statistical methods to establish dynamic volume thresholds, allowing it to adapt to different market conditions. OrderFlow Pro+ classifies absorption events as either bid or ask absorption, visualizes them with customizable highlighting, and identifies recurring patterns to form absorption zones. The tool includes a trend analysis component that evaluates the balance between bid and ask absorption over a configurable lookback period, providing users with insights into the dominant market force. With adjustable confidence levels, volume divisors, and visualization options, OrderFlow Pro+ delivers actionable order flow intelligence suitable multiple timeframes.Key Features:

Absorption Detection: Identifies when significant volume is absorbed at specific price levels with minimal price movement

Volume Analysis: Dynamically calculates volume thresholds based on statistical methods to filter meaningful readings.

Absorption Zones: Visualizes areas where multiple absorption events occur, potentially indicating strong support/resistance

Trend Assessment: Provides absorption trend readings to gauge market bias direction

Customizable Sensitivity: Adjust confidence levels for conservative, balanced, or aggressive signal detection

Visual Alerts: Optional alerts for bid/ask absorption events and significant trend changes

Benefits:

Gain deeper insights into market structure through volume behaviour analysis

Identify potential trend change zones where large orders are being absorbed

Understand the strength of buying and selling pressure by participants.

Get insights into orderflow dynamics

Complement your existing technical analysis with volume-price relationship data

Disclaimer: Orderflow Pro+ V2 is a technical tool developed with the purpose of understanding market trends but does not generate any buy/sell/hold signals or generate research recommendations. It is not shared with an aim to induce or encourage trading/investing. The use of the tool is only for the learning purpose of the user but should not be misconstrued as financial advice. No guarantees about the reliability, accuracy of the tool or data provided by data vendor is provided. Abishek Kondagunta Venkatesh will not be held liable or responsible for any direct or indirect outcomes with regards to the usage of the tool. By proceeding to use the toool, you confirm that you have read the disclosures, terms and conditions, MITC and all other policies referenced below.

Regulatory disclaimer: Registration granted by SEBI, enlistment with BSE, certification granted by NISM in no way guarantees the performance of the research analyst or provides any assurance of returns to the investors.

Standard Warning: Investment in securities market are subject to market risks. Read all the related documents carefully before investing.

Important information:

1. Disclosures: akvequityresearch.com/disclosure

2. Terms and Conditions: akvequityresearch.com/termsAndConditions

3. Refund Policy: akvequityresearch.com/refundPolicy

4. Grievance redressal: akvequityresearch.com/grievance

5. Investor Charter: akvequityresearch.com/investorCharter

6. Internal policies: akvequityresearch.com/internalPolicies

7. Privacy Policy: akvequityresearch.com/privacyPolicy

8. Code of conduct: akvequityresearch.com/codeOfConduct

초대 전용 스크립트

이 스크립트는 작성자가 승인한 사용자만 접근할 수 있습니다. 사용하려면 요청을 보내고 승인을 받아야 합니다. 일반적으로 결제 후에 승인이 이루어집니다. 자세한 내용은 아래 작성자의 지침을 따르거나 Abi_2025에게 직접 문의하세요.

트레이딩뷰는 스크립트 작성자를 완전히 신뢰하고 스크립트 작동 방식을 이해하지 않는 한 스크립트 비용을 지불하거나 사용하지 않는 것을 권장하지 않습니다. 무료 오픈소스 대체 스크립트는 커뮤니티 스크립트에서 찾을 수 있습니다.

작성자 지시 사항

Access available on request. For access to the script, reach out to me at abishekkvenkatesh@outlook.com

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.

초대 전용 스크립트

이 스크립트는 작성자가 승인한 사용자만 접근할 수 있습니다. 사용하려면 요청을 보내고 승인을 받아야 합니다. 일반적으로 결제 후에 승인이 이루어집니다. 자세한 내용은 아래 작성자의 지침을 따르거나 Abi_2025에게 직접 문의하세요.

트레이딩뷰는 스크립트 작성자를 완전히 신뢰하고 스크립트 작동 방식을 이해하지 않는 한 스크립트 비용을 지불하거나 사용하지 않는 것을 권장하지 않습니다. 무료 오픈소스 대체 스크립트는 커뮤니티 스크립트에서 찾을 수 있습니다.

작성자 지시 사항

Access available on request. For access to the script, reach out to me at abishekkvenkatesh@outlook.com

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.