OPEN-SOURCE SCRIPT

업데이트됨 Unusual Whale - Unusual Options Volume Data Screener

How to Use:

Benefits of Scanning Options Volume for Unusual Activity:

What to Do If Combinations Don't Yield Results:

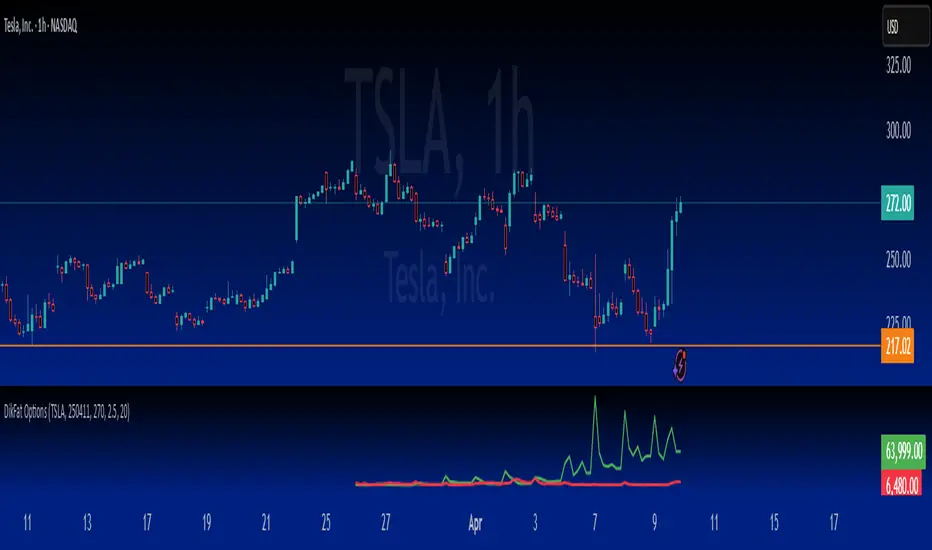

Cumulative Call Volume is Green, Put Volume is Red

- Custom Expiration Date: Use the calendar/date picker to select the expiration date. The chosen date is automatically converted to the "YYMMDD" format.

- Custom Base Strike: Enter a round strike value from the options chain (for example, "270"). This value serves as the starting point (at-the-money) for the scan.

- Strike Increment: Select the increment (e.g., 0.50, 1.00, 2.5, 5, or 10) to determine how the scan moves outward from the custom base strike.

- Options per Side (Max 20): Choose the number of valid option strikes to scan on each side. The script scans downward (for calls) and upward (for puts) from the custom base strike.

- Base Symbol: The base symbol is always taken from the chart (using syminfo.ticker); no manual entry is needed.

- Scanning & Aggregation: The script automatically constructs option symbols using the base symbol, custom expiration date, option type (C or P), and the formatted strike. It retrieves volume data for these options and aggregates the cumulative volume for calls and puts separately.

- Plotting: Cumulative call volume is plotted in green, and cumulative put volume is plotted in red—only if the required number of valid options is found.

Benefits of Scanning Options Volume for Unusual Activity:

- Offers a comprehensive view of volume across multiple strikes, making unusual or extreme volume patterns easier to detect.

- Helps gauge market sentiment by comparing aggregated call and put volumes, which may signal shifts in investor behavior.

- Aggregating volume from several strike levels provides smoother, more reliable data than using a single strike, enhancing your analytical insights.

What to Do If Combinations Don't Yield Results:

- Verify Your Inputs: Ensure that the Custom Base Symbol, Expiration Date, and Custom Base Strike are entered correctly and correspond to an active options chain.

- Adjust Strike Increment: If the options aren’t loading as expected, try selecting a different strike increment that more closely matches the spacing in your options chain.

- Reduce Options per Side: Lower the number of Options per Side (e.g., from 20 to a lower value) if the scan fails to find enough valid strikes.

- Review Your Options Chain: Confirm that the contracts for the specified expiration and strike range exist and are available in your data feed.

- Check Data Subscription: Make sure your TradingView plan includes access to the options data required for the selected symbols.

Cumulative Call Volume is Green, Put Volume is Red

릴리즈 노트

Updated chart image릴리즈 노트

Added Table for Unusual Activity릴리즈 노트

Further Optimized for performance릴리즈 노트

This script has been updated with dynamic tags to show which call or put strike has the most volume activity from all scanned strikes.오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

All opinions while deemed valid by its operators and shared on this board are not financial advice and are primarily for Entertainment Purposes.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

All opinions while deemed valid by its operators and shared on this board are not financial advice and are primarily for Entertainment Purposes.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.