OPEN-SOURCE SCRIPT

Bid/Ask Volume Tension with Rolling Avg

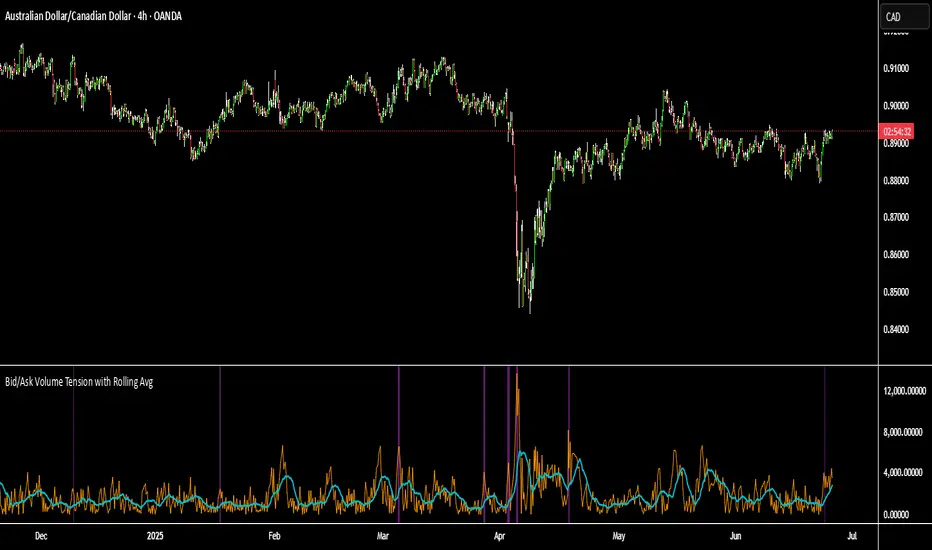

📊 Bid/Ask Volume Tension with Rolling Average

This indicator is designed to help traders identify pivotal moments of buildup, exhaustion, or imbalance in the market by calculating the tension between buy and sell volume.

🔍 How It Works:

Buy volume is approximated when the candle closes higher than or equal to its open.

Sell volume is approximated when the candle closes below its open.

Both are smoothed using an EMA (Exponential Moving Average) for noise reduction.

Tension is calculated as the absolute difference between smoothed buy and sell volume.

A rolling average of tension shows the baseline for normal behavior.

When instant tension rises significantly above the rolling average, it often signals:

A build-up before a large move

Aggressive order flow imbalances

Potential reversals or breakouts

🧠 How to Use:

Watch the orange line (instant tension) for spikes above the aqua line (rolling average).

Purple background highlights show when tension exceeds a customizable multiple of the average — a potential setup zone.

Use this indicator alongside:

Price action (candlestick structure)

Support/resistance

Liquidity zones or order blocks

⚙️ Settings:

Smoothing Length: Controls the responsiveness of buy/sell volume smoothing.

Rolling Avg Window: Defines the lookback period for the baseline tension.

Buildup Threshold: Triggers highlight zones when tension exceeds this multiple of the average.

🧪 Best For:

Spotting pre-breakout tension

Detecting volume-based divergences

Confirming order flow imbalances

This indicator is designed to help traders identify pivotal moments of buildup, exhaustion, or imbalance in the market by calculating the tension between buy and sell volume.

🔍 How It Works:

Buy volume is approximated when the candle closes higher than or equal to its open.

Sell volume is approximated when the candle closes below its open.

Both are smoothed using an EMA (Exponential Moving Average) for noise reduction.

Tension is calculated as the absolute difference between smoothed buy and sell volume.

A rolling average of tension shows the baseline for normal behavior.

When instant tension rises significantly above the rolling average, it often signals:

A build-up before a large move

Aggressive order flow imbalances

Potential reversals or breakouts

🧠 How to Use:

Watch the orange line (instant tension) for spikes above the aqua line (rolling average).

Purple background highlights show when tension exceeds a customizable multiple of the average — a potential setup zone.

Use this indicator alongside:

Price action (candlestick structure)

Support/resistance

Liquidity zones or order blocks

⚙️ Settings:

Smoothing Length: Controls the responsiveness of buy/sell volume smoothing.

Rolling Avg Window: Defines the lookback period for the baseline tension.

Buildup Threshold: Triggers highlight zones when tension exceeds this multiple of the average.

🧪 Best For:

Spotting pre-breakout tension

Detecting volume-based divergences

Confirming order flow imbalances

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.