OPEN-SOURCE SCRIPT

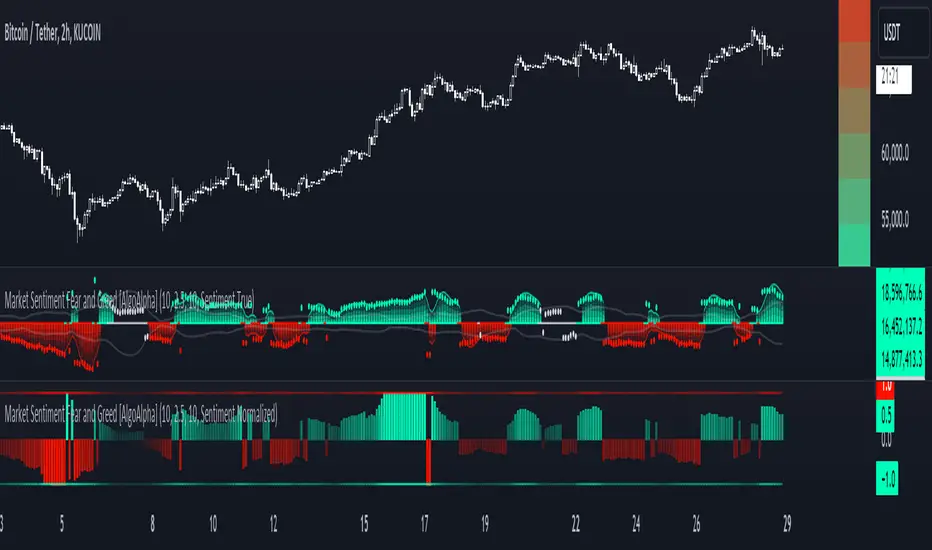

업데이트됨 Market Sentiment Fear and Greed [AlgoAlpha]

Unleash the power of sentiment analysis with the Market Sentiment Fear and Greed Indicator! 📈💡 This tool provides insights into market sentiment, helping you make informed trading decisions. Let's dive into its key features and how it works. 🚀✨

Key Features 🎯

How to Use 📖

Maximize your trading potential with this indicator by following these steps:

How It Works ⚙️

The indicator calculates market sentiment by averaging the volume and closing prices over a user-defined lookback period, creating a sentiment score. It differentiates between bullish and bearish sentiment by evaluating whether the closing price is higher or lower than the opening price, summing the respective volumes. The true sentiment is determined by comparing these summed values, with a positive score indicating bullish sentiment and a negative score indicating bearish sentiment. The indicator further normalizes this sentiment score by dividing it by the EMA of the highest high minus the lowest low over double the lookback period, ensuring values are constrained between -1 and 1. Bullish and bearish impulses are identified using Hull Moving Averages (HMA) of the positive and negative sentiments, respectively. When these impulses exceed a calculated threshold based on the standard deviation of the sentiment, it indicates a significant trend change. The script also includes a gradient color table to visually represent the strength of sentiment, and customizable alerts to notify users of key sentiment changes and trend impulses.

Unlock deeper insights into market sentiment and elevate your trading strategy with the Market Sentiment Fear and Greed Indicator! 📈✨

Key Features 🎯

- 🧠 Sentiment Analysis: Calculates market sentiment using volume and price data. 📊

- 📅 Customizable Lookback Window: Adjust the lookback period to fine-tune sensitivity. 🔧

- 🎨 Bullish and Bearish Colors: Visualize trends with customizable colors. 🟢🔴

- 🚀 Impulse Detection: Identifies bullish and bearish impulses for trend confirmation. 🔍

- 📉 Normalized Sentiment Index: Offers a normalized view of market sentiment. 📊

- 🔔 Alerts: Set alerts for key sentiment changes and trend impulses. 🚨

- 🟢🔴 Table Visualization: Displays sentiment strength using a gradient color table. 🗂️

How to Use 📖

Maximize your trading potential with this indicator by following these steps:

- 🔍 Add the Indicator: Search for "Market Sentiment Fear and Greed [AlgoAlpha]" in TradingView's Indicators & Strategies. Customize settings like the lookback window and trend breakout threshold to suit your trading strategy.

- 📊 Monitor Sentiment: Watch the sentiment gauge and plot changes to detect market sentiment shifts. Use the Normalized Sentiment Index for a more balanced view.

- 🚨 Set Alerts: Enable alerts for sentiment flips and trend impulses to stay ahead of market movements.

How It Works ⚙️

The indicator calculates market sentiment by averaging the volume and closing prices over a user-defined lookback period, creating a sentiment score. It differentiates between bullish and bearish sentiment by evaluating whether the closing price is higher or lower than the opening price, summing the respective volumes. The true sentiment is determined by comparing these summed values, with a positive score indicating bullish sentiment and a negative score indicating bearish sentiment. The indicator further normalizes this sentiment score by dividing it by the EMA of the highest high minus the lowest low over double the lookback period, ensuring values are constrained between -1 and 1. Bullish and bearish impulses are identified using Hull Moving Averages (HMA) of the positive and negative sentiments, respectively. When these impulses exceed a calculated threshold based on the standard deviation of the sentiment, it indicates a significant trend change. The script also includes a gradient color table to visually represent the strength of sentiment, and customizable alerts to notify users of key sentiment changes and trend impulses.

Unlock deeper insights into market sentiment and elevate your trading strategy with the Market Sentiment Fear and Greed Indicator! 📈✨

릴리즈 노트

Added the option to customize the Gauge position.오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

🚨Get premium: algoalpha.io

🛜Get FREE signals: discord.gg/xCmqTVRexz

❓Do you have feedback or indicator ideas? Join our server to tell us about it!

🛜Get FREE signals: discord.gg/xCmqTVRexz

❓Do you have feedback or indicator ideas? Join our server to tell us about it!

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

🚨Get premium: algoalpha.io

🛜Get FREE signals: discord.gg/xCmqTVRexz

❓Do you have feedback or indicator ideas? Join our server to tell us about it!

🛜Get FREE signals: discord.gg/xCmqTVRexz

❓Do you have feedback or indicator ideas? Join our server to tell us about it!

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.