OPEN-SOURCE SCRIPT

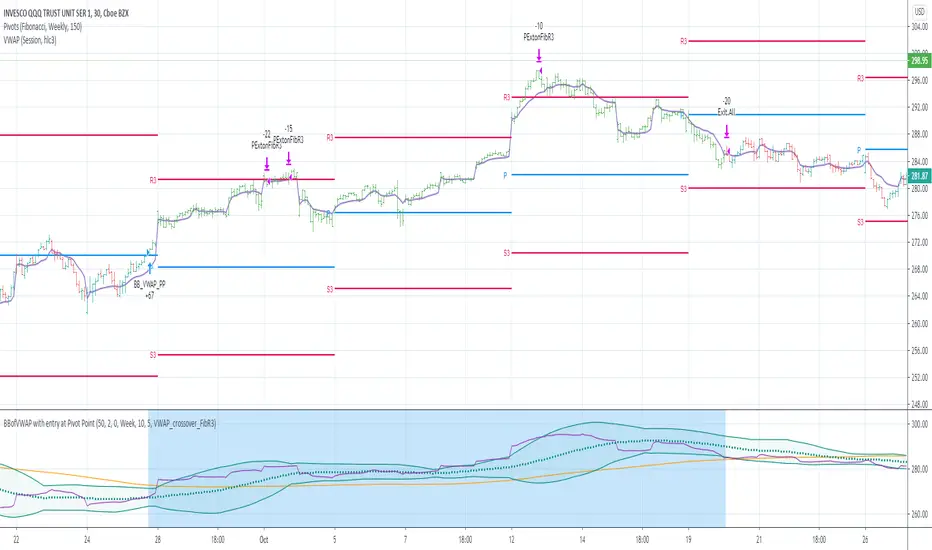

업데이트됨 BBofVWAP with entry at Pivot Point

This strategy uses BB of VWAP and Pivot point to enter and exit the Long position.

settings

BB length 50

BB Source VWAP

Entry

When VWAP crossing up BB midline and price/close is above weekly PivotPoint ( you can also use Daily pivot point )

Exit

When VWAP is crossing down BB lower band

Stop Loss

Stop loss defaulted to 5%

Note : Long will position will be exited on either VWAP crossing down BB lower band or stop loss is hit - whichever comes first . Being said that some time your stop loss exit is less than 5% which saves from more losses.

Entry is based on weekly Pivot point , so any time frame below weekly will work perfect. I have tested t on 30 min , 1 HR , 4 Hr , Daily charts. Even weekly setting shows good results , that will work for long term investing style.

if you change Pivot period to Daily , chose time frames below Daily.

I also noticed this strategy mostly do not enter Long position in a down trend. Even it finds one , it will be exited with minimal loss.

Warning

For the use of educational purposes only

settings

BB length 50

BB Source VWAP

Entry

When VWAP crossing up BB midline and price/close is above weekly PivotPoint ( you can also use Daily pivot point )

Exit

When VWAP is crossing down BB lower band

Stop Loss

Stop loss defaulted to 5%

Note : Long will position will be exited on either VWAP crossing down BB lower band or stop loss is hit - whichever comes first . Being said that some time your stop loss exit is less than 5% which saves from more losses.

Entry is based on weekly Pivot point , so any time frame below weekly will work perfect. I have tested t on 30 min , 1 HR , 4 Hr , Daily charts. Even weekly setting shows good results , that will work for long term investing style.

if you change Pivot period to Daily , chose time frames below Daily.

I also noticed this strategy mostly do not enter Long position in a down trend. Even it finds one , it will be exited with minimal loss.

Warning

For the use of educational purposes only

릴리즈 노트

I have added partial exit options. Original version used to exit partial when VWAP cross down upper BB band. Now you can chose one of the below 3 options ...VWAP_crossunder_upperBB --- This is same as original version

VWAP_crossover_FibR3 --- partial exit , when VWAP crosses above weekly Fib R3

VWAP_crossunder'_FibR3 --- partial exit , when VWAP crosses down weekly Fib R3

choosing second options are producing more net profit --- That is due to we are waiting to capture more profits :-)

Happy Trading

Please let me know your comments or feedback ...

Note : VWAP and Fib pivot points on the chart are not plotted by the script. If you want to see how the strategy is taking partial profits , please add VWAP (session) and Pivot Points Standard (select Fibonacci option) with weekly resolution

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.