OPEN-SOURCE SCRIPT

업데이트됨 RVOL Relative Volume - Intraday

Hello All,

Relative Volume is one of the most important indicators and Traders should check it while trading/analyzing. it is used to identify whether the volume flows are increasing or decreasing. Relative volume measures current volume in relation to the “usual” volume for this time of the day. What is considered “usual"? For that, we have to use a historical baseline known as the average daily volume. That means how much volume a security does on a daily basis over a defined period. (This scripts runs on the time frames greater or equal 1 minute and less than 1 day)

The common definition for real-time relative volume is: Current volume for this time of day / Average volume for this time of day. It does not mean taking the volume (for example) from 10:30 am to 10:45 am and comparing it to what it does from 10:30 am to 10:45 am every day. What it truly means is to compare cumulative volumes. Therefore, this is the precise definition of real-time relative volume:

Current cumulative volume up to this time of day / Average cumulative volume up to this time of day

What should we understand while checking RVOL;

- Relative volume tell us if volume flows are increasing or decreasing

- A high relative volume tells us that there is increased trading activity in a security today

- Increased volume flows often accompany higher volatility i.e. a significant price move

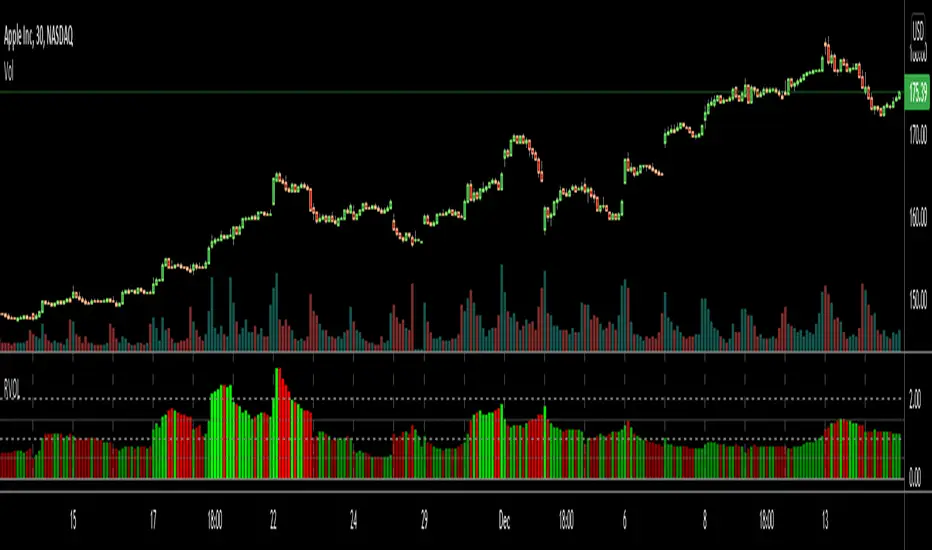

Let see an example:

P.S. if you want to get more info about RVOL/Relative Volume then you can search it on the net. While developing the script this was used as reference, you can also check it for more info.

Enjoy!

Relative Volume is one of the most important indicators and Traders should check it while trading/analyzing. it is used to identify whether the volume flows are increasing or decreasing. Relative volume measures current volume in relation to the “usual” volume for this time of the day. What is considered “usual"? For that, we have to use a historical baseline known as the average daily volume. That means how much volume a security does on a daily basis over a defined period. (This scripts runs on the time frames greater or equal 1 minute and less than 1 day)

The common definition for real-time relative volume is: Current volume for this time of day / Average volume for this time of day. It does not mean taking the volume (for example) from 10:30 am to 10:45 am and comparing it to what it does from 10:30 am to 10:45 am every day. What it truly means is to compare cumulative volumes. Therefore, this is the precise definition of real-time relative volume:

Current cumulative volume up to this time of day / Average cumulative volume up to this time of day

What should we understand while checking RVOL;

- Relative volume tell us if volume flows are increasing or decreasing

- A high relative volume tells us that there is increased trading activity in a security today

- Increased volume flows often accompany higher volatility i.e. a significant price move

Let see an example:

P.S. if you want to get more info about RVOL/Relative Volume then you can search it on the net. While developing the script this was used as reference, you can also check it for more info.

Enjoy!

릴리즈 노트

Algorithm slightly improved. instead of calculating cumulative volume on each bar, now the array keeps cumulative volumes.Lighter colors used.

릴리즈 노트

Tooltip added for the input "Number of Days". unnecessary input option removed.릴리즈 노트

Fixed for Daylight saving: "Daylight saving on last weekend" option added. Please enter +1/-1 if Daylight saving last weekend, if not please keep it 0.오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

🤝 LonesomeTheBlue community

t.me/LonesomeTheBlue_Official

🎦 YouTube Channel

Youtube.com/@lonesometheblue/videos

💰 Subscription to Pro indicators

Tradingview.com/spaces/LonesomeTheBlue/

t.me/LonesomeTheBlue_Official

🎦 YouTube Channel

Youtube.com/@lonesometheblue/videos

💰 Subscription to Pro indicators

Tradingview.com/spaces/LonesomeTheBlue/

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

🤝 LonesomeTheBlue community

t.me/LonesomeTheBlue_Official

🎦 YouTube Channel

Youtube.com/@lonesometheblue/videos

💰 Subscription to Pro indicators

Tradingview.com/spaces/LonesomeTheBlue/

t.me/LonesomeTheBlue_Official

🎦 YouTube Channel

Youtube.com/@lonesometheblue/videos

💰 Subscription to Pro indicators

Tradingview.com/spaces/LonesomeTheBlue/

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.