OPEN-SOURCE SCRIPT

stop out or margin call price levels

Abstract

This script finds the potential stop out or margin call price levels without considering timeframe.

This script computes stop out or margin call price levels that over leveraged positions buy cheap enough.

You can use this indicator to follow stop hunters.

Introduction

Stop hunting exists because of benefit conflict.

When most of retails traders are in the correct direction, big banks do not want to buy more expensive then retail traders.

Therefore, Big banks create sell pressure to make retail traders misunderstand their trade decisions are wrong.

When retail traders decide to cut loss, it is time big banks buy cheaper.

Many courses recommend average true range as a stop loss reference.

However, in different timeframe, average true ranges are different.

Therefore, we need to have a method to measure potential stop hunting levels which is not relative to timeframe.

There is a method because there are observable levels where over leveraged positions must cut loss.

For example, for a 100 leverage position, its margin call level is 0.005, so 0.005 drawdown is a potential stop hunting level.

Computing

For buy

potential stop out or margin call price level = low * ( 1 - ratio )

For sell

potential stop out or margin call price level = high * ( 1 + ratio )

Parameters

There are 4 levels available for adjusting.

The default values are :

(1) 0.001 : 500 leverage , 50% margin call

(2) 0.0025 : 200 leverage , 50% margin call

(3) 0.005 : 100 leverage , 50% margin call

(4) 0.010 : 50 leverage , 50% margin call

Usage

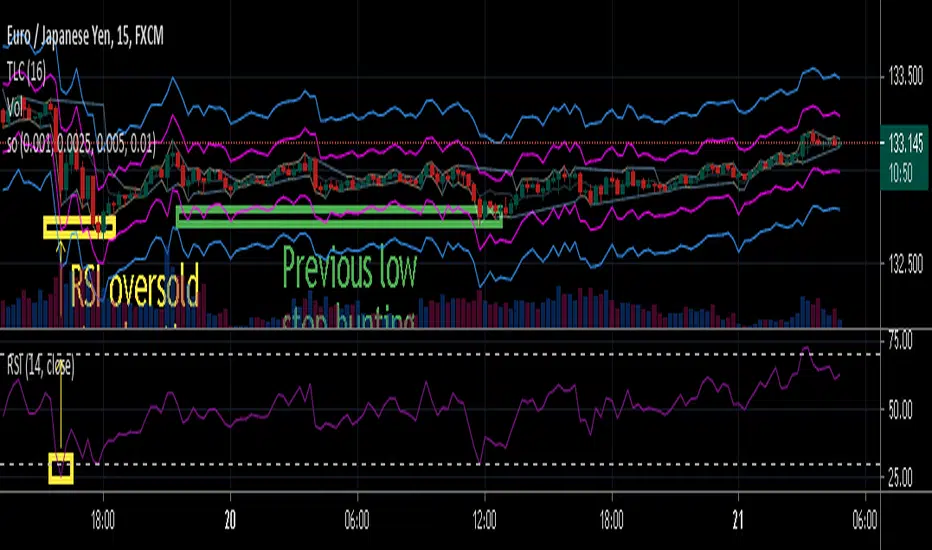

(1) Find an oversold price level. If you don't want to use an another indicator, you can use previous low.

(2) Memorize their stop out or margin call price levels of that level.

(2) Consider buy near those levels.

(3) If there are quick price rejection near those levels, better entry opportunities.

(4) Take profit and stop loss : you decide.

Conclusion

This script can find potential stop out or margin call price levels that over leveraged positions buy cheap enough.

If you are bored, you can consider find 100 signals you are interested in and share your observation.

Reference

Brokers, leverage and margin call threshold

This script finds the potential stop out or margin call price levels without considering timeframe.

This script computes stop out or margin call price levels that over leveraged positions buy cheap enough.

You can use this indicator to follow stop hunters.

Introduction

Stop hunting exists because of benefit conflict.

When most of retails traders are in the correct direction, big banks do not want to buy more expensive then retail traders.

Therefore, Big banks create sell pressure to make retail traders misunderstand their trade decisions are wrong.

When retail traders decide to cut loss, it is time big banks buy cheaper.

Many courses recommend average true range as a stop loss reference.

However, in different timeframe, average true ranges are different.

Therefore, we need to have a method to measure potential stop hunting levels which is not relative to timeframe.

There is a method because there are observable levels where over leveraged positions must cut loss.

For example, for a 100 leverage position, its margin call level is 0.005, so 0.005 drawdown is a potential stop hunting level.

Computing

For buy

potential stop out or margin call price level = low * ( 1 - ratio )

For sell

potential stop out or margin call price level = high * ( 1 + ratio )

Parameters

There are 4 levels available for adjusting.

The default values are :

(1) 0.001 : 500 leverage , 50% margin call

(2) 0.0025 : 200 leverage , 50% margin call

(3) 0.005 : 100 leverage , 50% margin call

(4) 0.010 : 50 leverage , 50% margin call

Usage

(1) Find an oversold price level. If you don't want to use an another indicator, you can use previous low.

(2) Memorize their stop out or margin call price levels of that level.

(2) Consider buy near those levels.

(3) If there are quick price rejection near those levels, better entry opportunities.

(4) Take profit and stop loss : you decide.

Conclusion

This script can find potential stop out or margin call price levels that over leveraged positions buy cheap enough.

If you are bored, you can consider find 100 signals you are interested in and share your observation.

Reference

Brokers, leverage and margin call threshold

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.