OPEN-SOURCE SCRIPT

업데이트됨 HoLo (Highest Open Lowest Open)

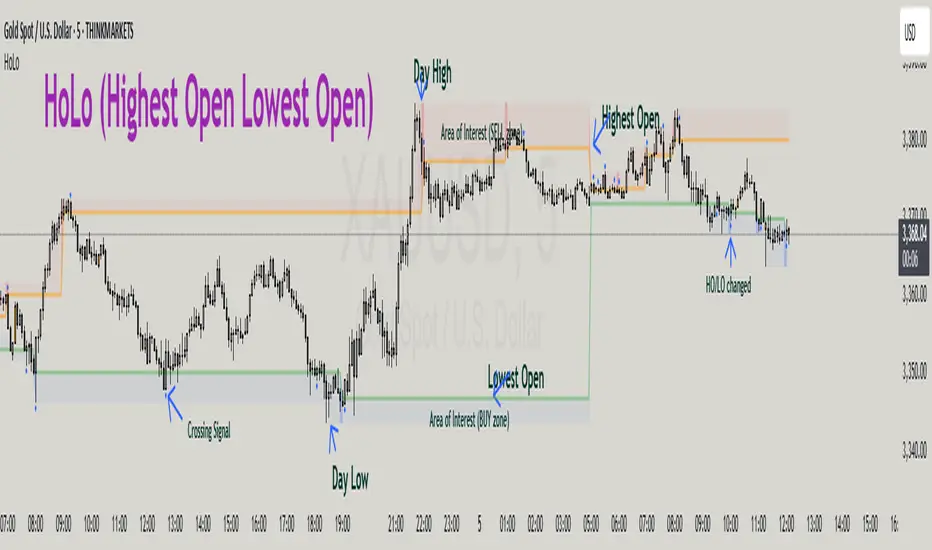

HoLo (Highest Open Lowest Open) Method

Overview

HoLo stands for "Highest Open Lowest Open" – a forex trading strategy.

Core Concept

Definition of HoLo:

Strategy Setup

Step 1: Mark Key Levels

Step 2: Define the Area of Interest

Trade Entry Rules

Sell Trade:

Buy Trade:

Trigger Timeframe:

Choose M1, M5, or M15 based on:

Risk and Profit Management

Stop Loss:

Take Profit (TP) Basic Rule:

You should open 2 positions:

Money Management:

Prioritize major pairs.

The Indicator

How to read data

For Day Traders

Monitor the sell zone (red area) for potential short entries near resistance

Watch the buy zone (blue area) for potential long entries near support

Use cross signals for entry/exit points

Pay attention to timing markers for key market hours

Alert

Overview

HoLo stands for "Highest Open Lowest Open" – a forex trading strategy.

Core Concept

Definition of HoLo:

- Highest Open (HO): The highest opening price among all H1 candles of the current trading day

- Lowest Open (LO): The lowest opening price among all H1 candles of the current trading day

- Trading Day: Starts at Asia Open Session

Strategy Setup

Step 1: Mark Key Levels

- Current day's High/Low

- Highest Open and Lowest Open (from H1 candles)

Step 2: Define the Area of Interest

- Sell Zone: Between the Highest Open and the current day's High

- Buy Zone: Between the Lowest Open and the current day's Low

Trade Entry Rules

Sell Trade:

- Price goes above the Highest Open

- Trigger candle (M5, M15, or M30) closes above the Highest Open

- Enter a sell when price revisits the Highest Open level (Sell Stop Order)

Buy Trade:

- Price drops below the Lowest Open

- Trigger candle closes below the Lowest Open

- Enter a buy when price revisits the Lowest Open level (Buy Stop Order)

Trigger Timeframe:

Choose M1, M5, or M15 based on:

- Your screen time availability

- Personal trading style

Risk and Profit Management

Stop Loss:

- For sell: Set SL at the day’s High + spread

- For buy: Set SL at the day’s Low + spread

Take Profit (TP) Basic Rule:

You should open 2 positions:

- When profit reaches 1R: Take partial profit + move SL to BE (Break Even)

- Let the remaining position run using partial TP or trailing stop

Money Management:

- Never risk more than 1% per trade

- Recommended: 0.5% risk due to multiple opportunities daily

Prioritize major pairs.

The Indicator

How to read data

For Day Traders

Monitor the sell zone (red area) for potential short entries near resistance

Watch the buy zone (blue area) for potential long entries near support

Use cross signals for entry/exit points

Pay attention to timing markers for key market hours

Alert

- HO (Highest Open) level changes

- LO (Lowest Close) level changes

- Price crossing key levels

- Timing notifications

릴리즈 노트

- Combine HO/LO changed alerts.

릴리즈 노트

- Change algorithm to detect the new day/hour.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

Day trader with RSI.

RSI 101 at rsi-101.gitbook.io/book

Telegram: t.me/daorsichat

RSI 101 at rsi-101.gitbook.io/book

Telegram: t.me/daorsichat

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

Day trader with RSI.

RSI 101 at rsi-101.gitbook.io/book

Telegram: t.me/daorsichat

RSI 101 at rsi-101.gitbook.io/book

Telegram: t.me/daorsichat

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.